EUR/USD Price Forecast: Caution rules ahead of Federal Reserve’s decision

EUR/USD Current price: 1.0501

- Tepid United States data limited US Dollar’s strength in a risk-averse environment.

- The focus shifts to the Federal Reserve and policymakers hints on monetary policy.

- EUR/USD extends its wait-and-see phase, risk skewed to the downside.

The EUR/USD pair held within familiar levels on Tuesday, stabilizing at around the 1.0500 mark. Market participants adopted a cautious stance amid looming central banks’ announcements and macroeconomic releases from major economies. The US Dollar (USD) started the day with a strong footing, albeit the momentum faded with the release of tepid United States (US) macroeconomic figures.

The Eurozone published the October Trade Balance, which posted a non seasonally adjusted surplus of €6.8 billion, down from the €11.6 billion posted in September. Additionally, the German ZEW Survey showed Economic Sentiment improved in December to 15.7 from 7.4 in the previous month. The figures provided Euro near-term support, but gains were short-lived.

Across the pond, the US released November Retail Sales, which were up 0.7%, better than the 0.5% expected, yet not enough to boost the USD. The country also reported that November Capacity Utilization rose 76.8%, worse than the 77.3% expected, while Industrial Production in the same period fell 0.1%, missing the 0.3% advance anticipated by market analysts.

The focus now shifts to the US Federal Reserve (Fed), expected to trim the benchmark interest rate by 25 basis points (bps) when it announces its decision on monetary policy on Wednesday. Alongside the announcement, officials will release the Summary of Economic Projections (SEP) or dot plot, which will offer fresh perspectives on growth, inflation and employment, and of course, policymakers’ intentions about interest rates.

EUR/USD short-term technical outlook

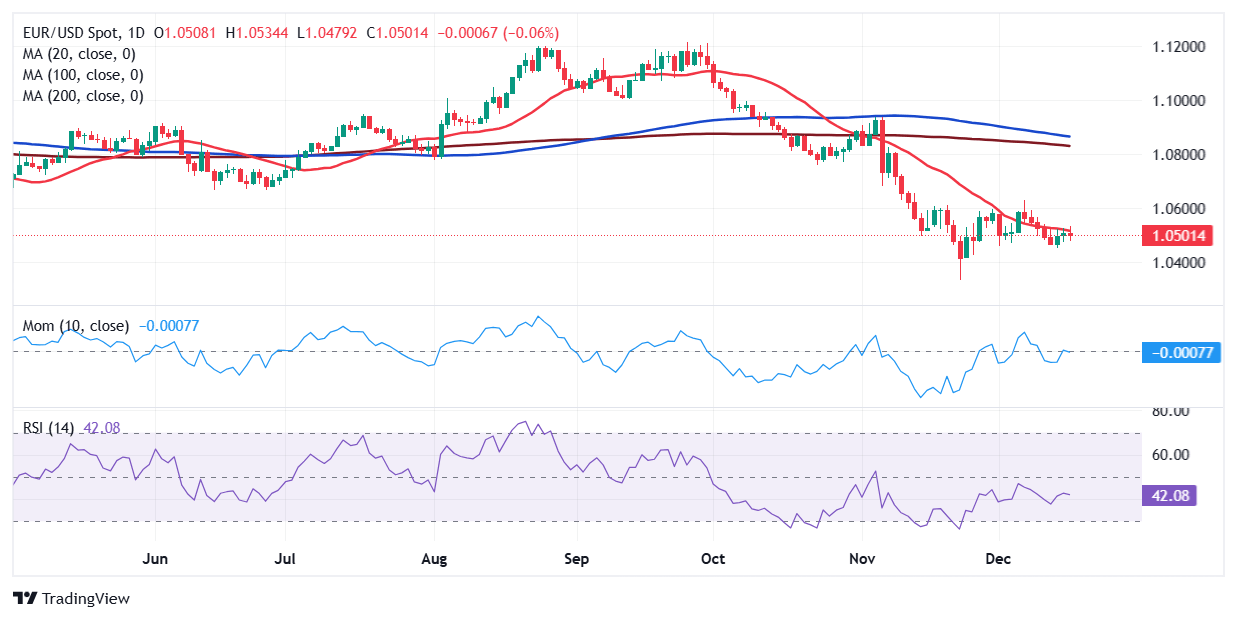

From a technical point of view, EUR/USD has made no progress. The pair trades around the 1.0500 level after peaking at 1.0533 during European trading hours. In the daily chart, a bearish 20 Simple Moving Average (SMA) keeps providing dynamic resistance at around 1.0520, while the 100 and 200 SMAs gain downward traction far above the shorter one. Technical indicators, in the meantime, turned lower, albeit with limited strength, falling short of anticipating a steeper decline.

In the near term, EUR/USD held within familiar levels, currently battling around a flat 20 SMA. At the same time, a directionless 100 SMA keeps attracting sellers on intraday spikes. Finally, the 200 SMA accelerated its slump well above the shorter ones. Technical indicators turned lower but remain around their midlines, reflecting the absence of clear directional strength yet skewing the risk to the downside.

Support levels: 1.0460 1.0410 1.0375

Resistance levels: 1.0520 1.0570 1.0625

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.