EUR/USD Price Forecast: Buyers add pressure amid US election’s polls

EUR/USD Current price: 1.0903

- Latest polls on US presidential election outcome favor Democrat Kamala Harris.

- HCOB upwardly revised the Eurozone October Manufacturing PMI.

- EUR/USD gains upward traction above 1.0900, faces static resistance at 1.0932.

The EUR/USD pair advances above the 1.0900 mark on Monday, trading at levels that were last seen in mid-October. The US Dollar retreats ahead of the first-tier events in the United States (US) this week. The country will choose the next President this week, with results expected early on Wednesday. Afterward, the Federal Reserve (Fed) will meet to decide on monetary policy, with the announcement scheduled for Thursday.

Polls ahead of the election show a slight difference in favor of the Democrat candidate Vice President Kamala Harris, putting additional pressure on the US Dollar. The latter surged in the last weeks on expectations that Republican Donald Trump may return to office, as his policies could lead to higher inflation and a steeper deficit, potentially pushing the Fed into hiking rates instead of loosening them.

Meanwhile, European data provided near-term support to the Euro, as the Hamburg Commercial Bank (HCOB) upwardly revised the Eurozone October Manufacturing Purchasing Manager Index (PMI) from 45.9 to 46. The German manufacturing index was also revised to 43 from a previous estimate of 42.6.

The US macroeconomic calendar has little to offer, as the country will only release September Factory Orders.

EUR/USD short-term technical outlook

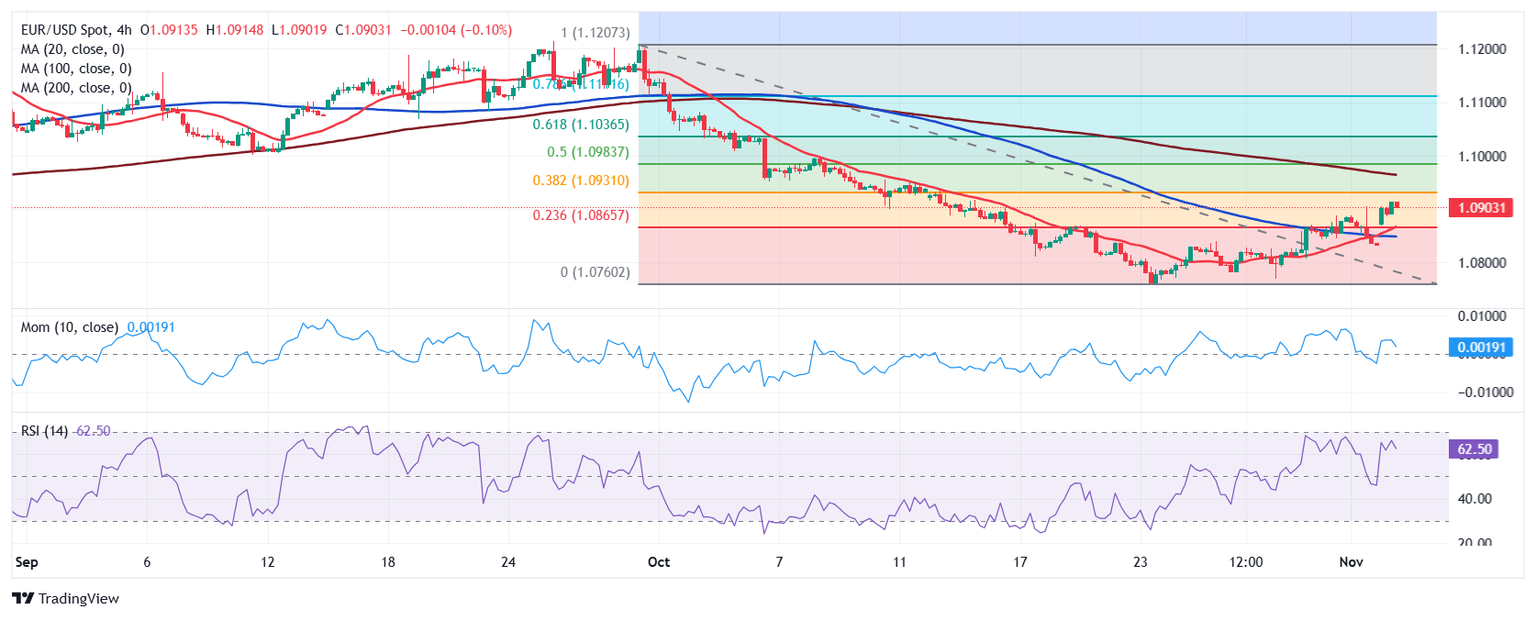

The EUR/USD pair gapped higher at the weekly opening and there are no technical signs the pair could fill the early gap in the near term. In the daily chart, EUR/USD stands well above its 20 and 200 Simple Moving Averages (SMAs), with the shorter one still heading lower below a flat longer one. Nevertheless, technical indicators aim firmly higher and are currently crossing their midlines into positive territory, not enough to confirm a bullish extension but clearly indicating buyers are in control.

Additionally, EUR/USD found intraday support at around 1.0866, the 23.6% Fibonacci retracement of the daily slump measured between 1.1208 and 1.0760. The 38.2% retracement provides resistance at 1.0932.

The near-term picture is neutral-to-bullish. In the 4-hour chart, technical indicators have lost directional strength but hold well above their midlines and without signs of upward exhaustion. At the same time, a bullish 20 SM converges with the mentioned 23.6% retracement after surpassing a flat 100 SMA, reflecting persistent buying interest and reinforcing the static support area.

Support levels: 1.0865 1.0820 1.0770

Resistance levels: 1.0935 1.0990 1.1020

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.