EUR/USD Price Forecast: A technical correction in the offing?

- EUR/USD rose past the 1.1200 mark, hitting new yearly highs.

- The US Dollar plummeted to fresh troughs on US-China concerns.

- The White House said the total tariffs on China surged to 145%.

The Euro (EUR) regained strong upside impulse on Thursday, prompting EUR/USD to advance north of 1.1200 the figure on the back of the persistent selling pressure on the US Dollar (DXY).

As a result, the US Dollar Index (DXY) broke below the 101.00 support to hit new multi-month lows amid mixed US yields across the board and a noticeable pullback in Germany’s 10-year bund yields.

Trade turbulence

President Trump imposed a sweeping 10% duty on all U.S. trade partners, effective April 5, with additional levies ranging from 10% to 50% on specific countries and regions, while the European Union (EU) was hit with a 20% rate.

Adding to the already mounting concerns, the White House said on Thursday that China will be hit with 145% tariffs a 125% tariff.

It is worth mentioning that President Trump signalled a temporary pause (90 days) on new tariffs for non-retaliating countries.

EU President Ursula von der Leyen stressed that the bloc remains open to negotiations but is ready to retaliate, stoking fears that a tit-for-tat escalation could slash Eurozone GDP by up to 0.5%.

Focus on central banks

The Fed recently decided to hold rates steady amid concerns that tariffs could fuel inflation and slow the U.S. economy further. Fed Chair Jerome Powell noted that a 50-basis-point rate cut remains an option if growth continues to falter. He also warned that tariffs might be “significantly larger than expected,” posing risks to both growth and price stability.

Thursday’s release of lower-than-expected US inflation figures, however, appears to have encourage investors to start pencilling in a full percentage point of Fed’s easing this year.

Across the Atlantic, the ECB trimmed its key interest rate by 25 basis points and signalled readiness to take further action if economic uncertainty lingers. While policymakers expect a modest decline in growth and continued near-term inflation, they anticipate easing price pressures by 2026.

President Christine Lagarde warned that a deepening trade conflict with the U.S. could reduce Eurozone GDP by 0.5%, with some officials even suggesting that further policy adjustments might become necessary.

Shifting market sentiment

Speculative traders cut net long Euro positions to around 52K contracts—a three-week low—while commercial traders reduced their shorts to roughly 83K contracts. Despite these adjustments, overall sentiment toward the Euro remains marginally positive, though ongoing uncertainty is causing many bulls to remain cautious.

Technical overview of EUR/USD

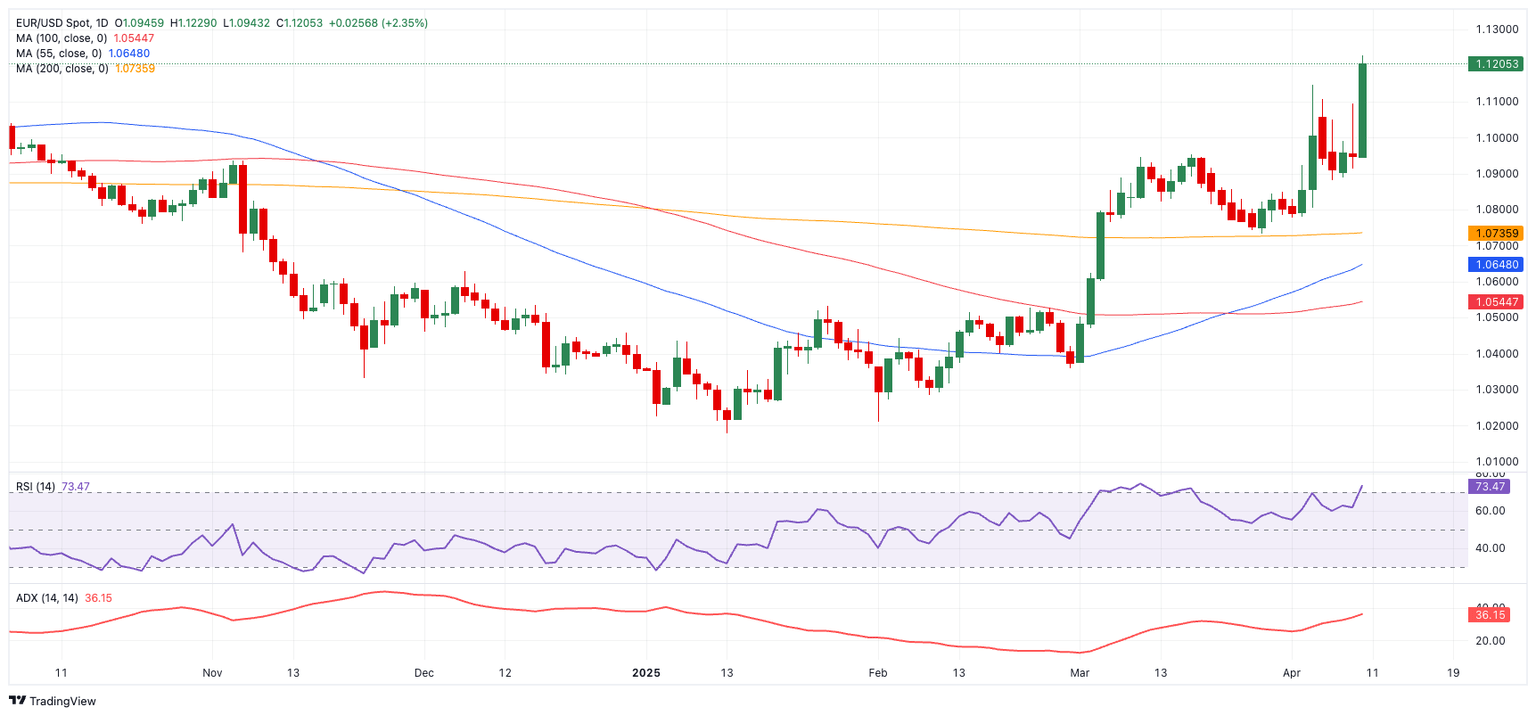

The upside barrier begins at the 2025 peak of 1.1228 (April 10). A break above that level could open the door to testing the 2023 high at 1.1275 (July 18) ahead of the weekly top at 1.1390 (February 21, 2022).

On the downside, support emerges at the key 200-day SMA at 1.039, prior to the weekly low at 1.0732 (March 27). A breakdown below this floor could expose the interim 55-day SMA at 1.0649.

Meanwhile, momentum indicators reflect a bullish undercurrent, with the RSI entering the overbought region above 71, and the ADX near 36 indicating a moderately strong trend.

EUR/USD daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.