EUR/USD Price Forecast: Markets await first-tier data with modest optimism

EUR/USD Current price: 1.1356

- Markets are in a better mood amid hopes for a trade-war de-escalation.

- First-tier employment, inflation and growth data will be out this week.

- EUR/USD consolidates around 1.1350, could turn bullish once above 1.1400.

The EUR/USD pair hovers around 1.1350 on Monday, extending its consolidative phase for a second consecutive day. At least, investors pared US Dollar (USD) selling and recovered some optimism amid hopes of easing trade war tensions.

Additionally, the latest comments from United States (US) Federal Reserve (Fed) officials were tilted to the dovish side. Such comments suggest officials are less concerned about a possible economic setback or higher inflation, and somehow helped the USD instead of hurting it.

Meanwhile, the lack of relevant macroeconomic news and upcoming first-tier events limit the EUR/USD intraday range. During the upcoming days, the US and the Eurozone will release updates on inflation, employment and growth, with most figures out on Wednesday, as most countries celebrate labor day on Thursday and markets will remain closed.

Meanwhile, Wall Street holds on to last week's gains and posts a modest intraday advance, reflecting the better, but cautious mood.

EUR/USD short-term technical outlook

The daily chart for the EUR/USD pair shows it hovers around its opening, lacking directional strength yet with the risk skewed to the upside. The pair develops well above all its moving averages, with a sharply bullish 20 Simple Moving Average (SMA) heading north at around 1.1200. At the same time, technical indicators hold well into positive territory, but turned flat. Sellers have been defending the upside at around 1.1400, the level to surpass for buyers to come back.

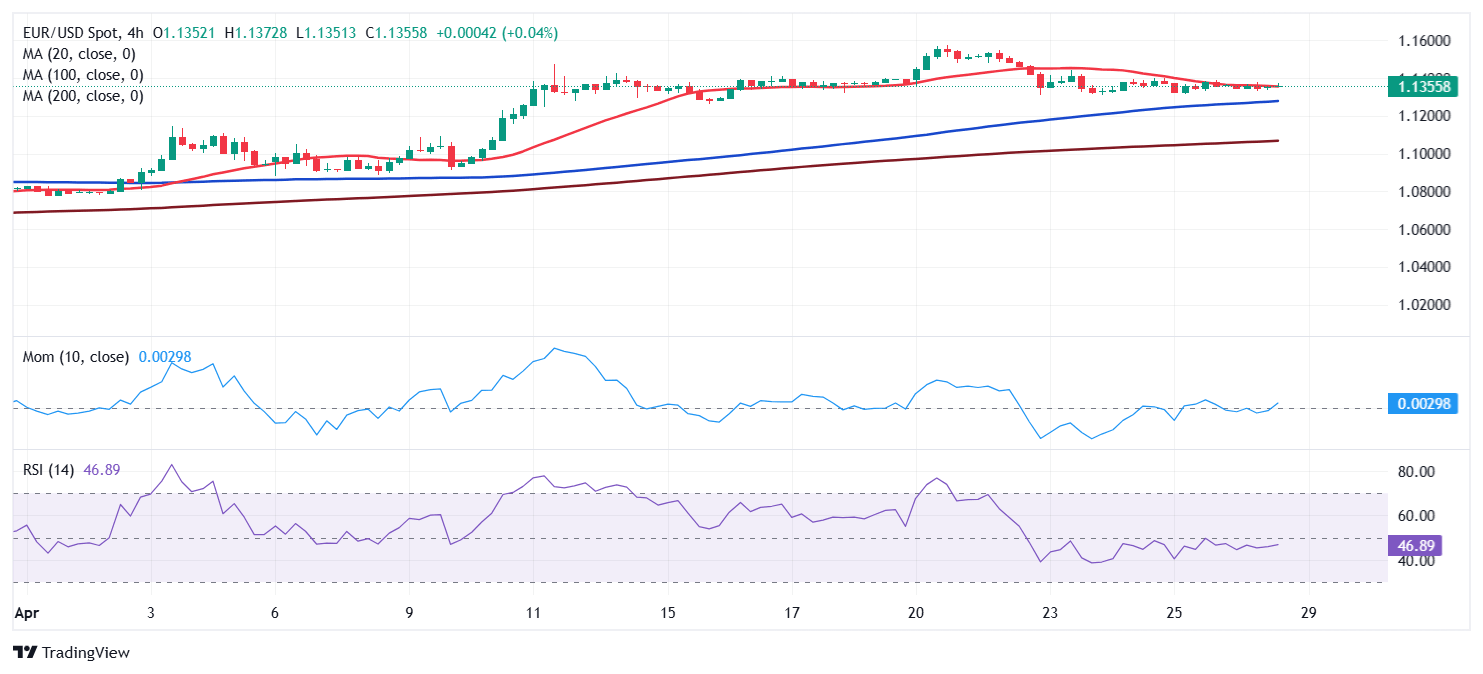

The near-term picture is neutral. The EUR/USD pair seesaws just below a flat 20 SMA, while the 100 and 200 SMAs maintain their bullish slopes far below the current level. The Momentum indicator heads nowhere around its 100 line, while the Relative Strength Index (RSI) indicator turned marginally higher and stands around 45, not enough to anticipate another leg north.

Support levels: 1.1330 1.1285 1.1240

Resistance levels: 1.1405 1.14350 1.1470

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.