EUR/USD Price Forecast: Cautious advance, little bullish potential

EUR/USD Current price: 1.0326

- Fed Chairman Jerome Powell is due to testify on monetary policy before Congress.

- Market players adopted a cautious approach after the last round of US tariffs.

- EUR/USD trades above 1.0300, has a limited bullish potential in the near term.

The US Dollar (USD) was under mild selling pressure throughout the first half of the day, albeit financial markets traded with a cautious tone, following ahead of Federal Reserve (Fed) Chairman Jerome Powell’s testimony before Congress.

Powell is due to testify about the Semi-Annual Monetary Policy Report before two different commissions on Tuesday and Wednesday. The first one tends to be more relevant, as whatever he says could impact the USD. His prepared remarks will be released when the event starts.

Meanwhile, United States (US) President Donald Trump delivered as promised on Monday and launched a fresh round of levies. Trump imposed a 25% tariff on all steel and aluminium imports into the US starting March 12. The White House said it could make an exception with Australia, but all other countries are now levied. As a result, risk aversion dominated financial markets during Asian trading hours, with local indexes edging sharply down.

Data-wise, the European Union (EU) did not release relevant macroeconomic data. The US calendar is focused on the Fed, as apart from Powell’s testimony, it includes speeches from several Fed officials spread throughout the American session.

EUR/USD short-term technical outlook

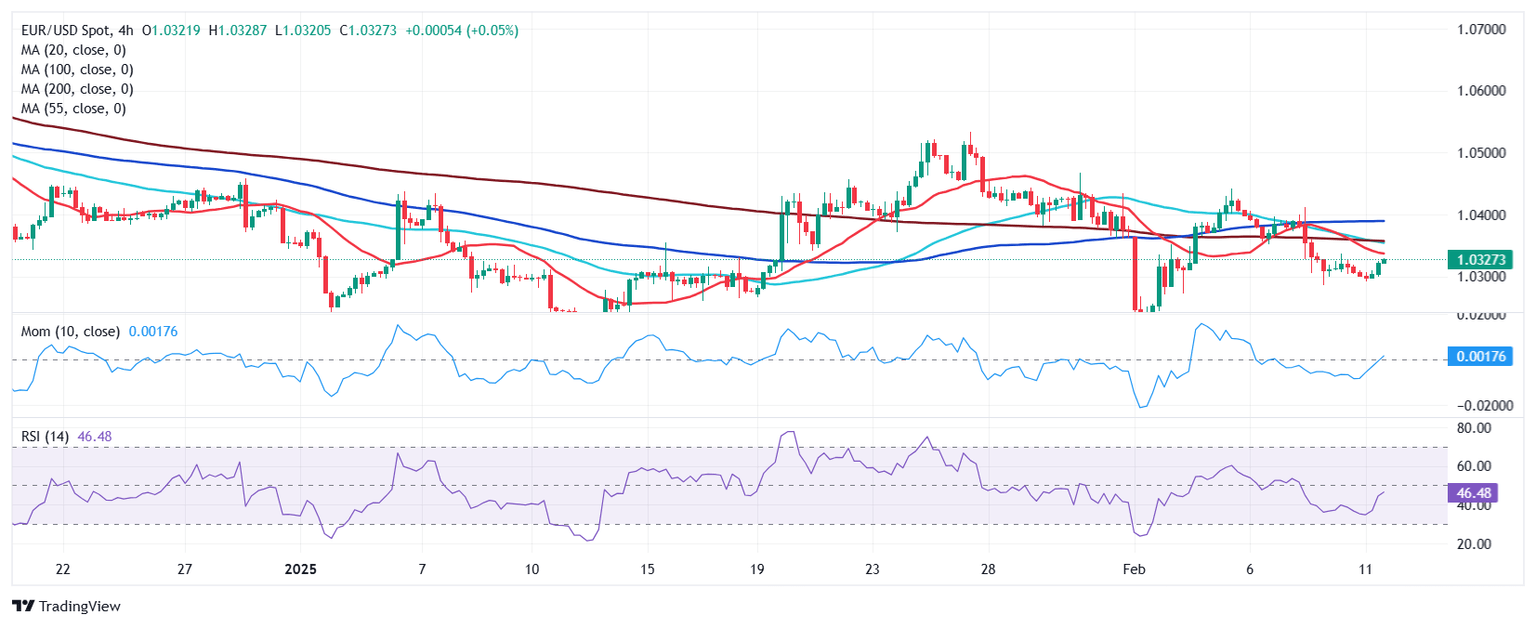

The EUR/USD daily chart shows it's up for a second consecutive day but still struggling to extend gains beyond Friday’s close at 1.0327. The technical picture favors a downward extension, although the directional momentum is missing. EUR/USD develops below all its moving averages, with the 100 Simple Moving Average (SMA) heading firmly south at around 1.0610, while a flat 20 SMA stands at 1.0378. Technical indicators, in the meantime, turned marginally higher, but remain within negative levels, not enough to confirm additional gains ahead.

The 4-hour chart shows that technical indicators keep advancing, although they stand below their midlines. At the same time, EUR/USD develops below all its moving averages, with the 20 SMA heading firmly south below the 100 and 200 SMAs, limiting the odds of an upward extension in the near term.

Support levels: 1.0330 1.0275 1.0230

Resistance levels: 1.0385 1.0420 1.0465

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.