EUR/USD Price Forecast: Buyers become more daring, aim to reconquer 1.0900

EUR/USD Current price: 1.0878

- The looming US presidential election undermines demand for the US Dollar.

- Higher-than-anticipated United States inflation data pushed EUR/USD further up.

- EUR/USD positive momentum is set to continue in the near term.

The EUR/USD pair maintains a positive tone on Thursday, trading near a weekly high in the 1.0880 region. The US Dollar remains on the back foot despite the sour tone of global equities, still affected by mixed data released on Wednesday as the United States (US) heads to the polls to choose the next president. Americans have to decide whether former President Donald Trump or current Vice President Kamala Harris will become the 47th president of the world’s largest economy.

Data-wise, Germany released September Retail Sales, which rose by 1.2% from the previous month and 3.8% year-on-year (YoY), much better than the -0.5% and 1.6% expected. Additionally, the Eurozone published the preliminary estimate of the October Harmonized Index of Consumer Prices (HICP), which increased 2% YoY, higher than the previous 1.7% and above the 1.9% expected. The core annual HICP held at 2.7%, against expectations of a down-tick to 2.6%.

The US published Initial Jobless Claims for the week ended October 25, which came in better than anticipated, falling to 216K from a revised 228K in the previous week. The country also released the September Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve’s (Fed) favorite inflation gauge. PCE inflation was up 2.1% YoY and 0.2% MoM, as expected, while the core annual reading hit 2.7%, higher than the 2.6% anticipated by market participants.

The news put pressure on the US Dollar and pushed it lower against most major rivals, sending EUR/USD closer to the 1.0900 level.

EUR/USD short-term technical outlook

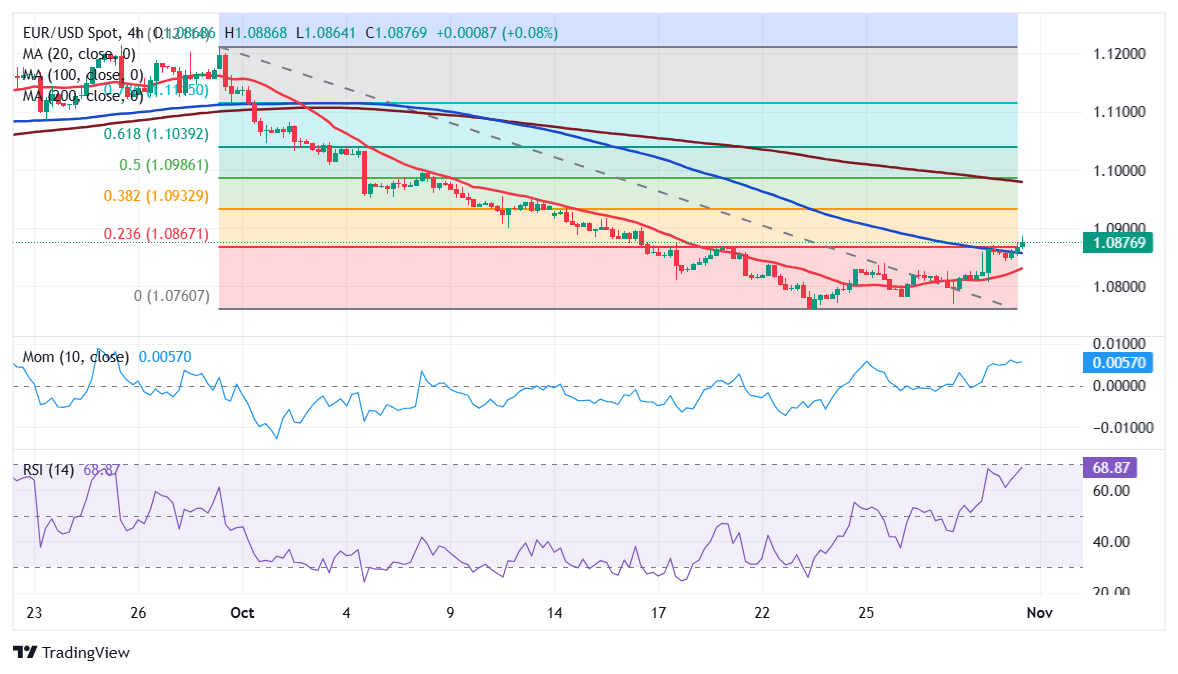

The daily chart for the EUR/USD pair shows it’s currently overcoming its 20 and 200 Simple Moving Averages (SMAs) with the shorter one maintaining its bearish slope and about to cross below the longer one. Technical indicators, in the meantime, grind higher with modest strength but remain below their midlines, suggesting buyers hesitate. Finally, the pair is above the 23.6% Fibonacci retracement of the 1.1208 - 1.0760 decline at 1.0865, the immediate support level.

In the near term, and according to the 4-hour chart, the risk skews to the upside. EUR/USD develops above its 20 and 100 SMAs, with the shorter one gaining upward traction below the longer one. At the same time, technical indicators head firmly north within positive levels, in line with the ongoing advance and a potential bullish extension, particularly if EUR/USD reconquers the 1.0900 mark.

Support levels: 1.0865 1.0820 1.0770

Resistance levels: 1.0900 1.0940 1.0985

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.