EUR/USD Price Forecast: Next on the upside comes 1.1000

- EUR/USD came under renewed pressure and breached 1.0900.

- The US Dollar regained some composure and bounced off lows.

- The Federal Reserve kept its rates unchanged on Wednesday.

EUR/USD lost part of its recent shine on Wednesday, retreating well south of the 1.0900 mark in response to a marked rebound in the US Dollar (USD).

This bounce lifted the US Dollar Index (DXY) to two-day highs around 103.80 against the backdrop of higher US yields across the curve, all after the Federal Reserve (Fed) matched the broad consensus and left its interest rates unchanged at 4.25%-4.50%.

Trade tensions keep the Greenback in check

Ongoing trade anxieties continue to dominate market sentiment, largely driven by President Trump’s unpredictable tariff policies. Although Canada and Mexico received a temporary extension until April 2, fears of an all-out global trade war persist, casting a shadow over economic growth and the Fed’s policy trajectory.

Tariffs can stoke inflation, potentially compelling the Fed to raise rates more aggressively. Yet they also threaten to curb economic momentum, creating a tug-of-war that leaves the near-term direction of the US Dollar uncertain.

Glimmers of Hope in Russia-Ukraine Talks

The Euro (EUR) has been gathering extra support on hints of progress in the Russia-Ukraine peace dialogue. Earlier in the week, the Kremlin announced that Russian President V. Putin accepted US President D. Trump’s proposal for a 30-day moratorium on energy infrastructure attacks between Russia and Ukraine, following a lengthy phone call between the two leaders.

Central banks in the spotlight

The Federal Reserve kept interest rates on hold Wednesday, as widely predicted, but signalled it still plans to cut rates by 50 basis points before the year ends, citing slowing economic growth and an eventual drop in inflation.

While Fed officials revised their 2025 inflation outlook upward to 2.7%—up from December’s 2.5%—they lowered this year’s growth forecast from 2.1% to 1.7% and projected a slight uptick in unemployment by year-end. Policymakers also noted that risks have grown, with most agreeing that the outlook for the remainder of the year remains uncertain.

Meanwhile, Federal Reserve Chair Jerome Powell warned that inflation progress could face delays this year, citing rising price pressures partly linked to Trump administration tariffs. He described uncertainty as "unusually elevated" and noted the difficulty in determining the extent to which tariffs are driving inflation and consumer behaviour. While acknowledging tariffs may already be pushing prices higher, he emphasized that their policy impact remains unclear and will depend on how quickly inflation moves through the economy and whether inflation expectations stay anchored. Once again, he reiterated that the central bank does not see any rush to reduce rates further.

The European Central Bank (ECB) recently lowered key rates by 25 basis points, hinting at further easing if uncertainty persists. Policymakers trimmed Eurozone growth forecasts and nudged inflation estimates higher for the near term, though they still expect inflation to cool by 2026. Meanwhile, speculation that the ECB might pull back from easing has added another layer of intrigue to the Euro’s outlook.

EUR/USD Technical Outlook

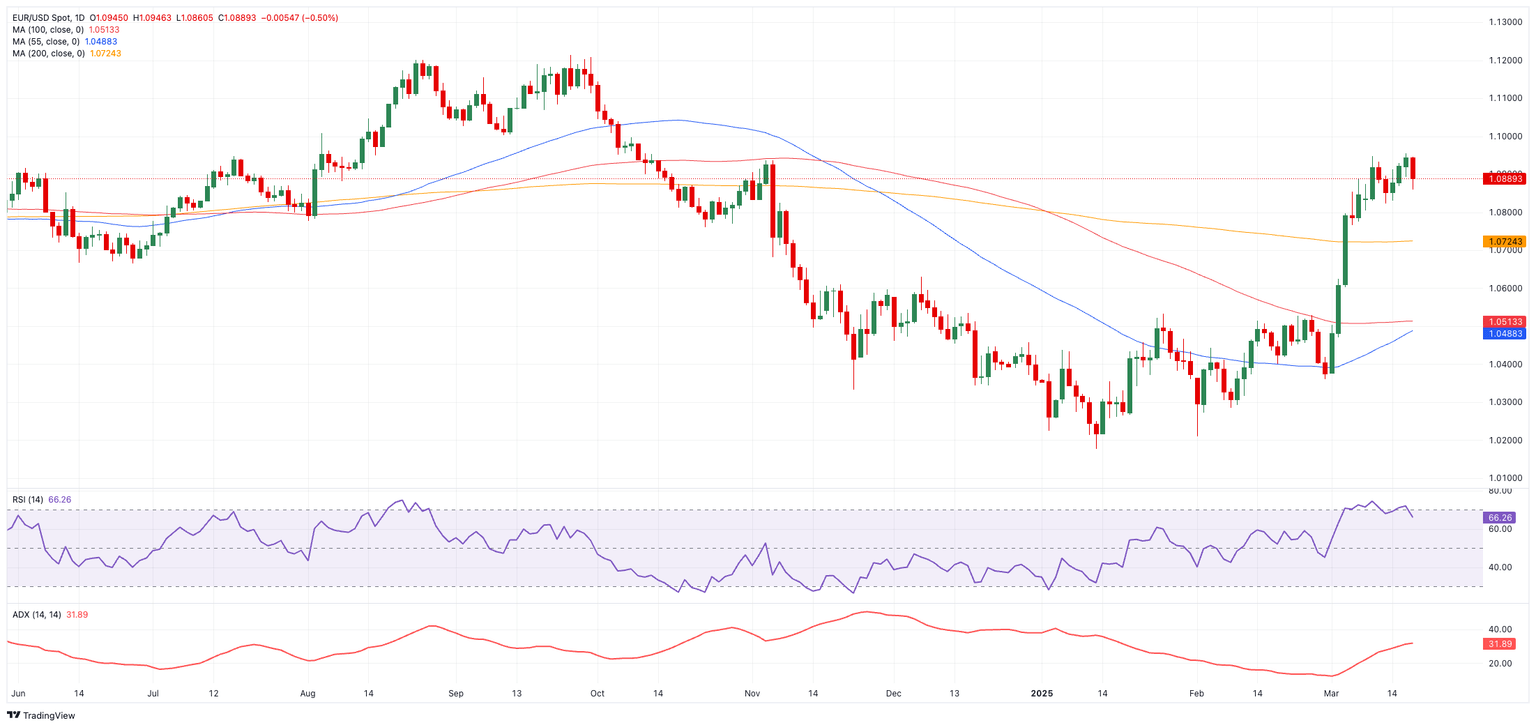

Immediate resistance is seen at the year-to-date (YTD) high of 1.0954 from March 18. A decisive break above this level would aim for 1.0969 (the 23.6% Fibonacci retracement) and potentially the psychological 1.1000 threshold.

On the downside, the 200-day Simple Moving Average (SMA) at 1.0727 provides initial support, followed by the 100-day SMA at 1.0521 and the 55-day SMA at 1.0487. Below these lie 1.0359 (the February 28 low), 1.0282 (the February 10 low), 1.0209 (the February 3 low), and 1.0176 (the January 13 low for 2025).

Momentum signals remain moderately bullish, with the Relative Strength Index (RSI) above 66, while the Average Directional Index (ADX) above 32 underscores a strengthening uptrend.

EUR/USD daily chart

What to watch next

EUR/USD looks poised to stay sensitive to headlines around trade policy, divergent central bank strategies, and the Eurozone’s growth story—especially around Germany’s increased fiscal spending. Any developments in the Russia-Ukraine situation could also swiftly shift market mood, meaning traders should keep a close eye on both geopolitical news and key economic indicators in the days ahead.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.