EUR/USD Price Forecast: Corrective slide to test buyers’ determination around 1.0800

EUR/USD Current price: 1.0836

- ECB President Christine Lagarde addressed the impact of US tariffs on EU inflation.

- US President Donald Trump is due to speak at the Digital Asset Summit in New York.

- EUR/USD corrective decline could extend in the near term, yet bulls hold the grip.

The EUR/USD pair trades near a fresh weekly low of 1.0833 on Thursday as the US Dollar(USD) surged in the European session. A dismal market mood fuels demand for safety ahead of United States (US) data, with Wall Street’s futures reversing most of Wednesday’s gains.

Market players welcomed comments from Federal Reserve (Fed) Chairman Jerome Powell, who noted that President Donald Trump's trade war may have a transitory impact on consumer prices. The central left its benchmark interest rate unchanged at 4.25%-4.5% following the March meeting, as widely anticipated. Officials maintained their view of 50 basis points (bps) cuts for this year while downgrading their growth perspectives.

Meanwhile, European Central Bank (ECB) President Christine Lagarde testified before the Committee on Economic and Monetary Affairs of the European Parliament on Thursday. Lagarde repeated that officials will be data-dependent and take decisions meeting by meeting. She added that Eurozone (EU) retaliatory measures on US tariffs and a weaker Euro exchange rate could lift inflation by around half a percentage point, noting that the effect would ease in the medium term due to lower economic activity. Finally, she warned that estimates are subject to very high uncertainty.

Data-wise, Germany published the February Producer Price Index (PPI), which contracted by 0.2% from the previous month and rose a modest 0.7% from a year earlier. The US, on the other hand, published Initial Jobless Claims, which increased to 223K in the previous week, although beating expectations of 224K. Additionally, the country published the Philadelphia Fed Manufacturing Survey, which posted 12.5 in March, better than the 8.5 anticipated yet below the previous 18.1.

After the US opening, President Donald Trump is due to speak at the Digital Asset Summit in New York and could spur some volatility when referring to the trade war.

EUR/USD short-term technical outlook

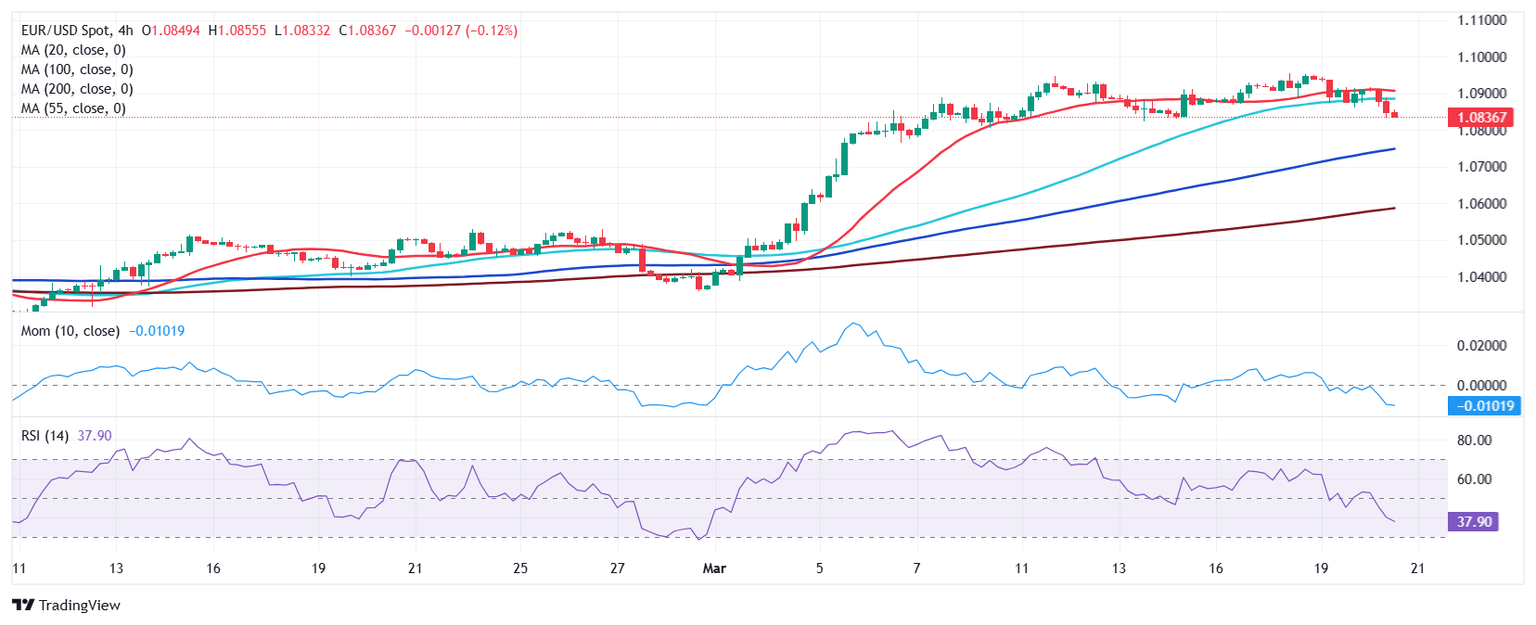

The daily chart for the EUR/USD pair shows the corrective slide could continue. Technical indicators retreat from extreme overbought readings, maintaining their bearish slopes but holding well above their midlines, somehow limiting the case for a steeper slide. At the same time, the 20 Simple Moving Average (SMA) maintains its bullish slope right below a flat 200 SMA and well above an also directionless 100 SMA, signaling bulls retain control in the longer run.

In the near term, and according to the 4-hour chart, the risk skews to the downside. EUR/USD extends its slide below a directionless 20 SMA, providing dynamic resistance at around 1.0905. At the same time, technical indicators maintain downward slopes within negative levels, reflecting increased selling interest. Finally, the 100 and 200 SMA head firmly higher far below the current level, in line with the dominant bullish trend.

Support levels: 1.0830 1.0790 1.0745

Resistance levels: 1.0860 1.0905 1.0950

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.