EUR/USD Price Forecast: A tough barrier remains around 1.0600

- EUR/USD faced increasing selling pressure, revisiting the 1.0460 zone.

- The US Dollar picked up further pace and rose to three-day tops.

- Political unrest in France weighed heavily on investors’ sentiment.

EUR/USD rapidly shook off Friday’s decent gains and resumed its downward impulse at the beginning of the week, breaching the 1.0500 mark to print fresh multi-day lows. This drop was fueled by a notable rebound in the US Dollar (USD), as markets assessed President-elect Donald Trump’s remarks hinting at a fresh wave of tariffs targeting imports from the BRICS coalition, as well as renewed political fears around the French government.

Policy Moves in Focus: Fed and ECB

On the monetary policy front, the Federal Reserve (Fed) delivered a widely expected rate cut on November 7, lowering its benchmark rate by 25 basis points to 4.75%-5.00%. The move aligns with the Fed’s goal of bringing inflation closer to its 2% target. However, cracks in the US labour market are beginning to show, even as unemployment hovers near historic lows.

Fed Chair Jerome Powell struck a cautious tone in his latest remarks, signalling no urgent need for additional rate cuts. This prudent stance has dampened expectations for further easing in December, offering some relief to the Greenback. Echoing Powell’s sentiments, FOMC Governor Michelle Bowman highlighted the importance of patience before taking further policy actions.

Meanwhile, the European Central Bank (ECB) has stayed put since its October rate cut, which brought the deposit rate down to 3.25%. Nonetheless, inflation worries remain front and centre, with Eurozone wage growth accelerating to 5.42% in Q3. ECB policymakers appear to be in wait-and-see mode, with key inflation data from Germany and the broader eurozone later this week likely to steer their next steps.

Hawkish comments from ECB board member Isabel Schnabel lent support to the European currency in past sessions, as she emphasised a cautious approach to easing, suggesting that aggressively lowering rates to stimulate growth might not be the right move.

Trump’s Trade Policies: A Wild Card

Looking ahead, Trump’s trade policies could inject further uncertainty into the market. Additional tariffs could stoke inflation in the US, potentially prompting a more hawkish response from the Fed. Such a scenario would likely strengthen the USD and apply renewed pressure on EUR/USD and the rest of its risk-linked peers.

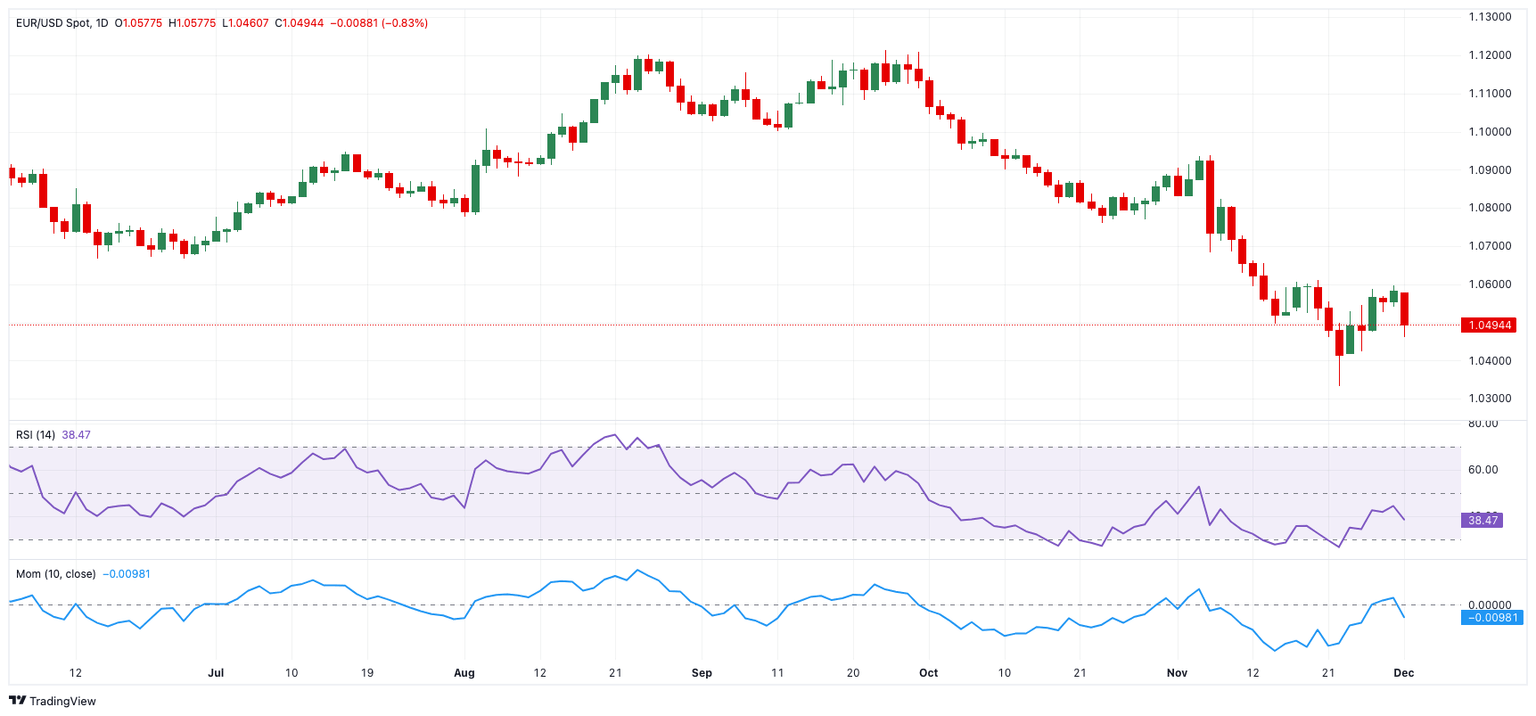

EUR/USD daily chart

Technical Outlook for EUR/USD

For now, the downside risks for EUR/USD remain in focus. Key support levels include the 2024 low of 1.0331 (recorded on November 22), with further declines potentially testing 1.0290 and 1.0222, which were weekly lows in November 2022.

On the flip side, immediate resistance lies at the weekly high of 1.0609 (November 20), prior to the 200-day SMA at 1.0849, and followed by the November top of 1.0936 (November 6).

The short-term technical picture leans bearish, especially as long as the pair trades below the 200-day moving average.

The four-hour chart hints at further losses, with resistance first at 1.0596, followed by 1.0609 and 1.0653. On the downside, the next targets are 1.0460, seconded by 1.0331 and 1.0290. Furthermore, the Relative Strength Index (RSI) receded to around 40, while the Average Directional Index (ADX) near 17 is indicates a soft trend.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.