EUR/USD Price Forecast: Fed boosts the US Dollar with a hawkish cut

EUR/USD Current price: 1.0356

- The US Federal Reserve trimmed the benchmark rate by 25 basis points as expected.

- Fed officials are confident on economic progress, foresee two rate cuts in 2025.

- The EUR/USD pair is on its way to retest the year low and even fall below it.

The EUR/USD pair is ending Wednesday near its 2024 low, as the US Dollar gathered momentum following the United States (US) Federal Reserve’s (Fed) monetary policy announcement. The Fed delivered a 25 basis points (bps) interest rate cut as widely anticipated, with the Summary of Economic Projections (SEP) or dot plot triggering a risk-averse reaction across financial boards.

The document showed that policymakers now expect the (Personal Consumption Expenditures) PCE inflation at 2.5% at the end of 2025, against the 2.1% foreseen in September. Growth, as measured by the Gross Domestic Product (GDP) is now seen at 2.1% versus 2.0% previously, while the Unemployment Rate is expected to e at 4.3%, slightly below the 4.4% estimated in September.

Finally and more relevantly, the SEP or dot-plot showed policymakers now foresee two rate cuts in 2025. As a result, market participants rushed away from high-yielding assets. Stocks plunged alongside European and commodity-related currencies. Speculative interest rushed to price in an on-hold interest rate in January, with the odds for it roughly at 90%.

Chairman Jerome Powell later clarified: “We will be looking for further progress on inflation to make those cuts.” Powell added that the decision to trim rates was a “close call” and sounded pretty confident about economic developments, noting the economy is performing “very, very well” and that the country avoided a recession. Finally, he added that policymakers have to maintain the restrictive policy to get inflation to their target goal of 2%.

The US will release the final estimate of the Q3 Gross Domestic Product (GDP) and weekly unemployment figures on Thursday.

EUR/USD short-term technical outlook

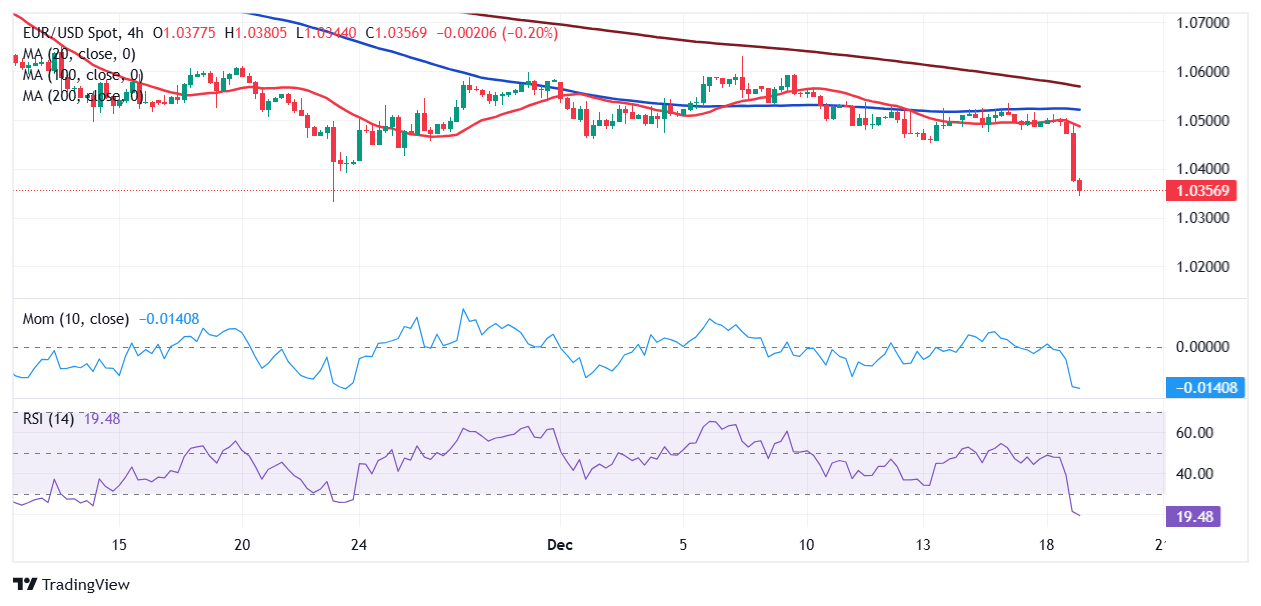

From a technical point of view, the EUR/USD is bearish and poised to extend its slump. The daily chart shows that, after repeatedly meeting sellers around a bearish 20 Simple Moving Average (SMA), the pair collapsed. The 100 and 200 SMAs slowly grind lower far above the shorter one, while technical indicators head south within negative levels, in line with a strong bearish momentum.

The near-term picture supports a test of the year low at 1.0332. In the 4-hour chart, technical indicators entered oversold territory while maintaining their vertical slopes, hardly suggesting an interim bottom ahead. At the same time the pair fell well below all its moving averages, forcing the 20 SMA lower below the longer ones.

Support levels: 1.0330 1.0290 1.0250

Resistance levels: 1.0400 1.0440 1.0485

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.