EUR/USD Price Forecast: Another test of the 2024 low remains possible

- EUR/USD resumed its downtrend and returned below 1.0500.

- The US Dollar maintained its bullish momentum following Monday’s drop.

- Markets’ attention is expected to shift to PCE and further US data releases.

EUR/USD quickly erased Monday’s gains and resumed its broader bearish trend on turnaround Tuesday, slipping back below the 1.0500 support level as the US Dollar (USD) strengthened significantly. The Greenback's recovery was fueled by investors reacting to recent comments from President-elect Donald Trump, who suggested imposing tariffs on imports from China, Mexico, Canada, and the European Union.

Trump’s announcements followed statements by newly appointed Treasury Secretary Scott Bessent, whose remarks describing sweeping trade tariffs as "maximalist" positions somewhat reassured markets. His comments hinted that Trump’s trade policies could adopt a more pragmatic approach than initially feared.

On the monetary policy front, the Federal Reserve (Fed) recently lowered its benchmark interest rate by 25 basis points to a range of 4.75%-5.00% at its November 7 meeting. This widely expected move aligns with the Fed’s efforts to guide inflation back to its 2% target. However, cracks are beginning to appear in the labour market, even as unemployment remains near historic lows.

Fed Chair Jerome Powell has struck a cautious tone, indicating no urgency for additional rate cuts. This stance has tempered market expectations for another cut in December, providing some support for the USD. Similarly, FOMC Governor Michelle Bowman echoed Powell’s view, emphasizing the need for patience before considering further monetary easing.

Following the release of the FOMC Minutes of the November 6-7 gathering, officials reportedly held differing opinions during their meeting earlier this month on how much further interest rates might need to be reduced. However, they collectively agreed that it was not the right time to provide explicit guidance on the future direction of US monetary policy in the coming weeks.

Across the Atlantic, the European Central Bank (ECB) has adopted a wait-and-see approach following its October decision to cut the deposit rate to 3.25%. While the ECB remains in data-gathering mode, inflationary pressures persist, with eurozone wage growth accelerating to 5.42% in the third quarter.

Looking ahead, Trump’s potential reinstatement of tariffs on European or Chinese imports could heighten inflationary pressures in the US, potentially prompting a more hawkish response from the Fed. Such a scenario could strengthen the USD further, maintaining downward pressure on EUR/USD.

Meanwhile, speculative traders have increased their bearish bets on the Euro (EUR), with net short positions rising to a three-week high of approximately 42.6K contracts. On the other hand, commercial traders have expanded their net longs to over 21K contracts, while open interest has rebounded after two weeks of declines.

In the coming days, the release of US PCE data and other key economic indicators will likely dominate discussions ahead of the Thanksgiving holiday. In Europe, preliminary inflation figures from Germany and the broader eurozone will keep investors engaged.

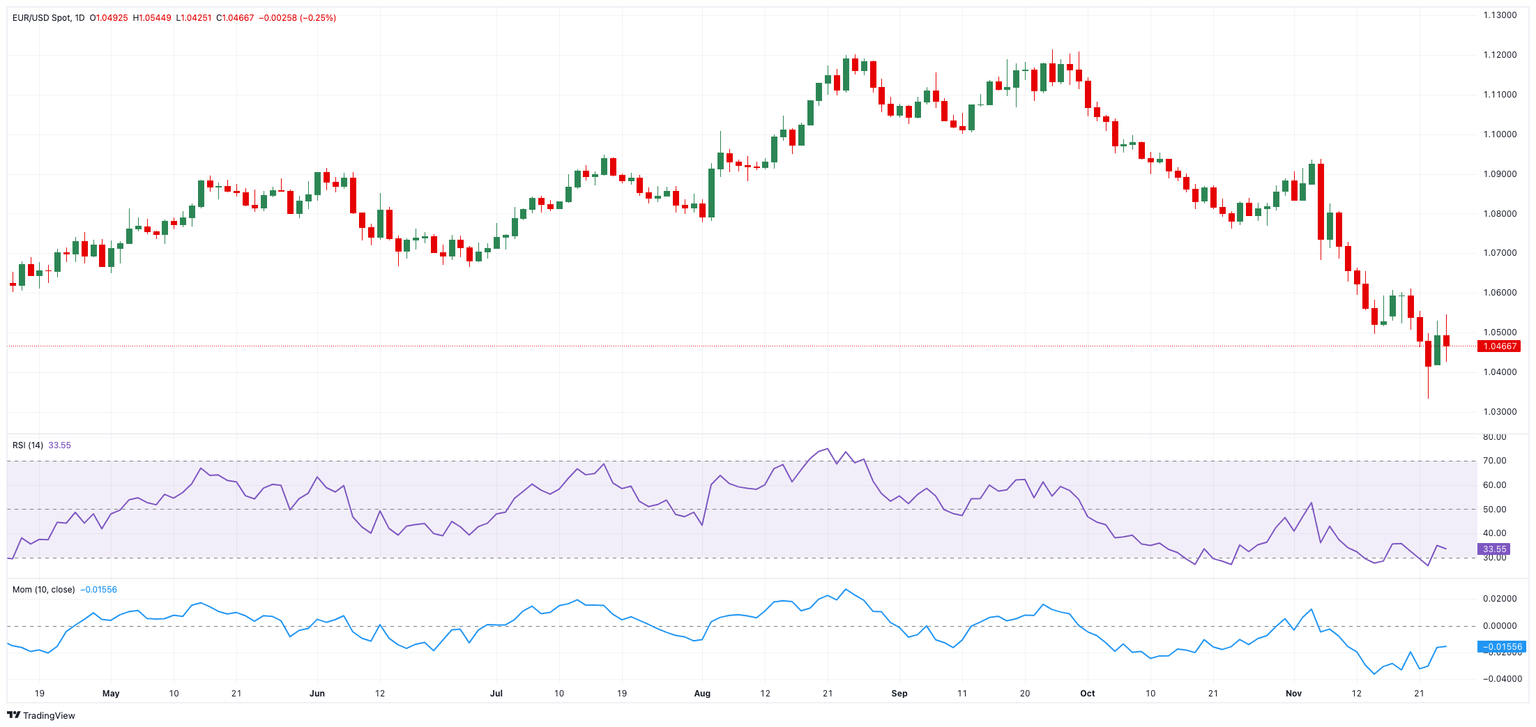

EUR/USD daily chart

Technical Outlook for EUR/USD

Further losses may drive the EUR/USD down to its 2024 low of 1.0331 (November 22), followed by weekly lows of 1.0290 (November 30, 2022) and 1.0222 (November 21, 2022).

On the upside, the 200-day SMA at 1.0856 is immediate resistance, followed by the intermediate 55-day SMA at 1.0878 and the November high at 1.0936 (November 6).

Furthermore, the short-term technical picture is bearish as long as the EUR/USD remains below the 200-day moving average.

The four-hour chart indicates that a moderate recovery is possible. However, the initial resistance is at 1.0530, before 1.0609 and 1.0653. The next negative objective is 1.0331, followed by 1.0290. The Relative Strength Index (RSI) rebounded to about 50.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.