EUR/USD Price Forecast: Next hurdle comes at 1.1140

- EUR/USD advanced to new 2024 highs around 1.1050 on Wednesday.

- The Dolla’s price action remained subdued post-US CPI data.

- Next of note will be the release of US Retail Sales on Thursday.

EUR/USD extended its gains for the third consecutive day on Wednesday, hitting fresh YTD peaks near 1.1050 on the back of further bearishness surrounding the US Dollar (USD).

Meanwhile, the Greenback managed to come back after slipping back to multi-day lows in the 102.30-102.25 band when measured by the US Dollar Index (DXY) as investors continued to assess the latest US inflation figures, where the CPI maintained its downward trend in July.

Following the CPI data, expectations for a half-point rate cut by the Federal Reserve (Fed) in September lost traction in favour of a smaller move. On this, the FedWatch Tool tracked by CME Group sees the probability of a 25 bps rate cut increasing to nearly 65%.

While the European Central Bank (ECB) has remained quiet, Fed policymakers are expected to share their perspectives as the September meeting nears. Over the weekend, FOMC Governor Michelle Bowman, typically known for her hawkish stance, took a more moderate approach, acknowledging "welcome" progress in reducing inflation in recent months but also noting that it remains "uncomfortably above" the Fed's 2% target and vulnerable to upward pressure.

If the Fed opts for more significant rate cuts, the policy divergence between the Fed and the ECB could narrow in the medium to long term, potentially supporting a rebound in EUR/USD, especially as market participants anticipate two more rate cuts by the ECB this year.

However, in the long run, the US economy is expected to outperform Europe, suggesting that any weakness in the Greenback may be short-lived.

A glimpse at what’s coming data-wise: The US Retail Sales on Thursday are also anticipated to provide key insights into the overall health of the US economy and the validity of recent recession concerns.

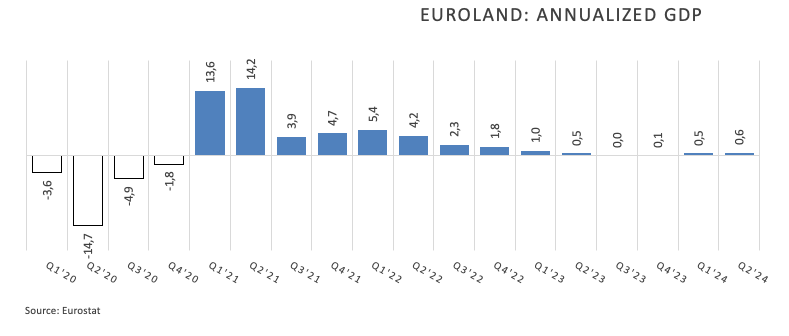

Closer to home, another revision saw the GDP Growth Rate in the broader euro area expand by 0.35 QoQ in Q2 and 0.6% YoY, while Industrial Production contracted by 3.9% in the year to June.

EUR/USD daily chart

EUR/USD short-term technical outlook

Further north, EUR/USD is expected to challenge the 2024 high of 1.1047 (August 14), before reaching its December 2023 peak of 1.1139 (December 28).

On the downside, the pair's next target is the 200-day SMA at 1.0837, followed by the weekly low of 1.0777 (August 1) and the June low of 1.0666 (June 26), all of which came before the May low of 1.0649 (May 1).

Looking at the larger picture, the pair's upward trend should continue if it remains above the important 200-day SMA.

So far, the four-hour chart indicates a strong pick-up in the positive bias. The initial resistance level is 1.1047, before 1.1132. On the other side, there is immediate dispute at 1.0881, which is before the 200-SMA of 1.0864 and 1.0777. The relative strength index (RSI) rose to around 73.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.