EUR/USD Price Forecast: From parity to… 1.1000?

- EUR/USD marched above 1.0900 to hit five-month highs.

- There seems to be no light at the end of the tunnel for the US Dollar.

- The improved political scenario in Germany sustained the EUR.

The Euro extended further the optimistic start to the week, advancing well past the 1.0900 hurdle to reach fresh five-month tops around 1.0940, always on the back of the intense downtrend in the US Dollar (USD) and reinforced by hopes that the announced defence/infrastructure deal in Germany could be reached in the next few days.

Back to the Greenback, the US Dollar Index (DXY) moved further south, reaching the 103.30 region for the first time since mid-October. Furthermore, it is worth noting the index has almost fully faded the “Trump trade” that was behind the October-January rally.

A fragile greenback and heightened trade concerns

Investors are increasingly uneasy about the strength of the US economy, especially in light of President Trump’s changing stance on trade issues. New US tariffs—25% on Canadian and Mexican goods and 20% on Chinese imports—have raised fears of retaliatory actions, even though the USMCA partners received a temporary reprieve until April 2. According to latest news, Trump announced an extra 25% tariff on Canadian steel and aluminium, adding to the already sour mood among market participants.

While tariffs can drive inflation and potentially lead the Federal Reserve (Fed) to tighten policy, they can also undermine economic growth, which might prompt the Fed to adopt a more cautious approach, further complicating the Dollar’s outlook.

Relief on the Russia-Ukraine front

In addition, the European currency also found some support in recent days from reports suggesting progress in peace negotiations between Russia and Ukraine. Following a tense White House meeting between Presidents Trump and Zelenskyy, any signs of easing geopolitical tensions could buoy risk sentiment and favour currencies like the Euro.

Central bank developments remain key

On the Federal Reserve side, the most recent decision kept rates in the 4.25%–4.50% range, with Chair Jerome Powell emphasising solid US fundamentals, contained inflation, and a tight labour market. However, trade-driven price increases could complicate the Fed’s policy outlook.

On the old continent, the European Central Bank (ECB) trimmed its key rates by 25 basis points, suggesting it might consider further easing if uncertainties persist, including those stemming from trade frictions and increased military spending. The ECB also lowered its growth forecasts for the Eurozone while slightly raising near-term inflation projections, though it expects price pressures to stabilise by 2026.

EUR/USD technical outlook

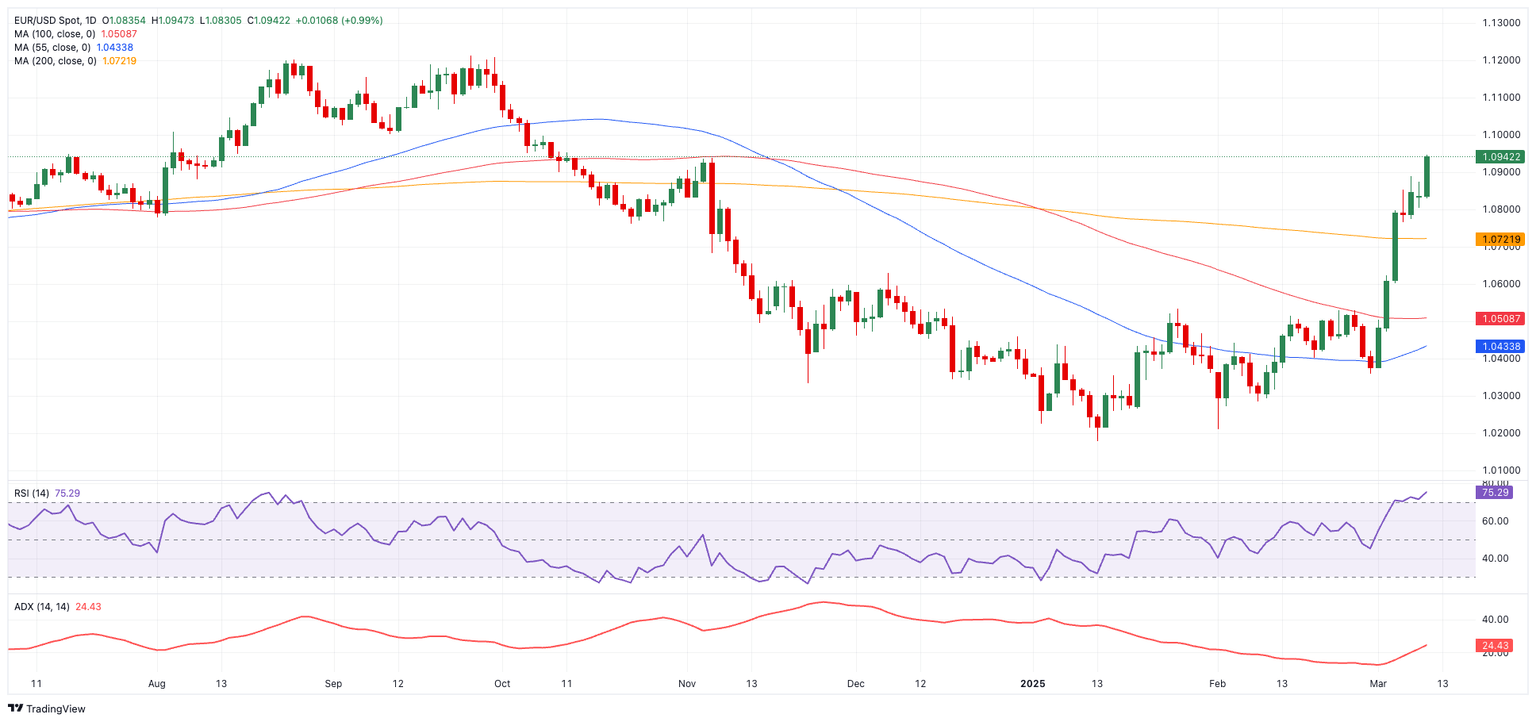

Immediate resistance stands at 1.0946, the 2025 high from March 11. A decisive break above that level could lead the pair toward 1.0969, which corresponds to the 23.6% Fibonacci retracement of the September–January decline.

In case bears regain the upper hand, the 200-day SMA at 1.0725 provides the first key support, followed by the interim 100-day SMA at 1.0518 and the 55-day SMA at 1.0433. Further down, levels of note include 1.0359 (February 28 low), 1.0282 (February 10 low), 1.0209 (February 3), and 1.0176 (2025 bottom from January 13).

In addition, momentum indicators reflect a (very) overbought market, with the RSI hovering around 77 and the Average Directional Index (ADX) rising to nearly 25, signalling a strengthening trend.

EUR/USD daily chart

Short-Term Considerations

In the near term, EUR/USD will be influenced by multiple factors, including potential shifts in trade policies, central bank divergence, Eurozone growth prospects boosted by Germany’s infrastructure and defence plans, and any geopolitical developments in the Russia-Ukraine conflict.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.