EUR/USD Price Forecast: Extra pullbacks on the table

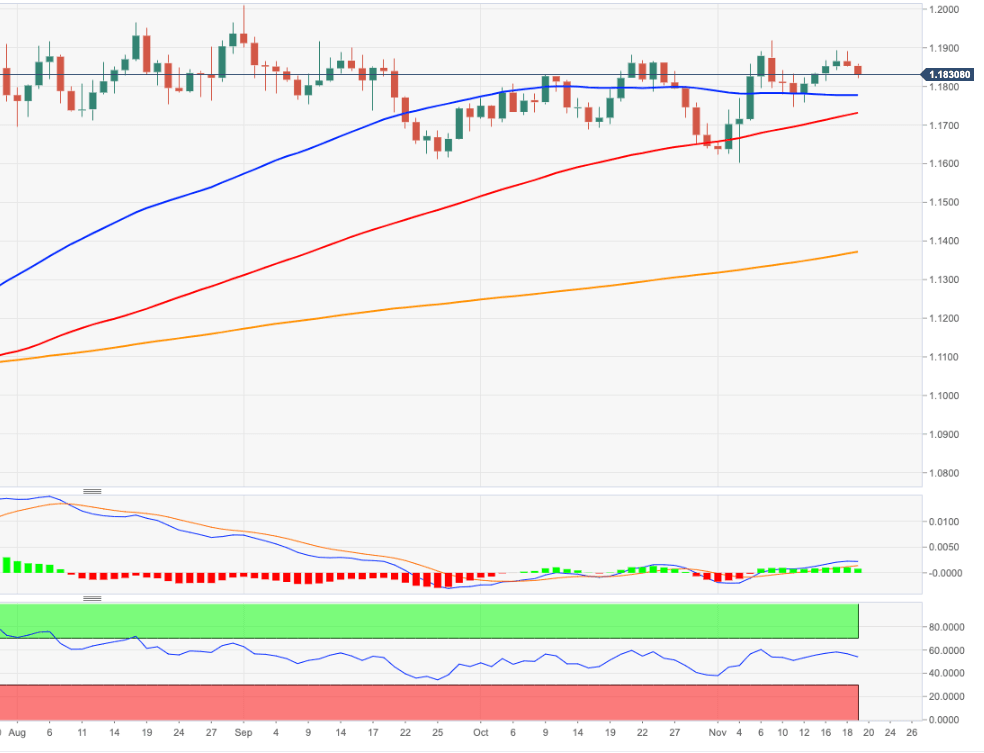

- EUR/USD failed once again to re-visit the 1.19 area.

- The corrective pullback could extend to the mid-1.1700s.

- Investors’ focus shifted to the EU Council Conference.

The multi-session recovery in EUR/USD met once again with a solid hurdle in the 1.19 neighbourhood, motivating sellers to return to the markets and drag spot back to the vicinity of the 1.18 mark in the second half of the week.

The unremitting advance of the pandemic and its impact on the growth prospects of the euro area and the rest of the world returns to the fore as the main driver for the price action, relegating at the same time the previous optimism that followed the vaccines news.

Also adding pressure to the single currency, fresh cracks emerge in the Old Continent in response to the potential vetoes from Hungary and Poland to the €1.8 trillion EU Recovery Fund. This issue is expected to be in the centre of the debate at the EU Council Video Conference on Thursday and carries the potential to re-ignite political effervescence among members and thus hurt the sentiment around the euro.

Near-term Outlook

Following the rejection from the 1.19 neighbourhood, the corrective downside in EUR/USD could extend initially to last week’s lows in the 1.1750 region ahead of the contention area near 1.1700, where coincide the 100-day SMA and a Fibo retracement (of the 2017-2018 rally). The loss of this level could pave the way for a deeper pullback to the monthly lows near 1.16 the figure (November 4). On the upside, 1.19 remains a tough nut to crack for EUR-bulls. If and when this level is cleared, then the attention should shift to the monthly peaks around 1.1920 (November 9) ahead of the August’s top at 1.1965.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.