EUR/USD Price Forecast: Extra weakness could revisit 1.0600

- EUR/USD came under heavy pressure and retested the 1.0630 region.

- The US Dollar added to recent gains and reached fresh tops.

- Markets’ attention remains on the release of US CPI and Fedspeak.

EUR/USD’s downside pressure gathered extra steam at the beginning of the week, adding to losses recorded on Friday and hitting fresh lows near 1.0630, a region last visited in late April.

The steep leg lower in the pair came in response to a sharp kickstart of the week by the US Dollar (USD), which sent the US Dollar Index (DXY) to new multi-week peaks well north of the 105.00 barrier, all supported at the same time by the strong persistence of the “Trump trade” and rising expectations regarding potential policies under the Trump administration.

The daily decline in spot came in tandem with the second consecutive daily loss in German 10-year yields, which retreated to monthly lows near the 2.30% zone.

On the policy front, the Federal Reserve (Fed) cut the Fed Funds Target Range by 25 basis points to 4.75%-5.00% last week, as widely expected. The bank’s statement noted that while inflation is edging closer to the 2% target, the labour market has shown some signs of easing despite low unemployment.

The Fed highlighted that risks to the job market and inflation are “roughly balanced,” echoing its stance from the September report. A subtle shift in language also described inflation as having “made progress” rather than the earlier phrasing of “made further progress.”

During his press conference, Fed Chair Jerome Powell remained non-committal about December’s policy decision, citing economic uncertainty as a factor limiting the Fed’s ability to provide clear guidance. Powell noted that recent positive economic data has helped alleviate some downside risks, and he firmly stated he wouldn’t step down if asked by President-elect Trump.

In Europe, the ECB recently cut its deposit rate to 3.25% on October 17 but signalled a cautious approach to any further rate changes, preferring to wait for upcoming economic data.

As both the Fed and the ECB face key policy decisions, the outlook for EUR/USD will hinge on broader economic developments.

However, the incoming Trump presidency is likely to introduce tariffs on European and Chinese imports and adopt a more relaxed fiscal stance in the US, which could spur inflation and cause the Fed to pause its rate-cutting cycle.

That said, other than macroeconomics favouring the Greenback, a U-turn in the Fed’s monetary policy stance, shifting to a more cautious approach, or even rethinking the idea of potential hikes, should be another source of strength for the US Dollar.

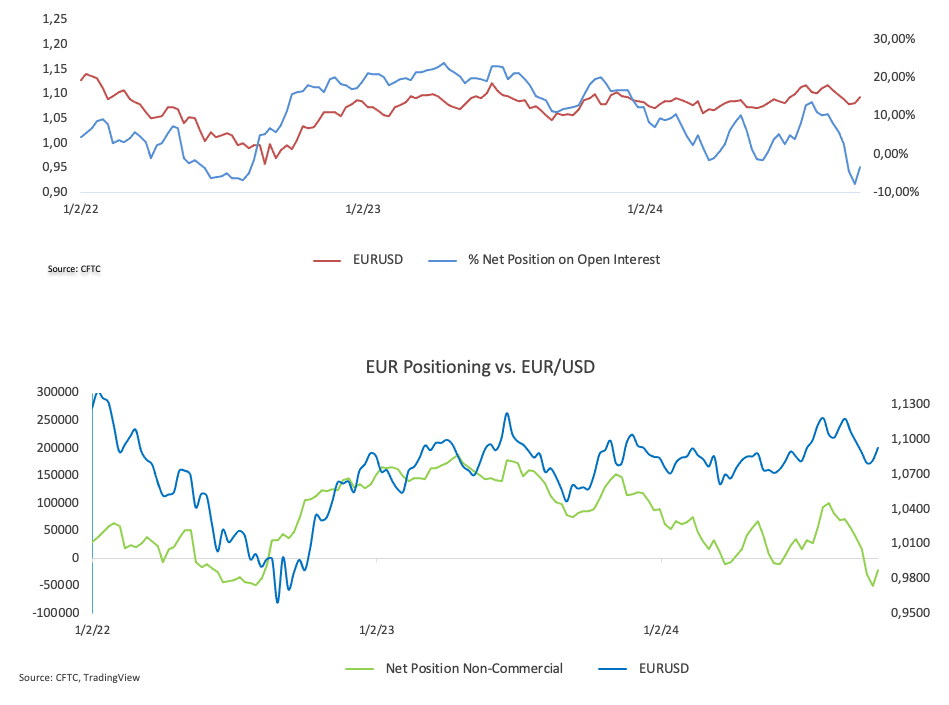

On the positioning front, speculative net short positions in the Euro have eased to a three-week low, standing at around 21.6K contracts in the week to November 5, as per the latest CFTC Positioning Report. At the same time, hedge funds and commercial traders have scaled back their net long positions slightly, now just above 600 contracts, amid a modest decline in open interest.

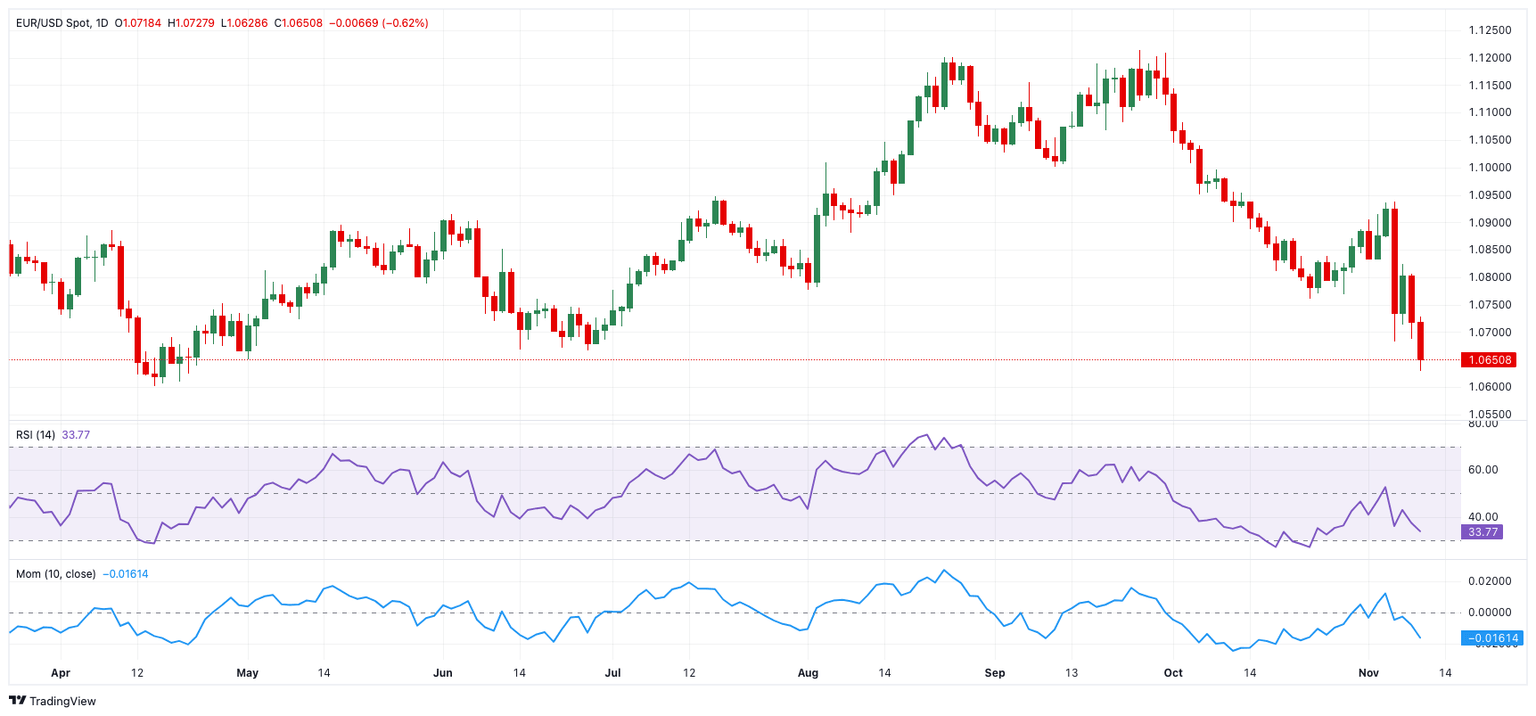

EUR/USD daily chart

EUR/USD short-term technical outlook

Extra losses might push the EUR/USD down to its November low of 1.0.628 (November 11), ahead of the 2024 bottom of 1.0601 (April 16).

On the upside, the 200-day SMA at 1.0867 aligns as the immediate resistance, seconded by the November high of 1.0936 (November 6) and the interim 55-day SMA of 1.0977.

Meanwhile, further drop is likely as long as the EUR/USD remains below the 200-day SMA.

The four-hour chart shows a pick-up in the bearish trend. Against that, initial support is at 1.0628 ahead of 1.0606. On the other hand, immediate up-barrier is at 1.0824 followed by 1.0936. The relative strength index (RSI) plummeted to around 28.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.