EUR/USD Price Forecast: Focus shifts to US PCE, and 1.1200

- EUR/USD resumed the weekly uptrend and faltered ahead of 1.1200.

- The US Dollar succumbed to the better tone in the risk complex.

- Chinese officials announced another set of stimulus early on Thursday.

EUR/USD managed to regain balance and leave behind Wednesday’s deep pullback, revisiting the 1.1190 region on the back of renewed and marked downward bias in the US Dollar (USD) on Thursday.

In addition, supporting the improvement in traders’ sentiment, China's Politburo has vowed to provide benefits for the poorest and give local authorities with the necessary finances to avoid additional property price falls. The decision follows earlier PBoC’s stimulus measures to revitalise the property sector and support the stock market, as well as a focus on stabilizing the real estate market and enhancing the consumption framework.

On the US side, the US Dollar Index (DXY) faced increased selling pressure as the NA session drew to close, retesting once again the 100.50 zone despite the move higher in US yields across different time frames.

In the context of broader monetary policy, market participants continued to anticipate further easing from the Federal Reserve (Fed) during its meetings in November and December, amidst positive expectations for a soft landing of the US economy.

Following the FOMC meeting, there is still uncertainty about whether the size of the September interest rate cut will be repeated. The updated 'dot plot' indicates an additional 50 basis points of easing this year. Furthermore, the Fed's statement and Chair Powell clarified that the 50-basis point cut was not a reaction to panic.

Turning to the European Central Bank (ECB), it's noteworthy that the decision to ease monetary policy last week was influenced by their assessment of inflation and economic conditions. While the ECB did not explicitly signal a rate cut for October, it acknowledged that domestic inflation remains high. ECB President Christine Lagarde mentioned that the waning impact of monetary policy restrictions should benefit the economy, with inflation projected to return to 2% by 2025, while maintaining a cautious view on further actions.

Looking ahead, if the Fed proceeds with additional rate cuts, the policy gap between the Fed and the ECB may narrow, which could provide support for EUR/USD. This scenario seems plausible, particularly as markets anticipate two more rate cuts from the ECB and between 100 and 125 basis points of easing from the Fed over the next 12 months.

However, the US economy is expected to outperform its European counterpart in the long term, which may limit any significant or prolonged weakness in the dollar.

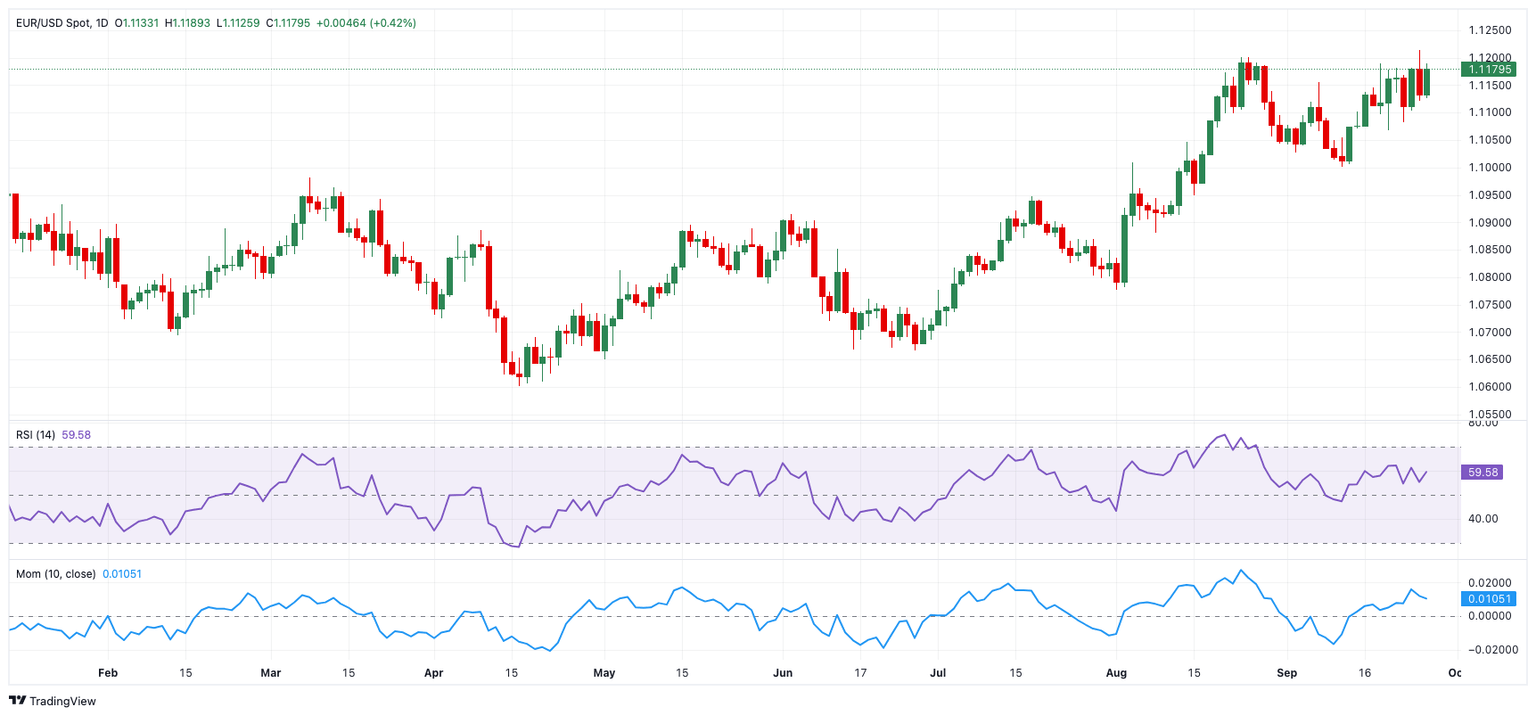

EUR/USD daily chart

EUR/USD short-term technical outlook

Further EUR/USD advances are likely to meet initial resistance at the 2024 peak of 1.1214 (September 25), followed by the 2023 high of 1.1275 (July 18).

The pair's next downward target is the September low of 1.1001 (September 11), which is supported by the temporary 55-day SMA and is above the weekly low of 1.0881 (August 8). The critical 200-day SMA is at 1.0873, ahead of the weekly low of 1.0777 (August 1) and the June low of 1.0666.

Meanwhile, the pair's upward trend is projected to continue as long as it remains above the key 200-day SMA.

The four-hour chart indicates a resurgence of the positive tendency. The initial resistance level is 1.1214, then 1.1275. On the other side, initial contention is at 1.1121, followed by 1.1083, and 1.1068. The relative strength index (RSI) rose to nearly 59.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.