EUR/USD Price Forecast: Next on tap comes 1.0500

- EUR/USD advanced further and surpassed 1.0400 on Thursday.

- The US Dollar sold off to the low-107.00s, multi-day lows.

- US Producer Prices came in higher than expected in January.

EUR/USD extended its recovery on Thursday, pushing well above the 1.0400 mark as the US Dollar (USD) took a sharp hit.

In fact, the US Dollar Index (DXY) retreated markedly amid lower US yields and despite growing expectations that the Federal Reserve (Fed) will maintain its restrictive stance for longer, especially after hotter-than-expected US Producer Prices in January.

The sharp uptick in the pair unfolded against a backdrop of mixed market signals. A broad correction in US yields, renewed trade tensions, and Fed Chair Jerome Powell’s cautious tone in his recent testimonies all added layers of complexity to the narrative.

Tariffs continue to inject volatility into markets

While a planned 25% tariff on Canadian and Mexican imports has been delayed, a 10% duty on Chinese goods remains in place, keeping investors on edge.

Initially, these trade uncertainties led traders to scale back their bullish bets on the US Dollar, creating some temporary softness. However, sentiment quickly shifted after Trump announced a 25% tariff on all steel and aluminium imports and hinted at further retaliatory tariffs.

Despite the choppy price action in recent sessions, these protectionist moves could ultimately strengthen the Greenback in the near future—potentially putting EUR/USD under renewed downside pressure.

Central banks step into the limelight

The Federal Reserve recently held interest rates steady at 4.25%-4.50%, maintaining a cautious stance amid solid economic growth, persistent inflation, and a strong labour market. During his semiannual testimonies, Chief Powell emphasised the importance of patience, noting that with unemployment around 4% and inflation still elevated at 4%, premature rate cuts could undermine efforts to control inflation. He reiterated that any future rate reductions would depend on inflation cooling further and the labour market remaining resilient.

The European Central Bank (ECB) recently delivered a widely expected 25-basis-point rate cut in an effort to combat sluggish growth while still contending with inflation that remains above target. ECB President Christine Lagarde highlighted that future rate decisions will be guided by incoming economic data, firmly dismissing the possibility of more aggressive 50-basis-point cuts for now. Despite ongoing trade tensions, she remained optimistic about bringing inflation under control by 2025, signalling a cautious but steady approach to monetary policy in the months ahead.

Trade war: Potential winners and losers

If tariffs drive US inflation higher, the Federal Reserve may be forced into a more hawkish stance, potentially giving the US Dollar another leg up.

Meanwhile, the Euro (EUR) could find itself under increasing pressure if trade tensions spill over into the European Union (EU), raising the risk of EUR/USD edging closer to parity sooner than expected. With markets closely watching policy shifts and economic fallout, currency traders remain on high alert for any signals that could tilt the balance further.

Technical outlook: Key price zones

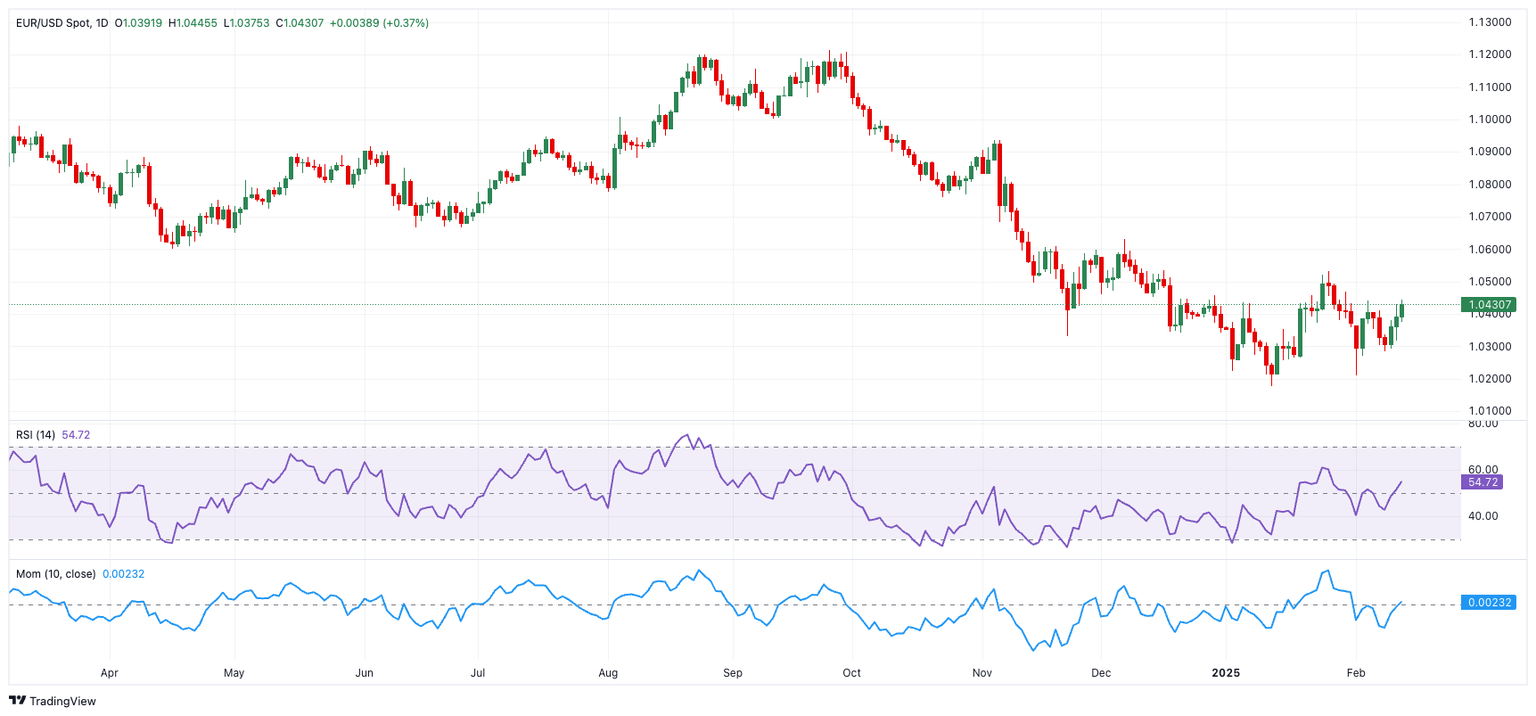

EUR/USD is treading a fine line, with 1.0209—the weekly low from February 3—acting as a key support level. A decisive break below could pave the way for a deeper slide toward 1.0176, the lowest level seen so far this year.

On the upside, resistance kicks in at 1.0532 (the 2025 high from January 27), followed by 1.0629 (December’s peak) and the 200-day Simple Moving Average at 1.0749.

Technical indicators offer mixed signals—while the Relative Strength Index (RSI) is above 55, suggesting improving momentum, the Average Directional Index (ADX) approaching 15 hints that the current trend may be losing steam.

Where does the Euro go next?

Looking ahead, EUR/USD is walking a tightrope, caught between trade tensions, diverging monetary policies at the Fed and ECB, and sluggish eurozone growth—especially in Germany. These factors create an unpredictable landscape where sentiment can shift in an instant.

While short-term spikes in the pair are possible, the bigger picture remains hazy until global uncertainties ease. With economic data and trade developments capable of swaying momentum at a moment’s notice, traders and investors will need to stay nimble and ready to react.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.