EUR/USD Price Forecast: Further gains on the table above the 200-day SMA

- EUR/USD added to the ongoing correction and deflated to 1.0820.

- The US Dollar picked up extra pace amid tariff jitters and higher yields.

- US Producer Prices came in below estimates in February.

EUR/USD extended for the second consecutive day its rejection from yearly highs well north of 1.0900 the figure reached earlier in the week, always in response to the acceptable rebound in the US Dollar (USD).

That said, the pair shed more than a cent since tops recorded a couple of days ago, while the US Dollar Index (DXY) reclaimed the area beyond the 104.00 barrier, just to shed some ground afterwards.

Trade jitters and a wavering Dollar

Lingering trade concerns continue to unsettle markets, as President Trump’s shifting stance on tariffs remains a source of perennial uncertainty. In fact, while Canada and Mexico have been granted a temporary reprieve until April 2, the fear of a global trade war has weighed on economic growth prospects and muddled the Federal Reserve’s (Fed) policy outlook.

Tariffs can stoke inflationary pressures and potentially prompt the Fed to tighten policy more aggressively, but they can also curb economic expansion—two competing forces that leave the Greenback’s trajectory uncertain.

Hope on the Russia-Ukraine front

The Euro (EUR) is expected to find some support from positive rumblings around Russia-Ukraine peace negotiations. Tensions appeared to cool slightly following a high-stakes meeting between Presidents Trump and Zelenskyy, and any signs of easing geopolitical risk tend to favour riskier currencies such as the Euro.

Central banks: A driving force

The Fed has maintained its target range of 4.25%–4.50%, with Chair Jerome Powell citing solid US fundamentals, subdued inflation, and a tight labour market. However, the prospect of tariff-driven price increases complicates the Fed’s path.

Across the pond, the European Central Bank (ECB) lowered key rates by 25 basis points and hinted at possible further easing if uncertainties persist. Policymakers also trimmed Eurozone growth forecasts while slightly raising near-term inflation estimates—though they still expect inflation to moderate by 2026.

Technical outlook

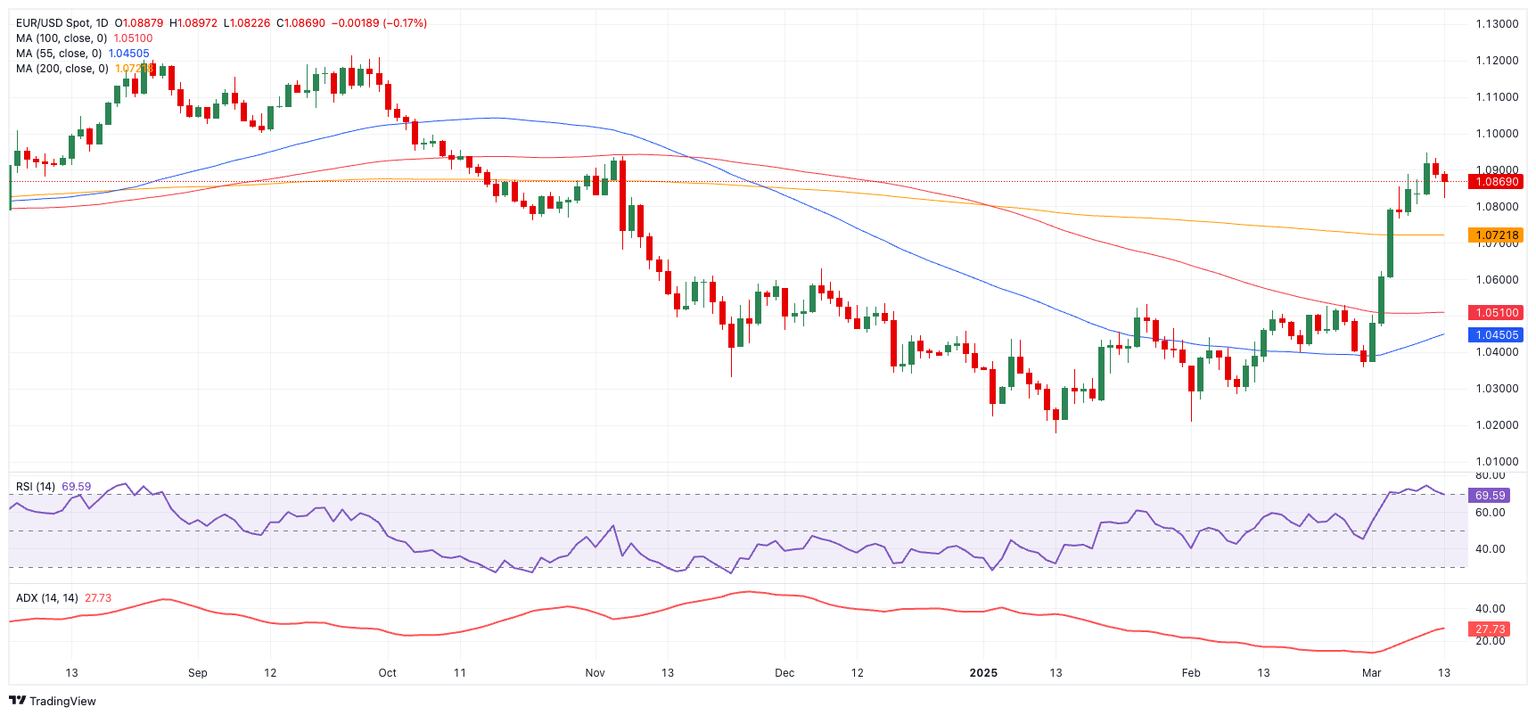

Immediate resistance for EUR/USD stands at 1.0946 (the March 11 high for 2025). A clear push beyond that level would target 1.0969 (the 23.6% Fibonacci retracement) before the pivotal 1.1000 zone.

On the downside, the 200-day Simple Moving Average (SMA) at 1.0725 offers the first layer of support, followed by the 100-day and 55-day SMAs at 1.0517 and 1.0450, respectively. Additional floors include 1.0359 (February 28 low), 1.0282 (February 10 low), 1.0209 (February 3), and 1.0176 (the January 13 bottom for 2025).

As long as the pair trades above the critical 200-day SMA, the likelihood of extra advances remains well in the pipeline.

Momentum indicators are beginning to flash caution: the Relative Strength Index (RSI) has receded to around 71, while the Average Directional Index (ADX) is nearing 28, hinting at a strengthening uptrend.

EUR/USD daily chart

Short-term outlook

Moving forward, EUR/USD will likely remain sensitive to developments in trade policy, divergent central bank strategies, and signs of growth within the Eurozone—particularly if Germany moves ahead with its proposed spending initiatives. Meanwhile, any shifts in the Russia-Ukraine situation could quickly reshape market sentiment, leaving traders to watch geopolitical headlines as closely as economic data.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.