EUR/USD Price Forecast: Initial support emerges at 1.0800

- EUR/USD retreated to new lows and approached the 1.0800 region.

- Further gains lifted the US Dollar to new two-month peaks.

- The ECB reduced its policy rate by 25 basis points, as widely expected.

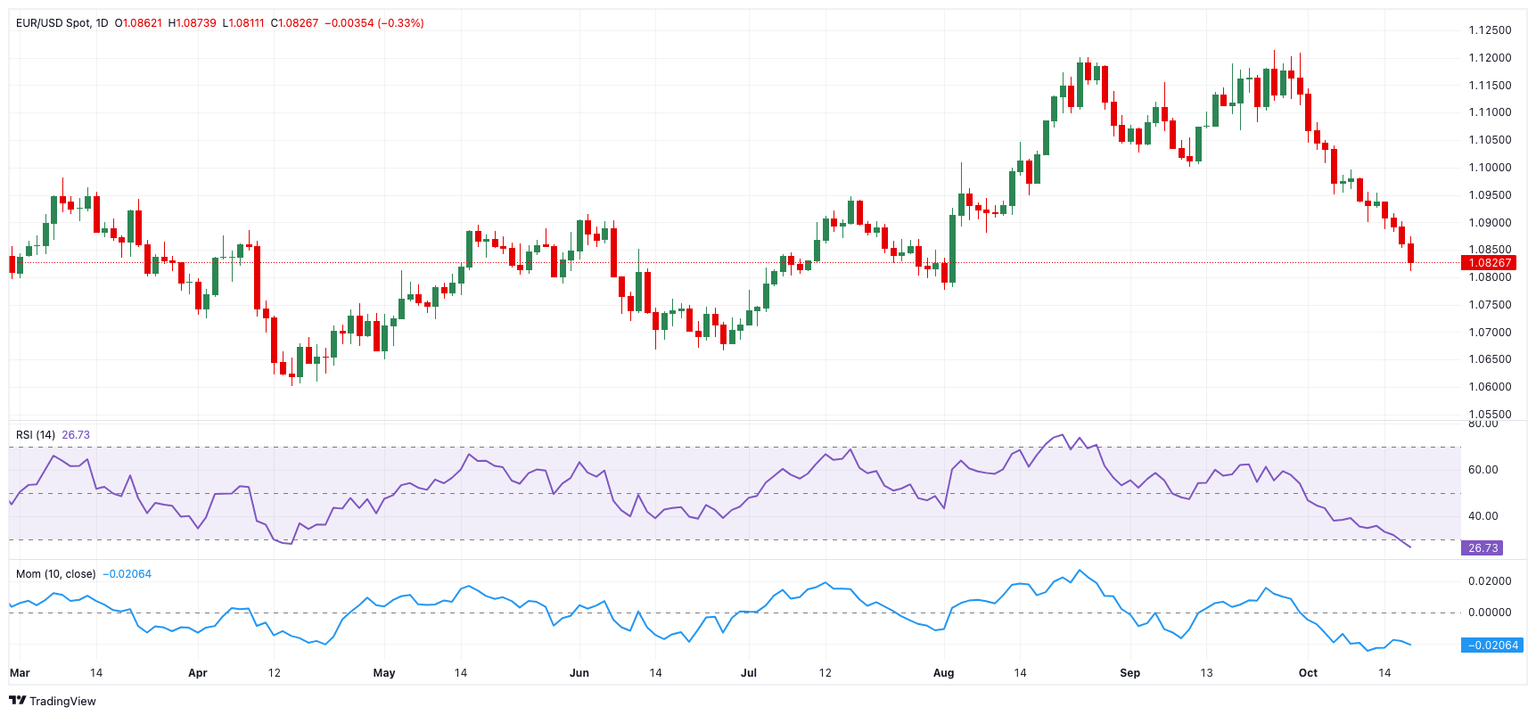

EUR/USD continued its downward trend on Thursday, reaching fresh two-month lows near the 1.0800 neighbourhood and extending the recent break below the critical 200-day Simple Moving Average (SMA) at 1.0872.

Meanwhile, the US Dollar (USD) remained strong, sending the U.S. Dollar Index (DXY) closer to the 104.00 barrier, a region last seen in early August. The extra advance in the Greenback was accompanied by a decent rebound in US yields across the spectrum.

The Dollar’s rally in place since the beginning of the month has been bolstered by firm US fundamentals and a cautious tone from Federal Reserve (Fed) officials. While many policymakers appear to lean toward a 25 basis point cut in the upcoming month, there are dissenting opinions, such as those from FOMC Governor Michelle Bowman and Atlanta Fed President Raphael Bostic, who even suggested that the Fed might skip a cut in November.

Additionally, San Francisco Fed President Mary Daly reaffirmed that "one or two cuts" would be appropriate, considering the more balanced state of the US economy.

According to the CME Group’s FedWatch Tool, markets are currently pricing in around 90% chance of a quarter percentage point cut next month.

In Europe, the European Central Bank (ECB) matched the broad consensus and trimmed its policy rates by 25 basis points, reducing the Deposit Facility Rate to 3.25%.

In its statement, the central bank said it plans to maintain restrictive policy rates and reduce the PEPP portfolio by €7.5B per month by ceasing full reinvestments of maturing securities, despite weaker-than-expected economic activity and elevated domestic inflation.

Later, President Christine Lagarde reported weaker-than-expected economic activity and sluggish growth, with household spending recovery but downside growth risks. She added that domestic inflation remains strong but is expected to reach target by 2025. Although not foreseeing a Eurozone recession, Lagarde anticipates a "soft landing" for the economy.

Eurozone inflation, measured by the Harmonized Index of Consumer Prices (HICP), fell below the bank’s target at 1.7% in the year to September. This, combined with stagnating GDP growth, is expected to maintain the case for additional ECB rate cuts in the next few months.

As both the Fed and ECB deliberate on their next moves, the outlook for EUR/USD will mainly hinge on macroeconomic developments. On this, the US economy is expected to outperform the Eurozone, most likely providing further support for the Greenback in the short/medium term.

EUR/USD daily chart

EUR/USD short-term technical outlook

Further declines might bring the EUR/USD to its October low of 1.0810 (October 17), which is ahead of the round level of 1.0800 and followed by the August low of 1.0777 (August 1).

On the upside, the 100-day and 55-day SMAs at 1.0935 and 1.1041, respectively, emerge as provisional resistance. The 2024 peak of 1.1214 (September 25) is expected to be followed by the 2023 high of 1.1275 (July 18).

Meanwhile, if the pair continues to fall below the crucial 200-day SMA of 1.0872, the picture might become negative.

The four-hour chart continues to show an unabated downward trend in the pair. That said, early support is at 1.0810, seconded by 1.0777. On the upside, the 55-SMA at 1.0925 comes first, ahead of 1.0996, and the 100-SMA at 1.1005. The relative strength index (RSI) tumbled to 23.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.