- EUR/USD failed to extend gains beyond the 1.1400 barrier.

- The US Dollar traded in a volatile mood amid steady tariff jitters.

- President Trump eased some tariffs on China, benefiting electronics.

On Monday, the Euro (EUR) failed to extend its recent bounce and succumbed to alternating trends among investors. That said, EUR/USD came under pressure soon after hitting daily highs around 1.1420, receding after to the 1.1300 zone, where it met some decent contention.

The pair’s price developments came in tandem with the irresolute price action surrounding the US Dollar (USD), which kept the US Dollar Index (DXY) under some modest pressure south of the 100.00 barrier.

The daily knee-jerk in spot also came along with shrinking US Treasury yields and a pullback to multi-week lows in Germany’s 10-year bund yields.

Trade jitters remain far from over

President Trump ignited fresh fears of a global trade war by imposing a broad 10% duty on all US trade partners effective April 5, along with additional tariffs of 10% to 50% on specific countries and regions.

While the European Union (EU) was hit by a 20% rate, the White House followed up later last week by confirming China would face tariffs as high as 145%.

Trump did announce a temporary 90-day pause on new tariffs for nations that opt not to retaliate, although EU President Ursula von der Leyen warned that Brussels is ready to respond if necessary.

However, Trump said on Sunday that smartphones and computers will be excluded from the newly announced tariffs on China, offering some respite for the risk complex.

Central banks under the microscope

The Federal Reserve (Fed) left interest rates unchanged, citing concerns that higher tariffs might stoke inflation just as economic growth shows signs of slowing. In later comments, Fed Chair Jerome Powell reiterated his cautious stance before resuming the bank’s easing cycle. Following Thursday’s weaker-than-expected US inflation data, traders began pricing in a full percentage point of Fed easing by year’s end.

Over in Europe, the European Central Bank (ECB) lowered its key interest rate by 25 basis points and voiced its readiness to respond if economic conditions deteriorate further. While policymakers predict modest near-term growth and slight inflation pressure through 2026, President Christine Lagarde cautioned that a deepening trade conflict with the US could slice off 0.5% of Eurozone GDP. Some ECB officials have hinted at further policy shifts if tensions escalate.

Shifting market sentiment

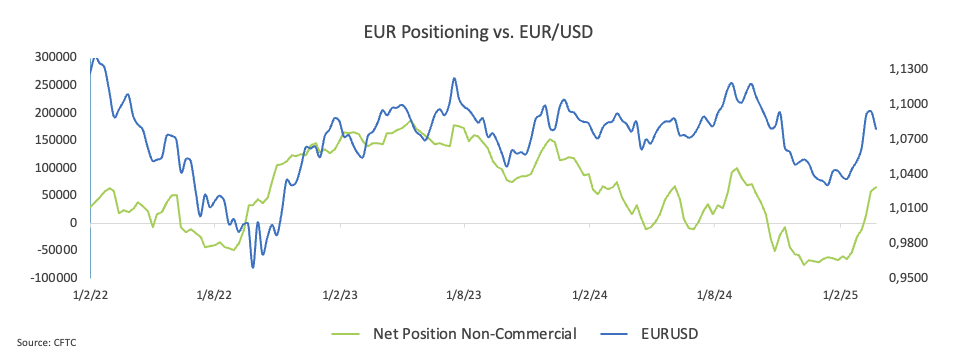

Speculative net longs in the Euro (EUR) climbed to two-week highs near 60K contracts, while hedge funds and other commercial participants boosted their net shorts to around 90.5K contracts, also reaching two-week peaks. Open interest simultaneously surged to multi-week highs of nearly 700K contracts.

Technical overview

Upside targets suggest that the first hurdle sits at the 2025 high of 1.1473 (April 11). A decisive break above this level could open the door toward the 2022 top of 1.1498 (February 19), just ahead of the 1.1500 round level.

On the downside, key support hovers at the 200-day Simple Moving Average (SMA) at 1.0746, followed by the weekly low of 1.0732 (March 27) and the transitory 55-day SMA at 1.0680.

As for momentum indicators, the RSI hovers around 74, still well in the overbought region, while the ADX past 41 suggests a moderately strong trend that could support the ongoing bullish bias.

EUR/USD daily chart

Bottom Line

With the US Dollar losing its footing, the Euro has found renewed strength—even as global trade frictions intensify. Central banks on both sides of the Atlantic are navigating uncharted waters, with policymakers closely watching inflation, growth signals, and fresh tariff announcements. While EUR/USD looks set to maintain its upward trajectory in the near term, shifting risk sentiment and ongoing trade developments could spark volatility.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.1350 after finding support at near nine-day EMA

EUR/USD pauses its two-day decline, hovering near 1.1340 during Thursday’s Asian session. Daily chart technical analysis indicates a weakening bullish bias, as the pair has slipped below the ascending channel pattern.

GBP/USD: Bullish outlook remains in play above 1.3250

The GBP/USD pair drifts higher to around 1.3270, snapping the two-day losing streak during the early European trading hours on Thursday. Mitigating concerns over potential tariff threats by US President Donald Trump exerts some selling pressure on the US Dollar.

Gold price trims part of intraday gains, still well bid above $3,300 mark

Gold price regains positive traction as fading US-China trade optimism revives safe-haven demand. The US economic worries and Fed rate cut bets undermine the USD, also benefiting the commodity. A positive risk tone might hold back the XAU/USD bulls from placing aggressive bets and cap gains.

SEC Crypto Task Force plans to establish digital asset regulatory sandbox

The Securities & Exchange Commission's Crypto Task Force met with El Salvador's National Commission on Digital Assets representatives to discuss cross-border regulation and a proposed cross-border sandbox project.

Five fundamentals for the week: Traders confront the trade war, important surveys, key Fed speech Premium

Will the US strike a trade deal with Japan? That would be positive progress. However, recent developments are not that positive, and there's only one certainty: headlines will dominate markets. Fresh US economic data is also of interest.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.