EUR/USD Price Forecast: Next on the downside comes 1.0700

- EUR/USD retreated further and reached new three-month lows near 1.0760.

- The rally in the US Dollar remained propped up by yields and the US election.

- Poor flash PMIs on Friday could accelerate the decline in the Euro.

EUR/USD extended its sharp multi-week decline on Wednesday, reaching new lows around 1.0760, extending further its recent breakdown of the critical 200-day Simple Moving Average (SMA) at 1.0870.

At the same time, the US dollar remained robust, pushing the US Dollar Index (DXY) well above the 104.00 mark for the first time since late July. The Greenback’s strength has been driven by fresh highs in US yields, supported by solid US fundamentals and a cautious tone from Federal Reserve (Fed) officials. Additionally, steady uncertainty ahead of the November 5 US election also added to the bid bias around the US Dollar.

In the meantime, many Fed policymakers are leaning toward a 25-basis-point rate cut next month, officials such as FOMC Governor Michelle Bowman and Atlanta Fed President Raphael Bostic have expressed some reservations. Bostic even suggested that the Fed might skip a cut in November. The CME Group’s FedWatch Tool currently shows a 90% probability of a quarter-point cut next month.

Across the Atlantic, the European Central Bank (ECB) met expectations by cutting policy rates by 25 basis points at its October 17 meeting, lowering the Deposit Facility Rate to 3.25%. However, ECB officials provided no clear direction on future moves, maintaining a data-driven approach.

Around the ECB, President Christine Lagarde stated on Wednesday that the ECB will need to exercise caution when deciding on further interest rate reductions, emphasizing that future decisions will be guided by incoming data. This was in response to a question regarding market expectations for additional and potentially larger rate cuts. Meanwhile, ECB Chief Economist Philip Lane noted that although recent weak data from the eurozone has raised concerns about the region’s economic outlook, the ECB still anticipates a recovery will take hold.

Eurozone inflation, measured by the Harmonised Index of Consumer Prices (HICP), dipped below the ECB's target to 1.7% in the year to September. Coupled with stagnant GDP growth, this could strengthen the case for further ECB rate cuts in the coming months.

As both the Fed and ECB consider their next policy steps, EUR/USD’s direction will be influenced by broader macroeconomic factors. With the US economy currently outperforming the Eurozone, the Greenback may continue to find support in the short to medium term.

CFTC data shows that speculative net long positions in the Euro have declined for three consecutive weeks amid a pullback in the long/short ratio. Meanwhile, hedge funds have been trimming their net short positions for six straight weeks, despite a slight decrease in open interest.

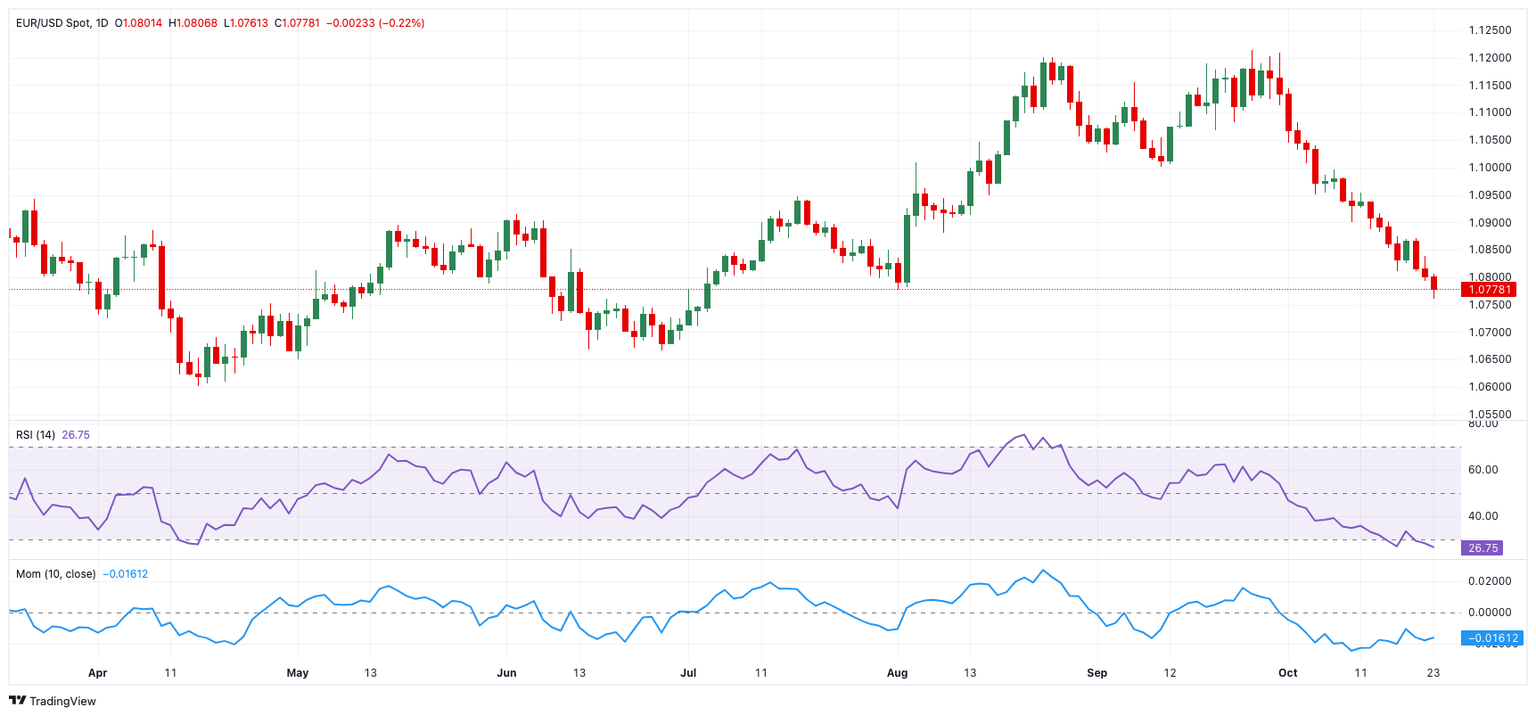

EUR/USD daily chart

EUR/USD short-term technical outlook

Further decline could push EUR/USD to its October low of 1.0760 (October 23), opening the door to a probable test of the June low of 1.0666 (June 26).

On the upside, the 200-day SMA at 1.0870 comes first ahead of the provisional 100-day and 55-day SMAs of 1.0933 and 1.1033. Further up aligns the 2024 top of 1.1214 (September 25) followed by the 2023 peak of 1.1275 (July 18).

Meanwhile, if the pair maintains its trade below the key 200-day SMA, the outlook should remain negative.

The four-hour chart shows the pair continuing its downward trend. Nonetheless, early support is at 1.0760, followed by 1.0666. On the upside, the 55-SMA at 1.0864 is ahead, followed by 1.0954 and 1.0996. The relative strength index (RSI) dropped to nearly 27.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.