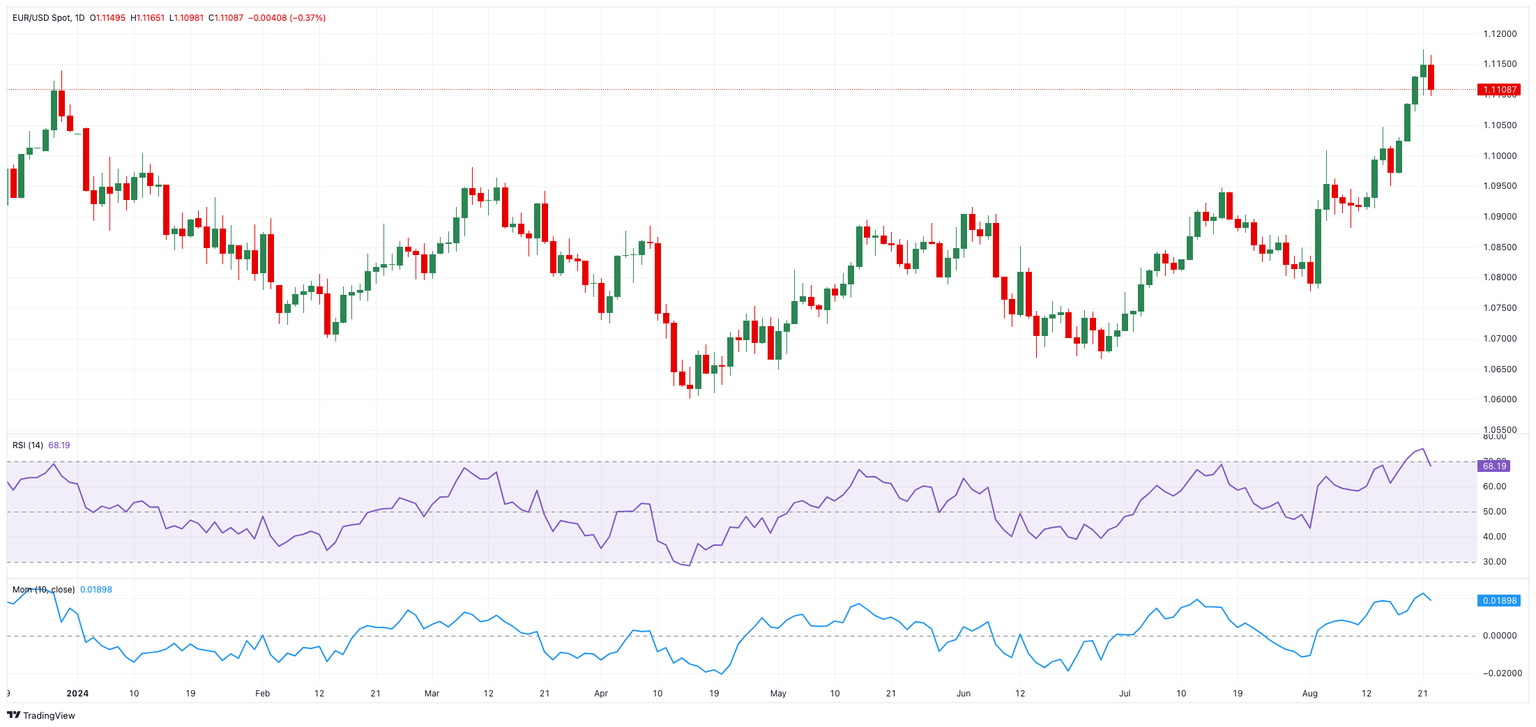

EUR/USD Price Forecast: Initial support comes at 1.1100

- EUR/USD gave away part of the recent advance and retested 1.1100.

- The Dollar regained its smile and bounced off 2024 lows.

- Investors will now look at Powell for confirmation of a rate cut next month.

EUR/USD halted its multi-day rebound and came under renewed downside pressure following Wednesday’s YTD peaks past 1.1170, all against the backdrop of the resurgence of some bid bias in the US Dollar (USD).

Indeed, the Greenback rebounded from recent 2024 lows in the sub-101.00 zone (August 21), as indicated by the US Dollar Index (DXY), in response to some loss of momentum in the risk complex after investors assessed the FOMC Minutes, which left the possibility of a rate cut by the Fed in September open.

Contributing to the daily rebound in the US Dollar, US yields also managed to gather extra steam, advancing markedly across various maturity periods.

In the meantime, mixed data from advanced PMIs in the euro area appears to have played against the continuation of the pair’s march north, while the ECB Accounts revealed that policymakers saw no need to lower interest rates last month but warned that a new discussion may take place in September as high rates continue to impact growth.

Still around the ECB, a new survey saw that growth in negotiated salaries, a crucial indication for forecasting future pricing pressures, slowed sharply in the second quarter.

Supporting the idea of a rate cut in September as exposed by the FOMC Minutes, Kansas City Fed Bank President Jeff Schmid announced that he is closely scrutinising the causes behind the rise in the unemployment rate and would rely on facts to determine whether to support a rate drop next month. In addition, Boston Fed President Susan Collins added that it would soon be time for the Fed to begin a rate-cutting cycle, indicating that she will likely support a rate decrease at the central bank's policy meeting next month. Similarly, Federal Reserve Bank of Philadelphia President Patrick Harker showed his readiness to back a September rate decrease if the data met his expectations. Harker stated that, unless there is an unexpected shift in the data before then, he believes it is time to start cutting rates.

Regarding potential rate cuts, the CME Group’s FedWatch Tool shows nearly a 75% probability of a 25 bps reduction at the September 18 meeting.

Should the Fed proceed with larger rate cuts, the policy gap between the Fed and the ECB could narrow over the medium to long term, potentially pushing EUR/USD higher, especially as markets expect two more rate cuts from the ECB this year.

However, in the longer term, the US economy is anticipated to outperform Europe, suggesting that any prolonged weakness in the dollar might be temporary.

Looking ahead, attention will turn to Chair Jerome Powell's speech at Jackson Hole and Bank of Japan Governor Kazuo Ueda's testimony before Parliament.

EUR/USD daily chart

EUR/USD short-term technical outlook

Further north, EUR/USD is expected to challenge its 2024 high of 1.1174 (August 21), followed by the 1.1200 round mark and the 2023 top of 1.1275 (July 18).

The pair's next downward target is the weekly low of 1.0881 (August 8), prior to the key 200-day SMA at 1.0846, and the weekly low of 1.0777 (August 1). Down from here comes the June bottom of 1.0666 (June 26), before the May low of 1.0649 (May 1).

Looking at the larger picture, the pair's upward trend should continue as long as it remains above the crucial 200-day SMA.

So far, the four-hour chart shows a tepid deceleration of the upside bias. The initial resistance level is 1.1174, which precedes 1.1275. On the other hand, there is immediate support at the 55-SMA of 1.1028, followed by 1.0949 and lastly 1.0881. The relative strength index (RSI) retreated to around 56.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.