EUR/USD Price Forecast: Buyers paused, retain control

EUR/USD Current price: 1.0888

- Encouraging Chinese data lifted the mood at the beginning of the week.

- Uncertainties surrounding United States trade war weigh on markets.

- EUR/USD eases within range, buyers paused, but sellers nowhere to be found.

The EUR/USD pair hovers around 1.0900 in quiet trading on Monday, confined to a limited intraday range. Cautious optimism rules financial markets, as Chinese data released over the weekend provided a boost to Asian shares, later extending into European trading.

China reported that Industrial Production rose 5.9% Year-on-Year (YoY) in February, while Retail Sales in the same period were up 4%, beating the market expectations and easing concerns about the Asian giant economic health. Additionally, the country reported that Fixed Assets Investment surged by 4.1%, better than the previous 3.2%.

Meanwhile, European Central Bank (ECB) Vice President Luis de Guindos made some interesting remarks while speaking with a Spanish radio station. On the one hand, de Guindos noted energy inflation behaving “relatively well,” while adding inflation will meet the central bank’s 2% target. On the other hand, de Guindos said that the increased uncertainty caused by United States (US) President Donald Trump’s tariffs “has reduced the clarity regarding future (monetary policy) decisions.”

The American session brought the NY Empire State Manufacturing Index, which plummeted to -20 in March, much worse than the -1.9 expected and the previous 5.7. The US also reported that Retail Sales were up 0.2% in February, below the 0.7% advance expected although better than the -1.2% posted in January.

ECB President Christine Lagarde will hit the wires during US trading hours, although no big monetary policy surprises are to be expected.

EUR/USD short-term technical outlook

The EUR/USD pair is up, although the bullish potential is limited, according to technical readings in the daily chart. Technical indicators are flat to mildly bearish within overbought territory, indicating modest upward exhaustion yet not enough to anticipate a slide. At the same time, the pair keeps developing above all its moving averages, with a firmly bullish 20 Simple Moving Average (SMA) extending its advance above a flat 100 SMA, yet still below a directionless 200 SMA, the latter at 1.0725.

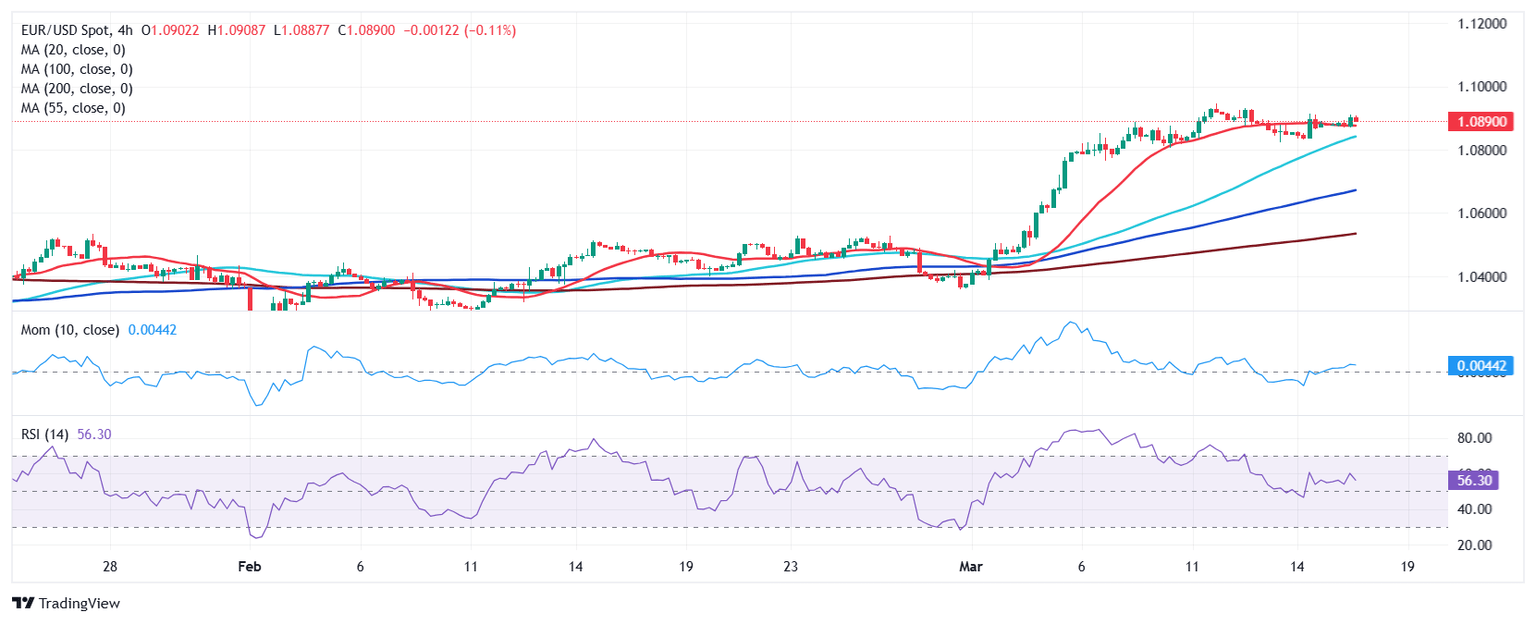

In the near term, and according to the 4-hour chart, EUR/USD is neutral-to-bullish. The pair is resting just above a flat 20 SMA, while the 100 and 200 SMAs head firmly higher far below the shorter one. At the same time, the Momentum indicator is stuck directionless around its 100 line, while the Relative Strength Index (RSI) indicator turned modestly lower at around 58, reflecting receding buying interest.

Support levels: 1.0870 1.0820 1.0790

Resistance levels: 1.0925 1.0960 1.1000

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.