EUR/USD Price Forecast: Corrective slide could gain traction once below 1.0410

EUR/USD Current price: 1.0459

- A better market mood limits US Dollar gains in the near term.

- German ZEW Economic Sentiment posted an unexpected improvement in February.

- EUR/USD trades with a soft tone for a second consecutive day, losses limited.

The EUR/USD pair trades with a softer tone on Tuesday, easing further from Friday’s peak at 1.0514 and trading in the 1.0450 region in the mid-European session. The US Dollar (USD) finds mild near-term support on rising US government yields, as the 10-year Treasury note resumed activity by offering 4.51%, up 4 basis points (bps), although the optimistic tone of stock markets limits USD upward potential.

Asian shares surged amid hopes the Chinese government will extend measures to support the private sector after President Xi Jinping met with business leaders. European indexes, however, are mixed, not far from their opening levels, and are weighing on Wall Street’s futures.

The Eurozone (EU) macroeconomic calendar was light, with only Germany publishing the February ZEW Survey. Economic Sentiment in the country improved to 26 in the month from 10.6 in January, while the EU Economic Sentiment printed at 24.2, better than the previous 18 yet below the 24.3 expected. Finally, the assessment of the German Current Situation resulted in -88.5, better than the previous -90.4.

The United States (US) will publish the February NY Empire State Manufacturing Index, foreseen at -1 after posting -12.6 in the previous month. Additionally, a couple of Federal Reserve (Fed) speakers will hit the wires.

EUR/USD short-term technical outlook

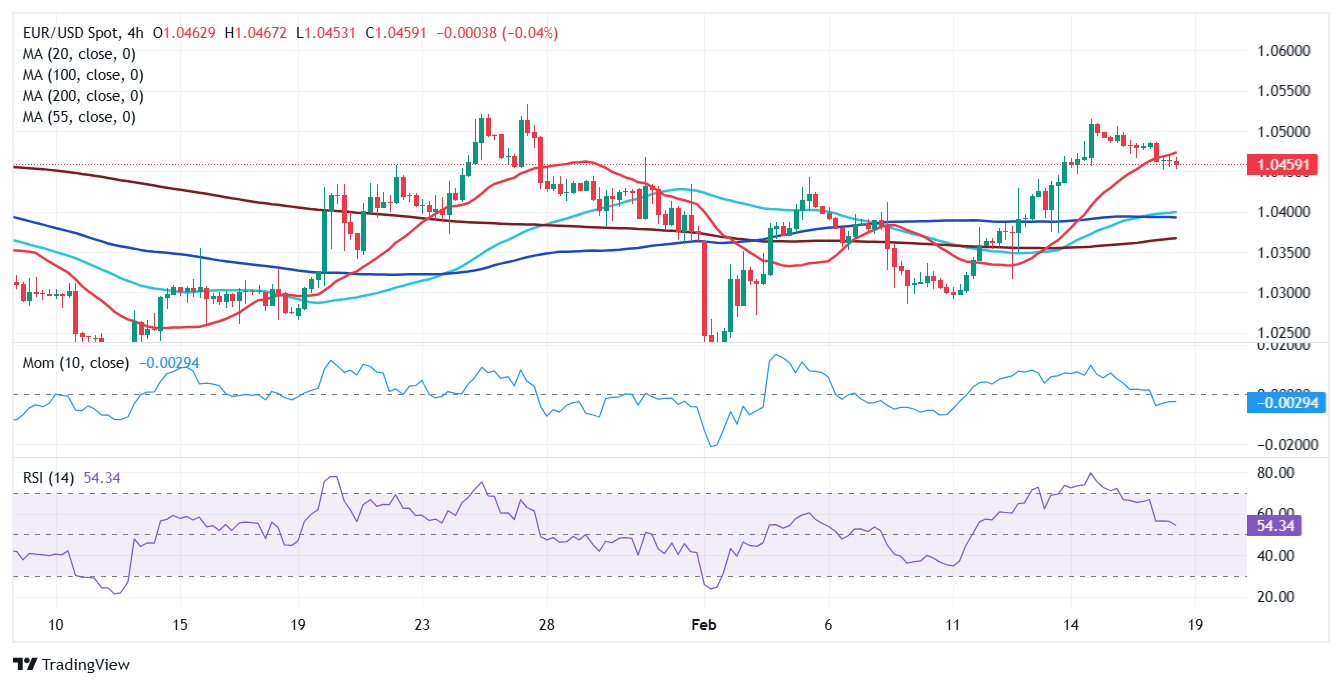

The EUR/USD pair is down for a second consecutive day, and technical readings in the daily chart show the pair is neutral. It trades above a flat 20 Simple Moving Average (SMA), providing dynamic support at around 1.0410. At the same time, the 100 SMA extended its slide above the current level, acting as dynamic resistance at around 1.0570. Technical indicators, in the meantime, turned south but remain within neutral levels, not enough to anticipate a certain directional movement.

In the near term, and according to the 4-hour chart, the risk skews to the downside, albeit another leg south is not yet confirmed. The EUR/USD pair develops below a flat 20 SMA, which provides dynamic resistance at around 1.0465. The 100 and 200 SMAs, in the meantime, lack directional strength far below the current level. Finally, technical indicators remain directionless just above their midlines.

Support levels: 1.0410 1.0370 1.0320

Resistance levels: 1.0480 1.0515 1.0550

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.