EUR/USD Price Forecast: Bears add pressure ahead of FOMC Minutes

EUR/USD Current price: 1.0955

- United States FOMC Meeting Minutes stand out in the American afternoon.

- The sour sentiment prevails amid geopolitical tensions, US headlines.

- EUR/USD extends its slide and could test the 1.0900 area in the near term.

The EUR/USD keeps trading uneventfully below the 1.1000 mark on Wednesday, confined to a tight range. The absence of a fresh catalyst and upcoming United States (US) releases keep investors in cautious mode, while geopolitical tensions also undermine the mood.

Asian shares traded mixed, with a notorious slide in Chinese stocks, which came under selling pressure after the long one-week holiday. China’s recent data spurred concerns that stimulus measures may not be enough to revive the battered economy. US futures were also down following news indicating that the US Department of Justice indicated that it was considering a possible breakup of Google as an antitrust remedy for its search and advertising monopoly.

The US Dollar (USD) made the most out of this environment pushing higher against most major rivals, although unable to run.

Investors await the Federal Open Market Committee (FOMC) Meeting Minutes, scheduled for the American afternoon. The document is meant to provide insights into policymakers´ reasoning behind the decision to trim the benchmark interest rate by 50 basis points (bps). It could also include hints on future action, although financial markets will likely take them with a pinch of salt, given the latest macroeconomic figures indicating the labor market is much healthier than previously feared.

Data-wise, Germany released the August Trade Balance, which posted a surplus of €22.5 billion, beating expectations of €18.4 billion. The US published MBA Mortgage Applications for the week ended October 4, which where down 5.1%.Beyond FOMC Minutes, the macroeconomic calendar for the American session includes a couple of Federal Reserve (Fed) speakers spread through the afternoon and August Wholesale Inventories.

EUR/USD short-term technical outlook

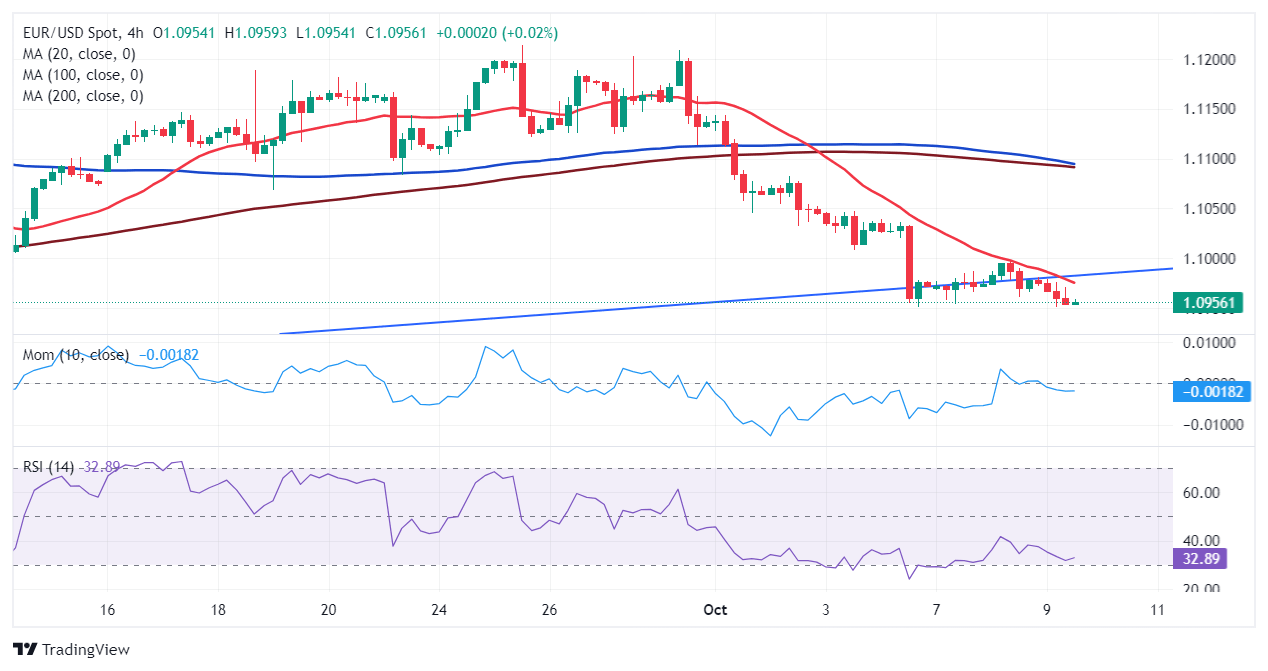

The EUR/USD pair has reached a fresh weekly low of 1.0950 during European trading hours and trades nearby ahead of the US opening. The daily chart shows that a broken daily ascendant trend line coming from June keeps offering resistance, currently around the 1.1000 figure. At the same time, the 20 Simple Moving Average (SMA) gains downward traction roughly 150 pips above the current level, while the 100 and 200 SMAs stand pat below the current level. Finally, technical indicators maintain their downward slopes within negative levels, albeit with uneven strength.

In the near term, and according to the 4-hour chart, the risk skews to the downside. A bearish 20 SMA acts as dynamic intraday resistance, now at around 1.0970. Technical indicators, in the meantime, lack directional strength but remain within negative levels, in line with another leg south. Finally, the 100 and 200 SMAs turned south far above the current level, reflecting persistent selling interest.

Support levels: 1.0920 1.0885 1.0840

Resistance levels: 1.0970 1.1000 1.1045

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.