EUR/USD Price Forecast: Next on the downside emerges the parity level

- EUR/USD retreated further and challenged the key 1.0200 support.

- The US Dollar climbed to fresh highs near 110.00 amid higher yields.

- The ECB’s O. Rehn said the interest rate will reach the neutral level in H1 2025.

Another positive day in the Greenback saw EUR/USD slip back below the 1.0200 key support, hitting a new cycle low and opening the door to a probable challenge to the parity zone sooner rather than later.

Meanwhile, the US Dollar (USD) extended its bull run for the fifth straight day, surpassing the 110.00 level when measured by the US Dollar Index (DXY). The move higher in the Greenback came as investors continued to assess the likelihood that the Federal Reserve (Fed) might cut rates only once this year (if any at all).

In addition, caution prevailed as markets looked ahead to this week’s key US CPI report, Retail Sales data and comments from Fed officials.

Central banks in the spotlight

Monetary policy continues to shape market sentiment. Following another strong reading from the US Nonfarm Payrolls for December (+256K), market participants have significantly reduced their expectations for Fed rate cuts. They now anticipate the Fed will either lower rates by 25 basis points in 2025 or hold them steady altogether.

On December 18, the Federal Reserve trimmed its benchmark interest rate by 25 basis points to 4.25%-4.50%. However, it signalled a more cautious pace of easing for the coming year, with many officials expressing concerns about the potential resurgence of inflation.

During his final press conference of 2024, Chair Jerome Powell emphasized that policymakers remain focused on bringing inflation closer to the 2% target before considering further rate cuts. He acknowledged that inflation has exceeded year-end expectations, reinforcing the need for continued efforts to achieve price stability.

Powell also noted that while the labour market is softening, the adjustment has been gradual and orderly. He described current economic conditions as relatively balanced between the Fed’s dual mandates of maintaining low inflation and achieving full employment.

Across the Atlantic, the European Central Bank (ECB) is expected to continue its easing cycle despite a recent uptick in December inflation figures in both Germany and the broader eurozone. The ECB’s ongoing rate cuts appear to be aimed at revitalizing the region’s gloomy economic outlook—particularly in Germany—and mitigating the risk of political instability affecting the economy.

Trade policy adds a twist

The potential return of trade tariffs, as proposed by President-elect Donald Trump, could add complexity to the economic landscape. Such measures might push US inflation higher, forcing the Fed to adopt a more aggressive policy stance. This could strengthen the USD further, placing additional pressure on EUR/USD in the coming months.

What’s next this week

Industrial Production figures in the euro area are due on January 15, along with the final Inflation Rate in Germany and the ECB’s Accounts on January 16. Closing the weekly docket will be the release of the final Inflation Rate in the Euroland seconded by Current Account results.

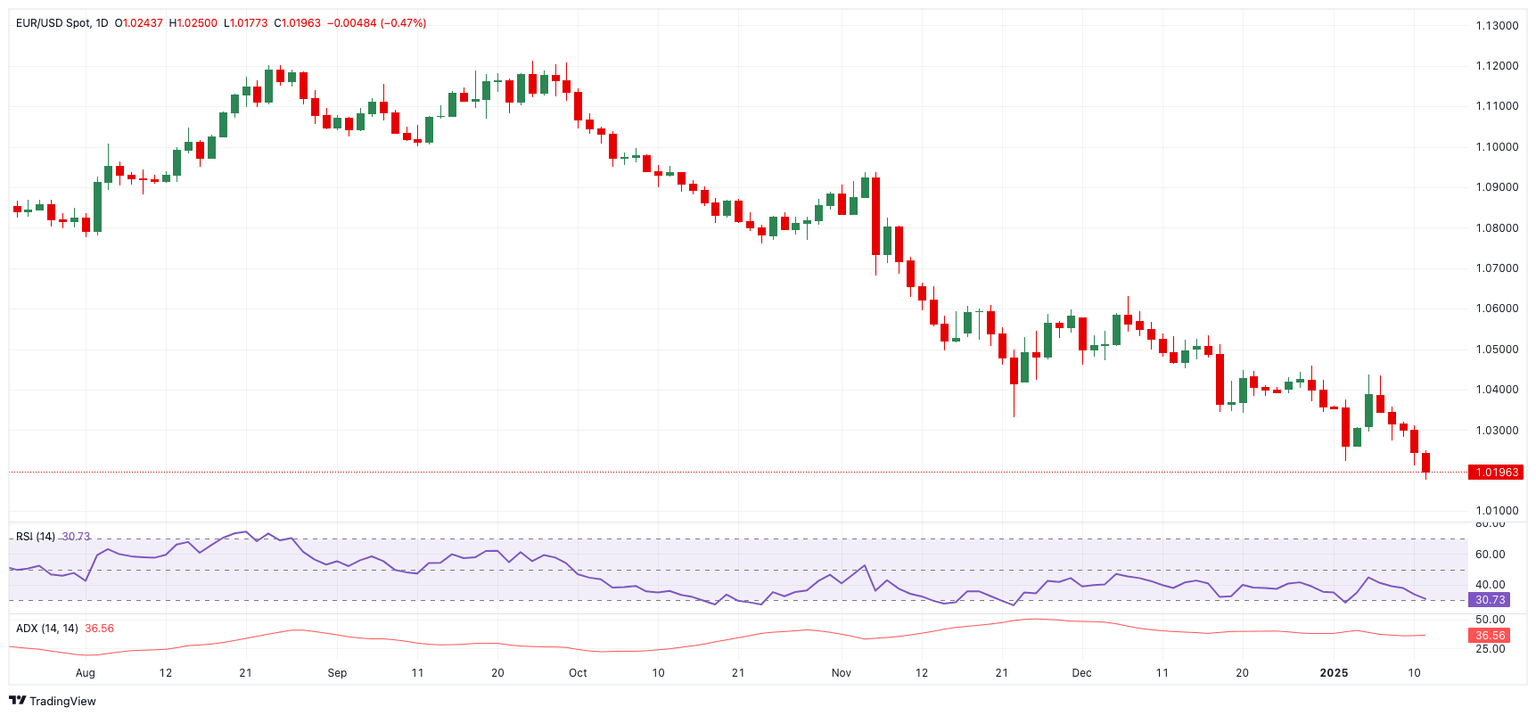

EUR/USD daily chart

Technical Analysis: EUR/USD

Technically, the EUR/USD continues under negative pressure. Key support levels include the YTD low of 1.0176 (January 13) followed by the key parity level. On the upside, immediate resistance is at the 2025 peak of 1.0436 (January 6), which anticipates the temporary 55-day SMA at 1.0533 and the December 2024 high of 1.0629 (December 6).

Looking at the bigger picture, the negative trend will continue as long as the pair trades below the 200-day SMA at 1.0787.

On a four-hour chart, resistance is at 1.0341, 1.0378, and 1.0434, while support levels include 1.0211, 0.9935, and 0.9730.

Momentum indicators such as the RSI (around 31) favours extra downward pressure, while the ADX above 38 indicates a little increase in trend strength.

Bottom Line

The EUR/USD is struggling to find its footing, pressured by a strong US Dollar, lingering political uncertainties, and a growing divide in monetary policy approaches between the Fed and the ECB. Adding to the euro’s challenges is the bleak economic outlook for the eurozone, with Germany’s slowdown casting a shadow over the region's prospects in the months ahead.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.