EUR/USD Price Forecast: Bears maintain the pressure as risk aversion prevails

EUR/USD Current price: 1.0974

- The sour market mood limits Euro gains despite encouraging German figures.

- The negative tone of global stocks leads the way amid a scarce macroeconomic calendar.

- EUR/USD keeps finding sellers ahead of 1.1000, risk skews to the downside.

The EUR/USD pair keeps trading within familiar levels on Tuesday, meeting sellers ahead of the 1.1000 mark. The Euro received little to no attention despite encouraging German data, as the country released August Industrial Production, which rose by 2.9% in the month, much better than the 0.8% anticipated by market players. Compared to a year earlier, however, Industrial Production declined by 2.7%, still better than the previous -5.3%.

Global stocks´ poor performance limits high-yielding advances. Asian and European indexes fell following Wall Street’s slump on Monday, the latter led by a tech sell-off. The mood also soured amid persistent tensions in the Middle East and mounting speculation the good shape of the United States (US) economy is healthy enough to limit the upcoming Federal Reserve (Fed) interest rate cuts.

Ahead of the US opening, the country released the August Good and Services Trade Balance, which posted a deficit of $70.4 billion, better than the $-70.6 billion anticipated. The American session will bring little of interest, with a couple of Fed speakers scheduled throughout the session.

EUR/USD short-term technical outlook

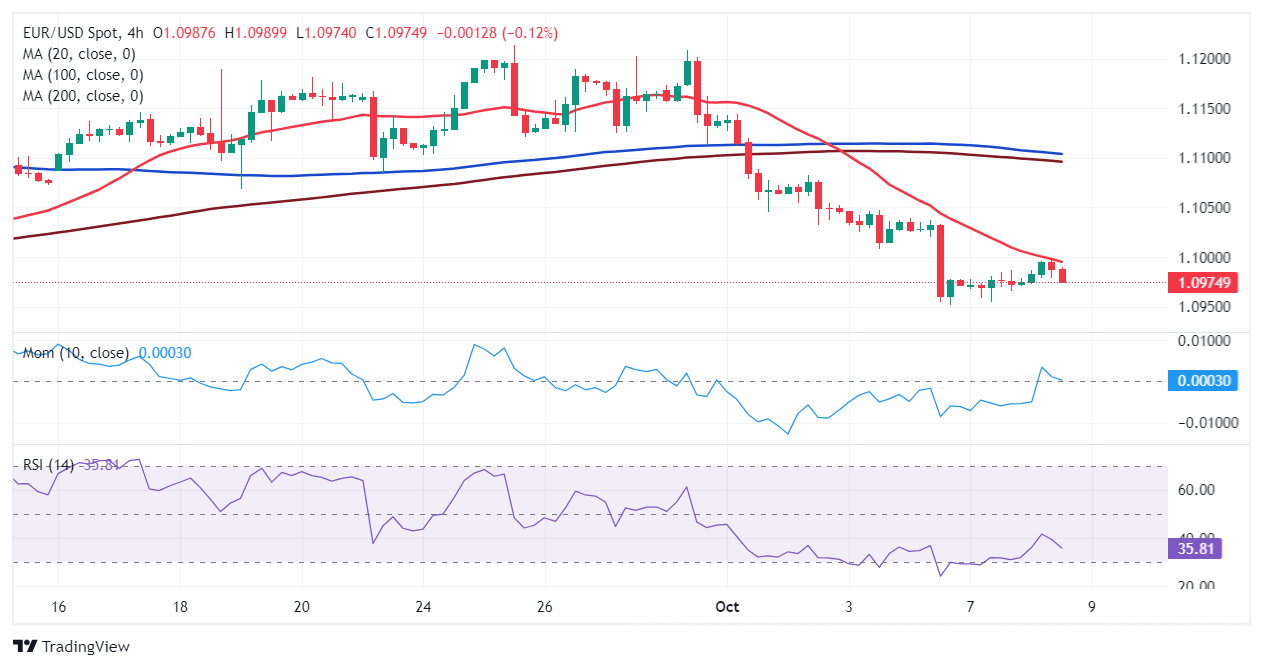

Technically, the EUR/USD pair is still battling a daily ascendant trend line broken at the beginning of the week. The line acts as dynamic resistance, a handful of pips above the current level, with near-term spikes beyond it being quickly rejected by sellers. From a technical point of view, the daily chart shows that technical indicators have lost their directional strength but consolidate within negative levels without signs of a potential recovery underway. At the same time, the 20 Simple Moving Average (SMA) heads marginally higher above the current level, while a flat 100 SMA provides support at around 1.0930.

In the 4-hour chart, however, the technical picture is bearish. A bearish 20 Simple Moving Average (SMA) nears the aforementioned trend line, reinforcing its relevance as resistance and containing advances. Even further, the 100 and 200 SMAs gain downward traction far above the shorter one, reflecting persistent selling interest. Finally, technical indicators turned south, maintaining their downward slopes within negative levels and favoring another leg south.

Support levels: 1.0960 1.0920 1.0885

Resistance levels: 1.0990 1.1040 1.1085

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.