EUR/USD Price Forecast: Decent support aligns around 1.1000

- EUR/USD partially left behind the recent multi-day retracement.

- The Greenback traded with decent losses following soft data releases.

- The ECB matched the broad consensus and lowered its policy rates.

EUR/USD experienced renewed upward momentum on Thursday, reversing part of its recent losses and moving back towards the 1.1050 zone, driven by fresh selling pressure on the US Dollar (USD).

Meanwhile, the US Dollar Index (DXY) left behind four days in a row of gains and succumbed to the fresh downward bias in response to softer-than-expected prints from the weekly US labour market and Producer Prices in August. So far, the index appears to have met a decent resistance around 101.80.

In addition, further improvement in the risk complex also weighed on the Greenback amidst the move higher in US and German yields.

Further strength in the single currency also came after the European Central Bank (ECB) lowered its policy rates at its meeting on Thursday, as broadly anticipated, although it did not provide any forward guidance regarding future steps.

In fact, the ECB has decided to moderate monetary policy restrictions due to the Governing Council's assessment of the inflation outlook and underlying dynamics. The bank did not explicitly hint at a rate reduction in October but noted that domestic inflation remained high.

At her subsequent press conference, President Christine Lagarde argued that the diminishing effects of monetary policy restrictions should support the economy, with inflation predicted to fall to 2% by 2025. However, she did not commit to any actions in October and emphasized that the policy would remain restrictive as long as necessary.

Overall, if the Fed proceeds with additional or larger rate cuts, the policy gap between the Fed and the ECB could narrow over the medium to long term, potentially supporting EUR/USD. This is particularly likely, as markets anticipate two more rate cuts from the ECB this year.

In the longer term, however, the US economy is expected to outperform the European economy, which could limit any prolonged weakness in the dollar.

Finally, according to the CFTC report for the week ending September 3, speculators (non-commercial traders) have increased their net long positions in the Euro (EUR) to the highest levels since January, while commercial traders (such as hedge funds) have raised their net short positions to multi-month highs amid a notable increase in open interest.

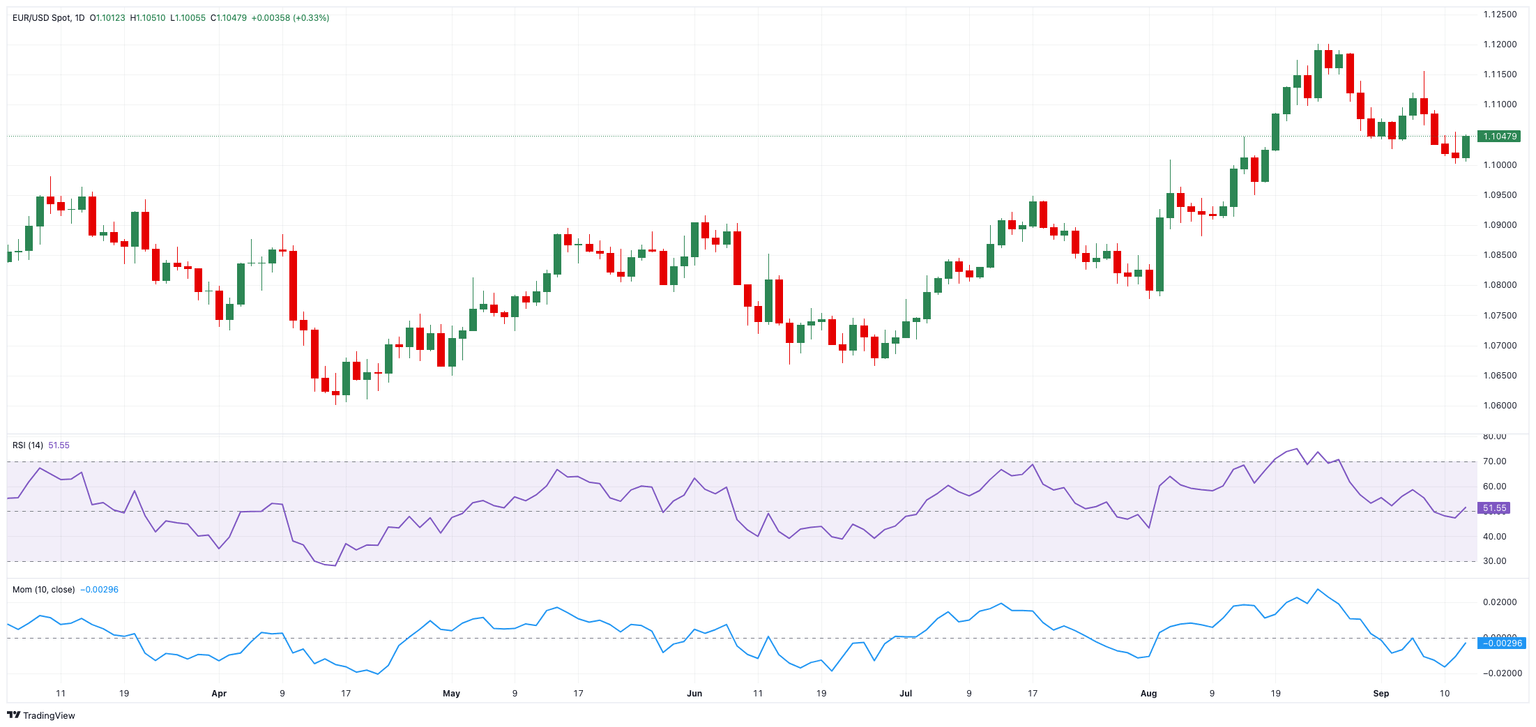

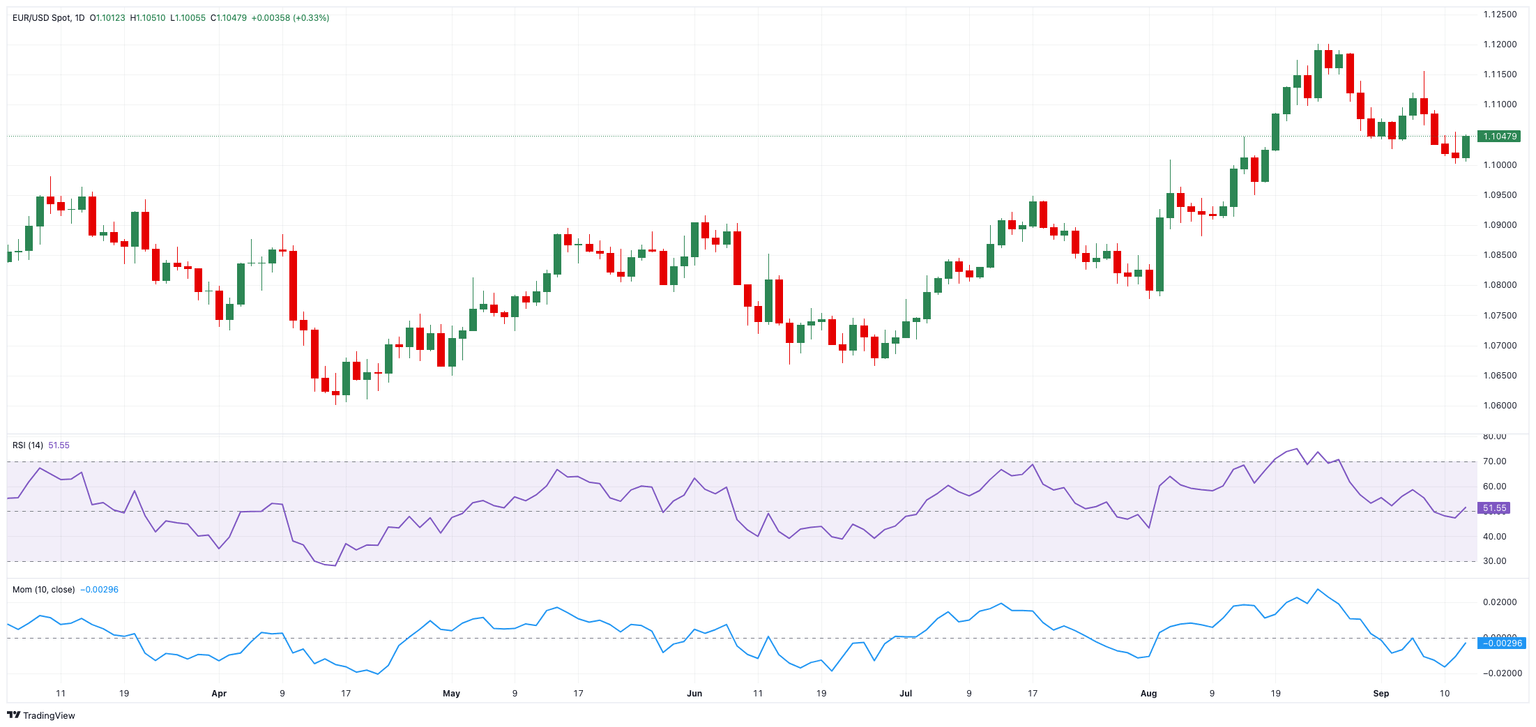

EUR/USD daily chart

EUR/USD short-term technical outlook

EUR/USD short-term technical outlook

If bulls take control, EUR/USD should meet an early resistance level at the September high of 1.1155 (September 6), before reaching the 2024 top of 1.1201 (August 26) and the 2023 peak of 1.1275 (July 18).

The pair's next downward target is the September low of 1.1001 (September 11), which is ahead of the preliminary 55-day SMA at 1.0948 and the weekly low of 1.0881 (August 8). The critical 200-day SMA is at 1.0861, prior to the weekly low of 1.0777 (August 1) and the June low of 1.0666.

Meanwhile, the pair's rising trend is expected to continue as long as it is above the important 200-day SMA.

The four-hour chart indicates a small resurgence in positive sentiment. That said, the initial resistance level is at the 100-SMA at 1.1091 seconded by 1.1155, and 1.1190. Instead, there is immediate support around 1.1001, ahead of 1.0949. The relative strength index (RSI) advanced above 56.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.