EUR/USD Price Forecast: Further pullbacks remain on the cards

- EUR/USD came under extra selling pressure and breached 1.0900.

- The US Dollar picked up extra pace amidst persistent risk aversion.

- Disappointing Chinese results and doubts around stimulus weigh on the pair.

A negative start to the week saw EUR/USD extend its losses, dipping below the 1.0900 mark and recording new two-month lows near the critical 200-day Simple Moving Average (SMA).

At the same time, the US Dollar (USD) continued its upward trajectory, sending the US Dollar Index (DXY) to new multi-week tops north of the 103.00 barrier on the back of the persistently high risk aversion and unabated geopolitical tensions in the Middle East.

Further bolstering the greenback were the recently released Minutes from the Federal Open Market Committee (FOMC) meeting on September 18. The minutes revealed that a "substantial majority" of policymakers supported easing monetary policy with a 50-basis-point cut. However, they highlighted that this decision did not lock the Federal Reserve into a specific timeline for future rate cuts.

Adding to the ongoing US Dollar's momentum, several Federal Reserve officials expressed differing views on future interest rate cuts and the economic outlook over the past week: Federal Reserve Bank of St. Louis President Alberto Musalem supported further rate cuts as the economy progresses, with future policy decisions guided by economic performance. His colleague, John Williams, President of the Federal Reserve Bank of New York Fed, believed gradual rate reductions were appropriate following September’s significant cut, while San Francisco Federal Reserve Bank President Mary Daly supported the last cut and suggested further reductions might occur this year, depending on economic developments.

However, Atlanta Fed President Raphael Bostic expressed comfort with pausing rate cuts in November, citing mixed inflation and employment data, a view that somewhat aligns with FOMC Governor Michelle Bowman.

According to the CME Group’s FedWatch Tool, there is around 84% probability of a 25-basis-point rate cut next month.

Meanwhile, across the Atlantic, the European Central Bank (ECB) has adopted a more cautious stance. ECB President Christine Lagarde emphasized that while inflation remains high in the Eurozone, the effects of restrictive monetary policies are beginning to wane, potentially aiding economic growth. The ECB is targeting a 2% inflation rate by 2025.

Recently, ECB board member Yannis Stournaras voiced support for two rate cuts this year, with further easing expected in 2025. François Villeroy also pointed to a likely rate cut next week, while Peter Kazimir urged caution, advocating for more data before making decisions in December. Gabriel Makhlouf warned of potential inflationary risks driven by strong wage growth and persistent service-sector inflation, despite expectations that inflation will decline to the 2% target by late next year.

Recent data showed that Eurozone inflation, as measured by the Harmonized Index of Consumer Prices (HICP), fell to 1.8% YoY in September, below the ECB’s target. This, coupled with stagnating GDP growth across the euro bloc, has fuelled speculation of further rate cuts in the near future.

As both the Fed and ECB contemplate additional rate cuts, the EUR/USD outlook remains closely tied to macroeconomic developments. In this context, the US economy is expected to outperform the Eurozone, which could further strengthen the US Dollar.

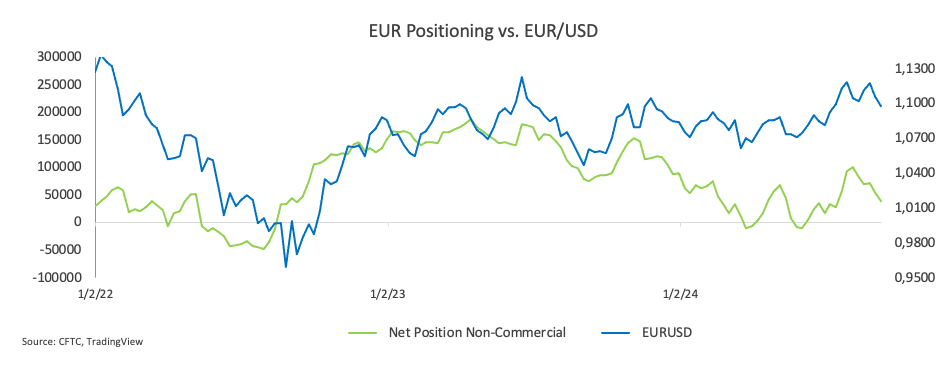

On another front, speculators trimmed their net long positions in the EUR to an eight-week low, around 39K contracts. Meanwhile, commercial traders have increased their net short positions to levels not seen since late July. Additionally, open interest has declined for the second consecutive week.

EUR/USD daily chart

EUR/USD short-term technical outlook

Further falls may cause the EUR/USD to reach its October low of 1.0897 (October 14), which precedes the weekly low of 1.0881 (August 8).

On the upside, the 55-day SMA at 1.1038 serves as a temporary barrier ahead of the 2024 high of 1.1214 (September 25), seconded by the 2023 top of 1.1275 (July 18) and the 1.1300 round mark.

Meanwhile, the pair's upward trend is projected to continue as long as it remains above the crucial 200-day SMA at 1.0873.

The four-hour chart now shows a worsening of the downward trend. Against this, early disagreement is at 1.0897, ahead of 1.0881. On the upside, 1.0996 is the initial resistance level, followed by the 100-SMA of 1.1055 and finally 1.1082. The relative strength index (RSI) decreased to about 33.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.