EUR/USD Price Forecast: A move to 1.1000 starts shaping up

- EUR/USD rose markedly to the vicinity of 1.0980 on Tuesday.

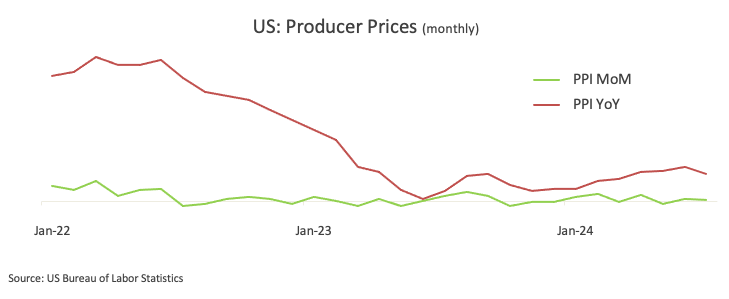

- The Dollar accelerated its losses following Producer Prices data.

- Economic Sentiment in Germany and the euro bloc worsened in August.

EUR/USD extended Monday’s advance and flirted with the 1.0980 zone on turnaround Tuesday, picking up momentum on the back of the intense sell-off in the US Dollar (USD).

Meanwhile, extra losses saw the Greenback retreat to multi-day lows in the sub-103.00 area when tracked by the US Dollar Index (DXY), reflecting an improved sentiment in the risk complex, which was particularly exacerbated after a soft print from US Producer Prices in July, all ahead of the publication of the key US fundamentals later in the week.

Specifically, the upcoming US inflation data, as measured by the Consumer Price Index (CPI) on Wednesday and Retail Sales figures on Thursday, are expected to provide the markets with insight into the Federal Reserve’s intentions regarding potential interest rate cuts in September, including the possible extent of such cuts. Additionally, these reports could offer further clarity on the state of the US economy and whether recent concerns about a recession are well-founded.

On a regional level, Economic Sentiment in both Germany and the broader Eurozone declined further in August, reflecting a slowdown in German economic activity and key sectors within the euro area.

While the European Central Bank (ECB) has remained silent, Fed policymakers are expected to express their views as the September meeting approaches. Over the weekend, FOMC Governor Michelle Bowman, typically known for her hawkish stance, adopted a more moderate tone, acknowledging "welcome" improvements in inflation in recent months. However, she also noted that inflation remains "uncomfortably above" the central bank's 2% target and is still susceptible to upward pressure.

Regarding a potential rate cut by the Fed in September, market expectations for a 50 bps reduction have increased to around 55% from Monday’s 48%, according to the CME Group’s FedWatch Tool. It is noteworthy that just last week, the probability of such a scenario was around 70%.

Furthermore, if the Fed opts for more substantial rate cuts, the policy gap between the Fed and the ECB could narrow in the medium-to-long term as market participants expect two more interest rate reductions by the ECB this year, all of which could potentially support a rebound in EUR/USD.

However, in the longer term, the US economy is expected to outperform its European counterpart, suggesting that any weakness in the US Dollar may be temporary.

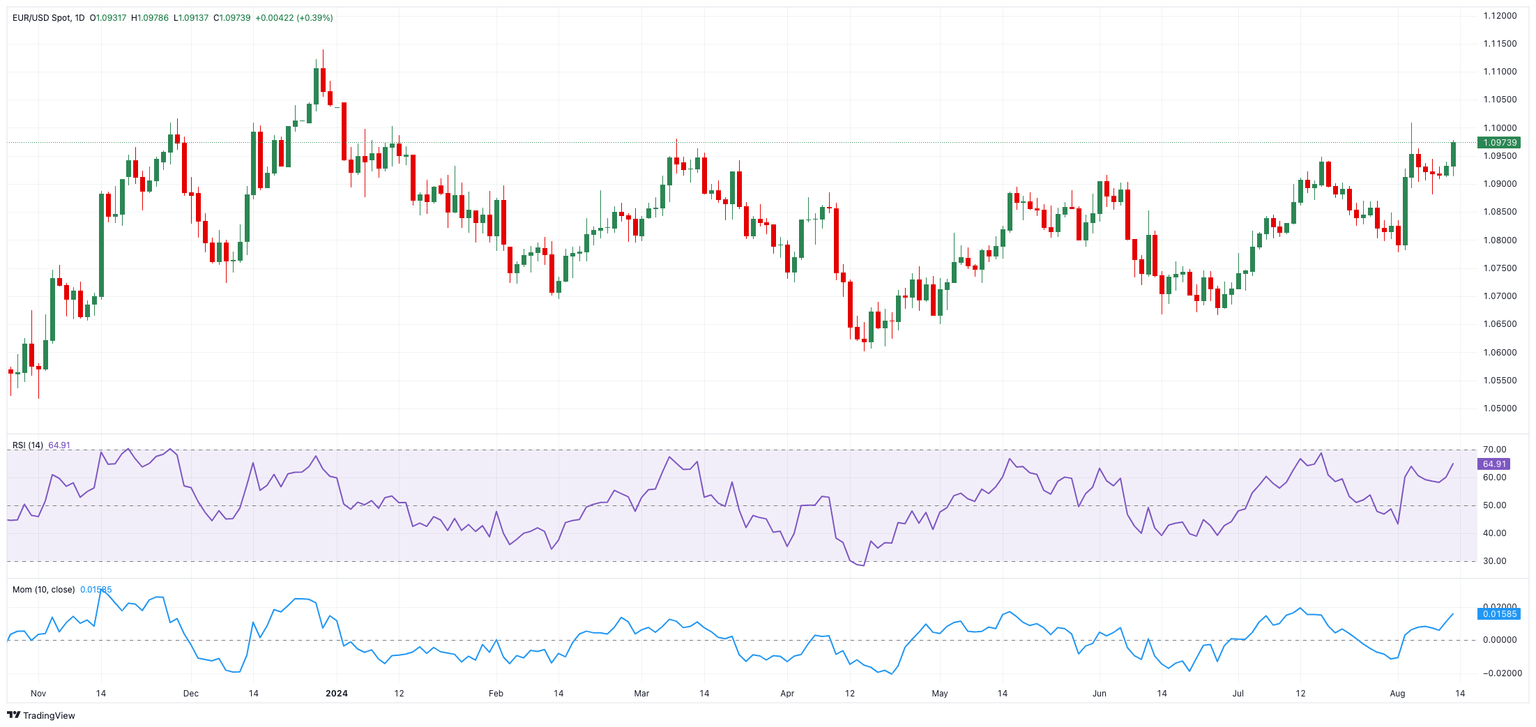

EUR/USD daily chart

EUR/USD short-term technical outlook

Further north, EUR/USD is likely to test the August high of 1.1008 (August 5) before reaching its December 2023 top of 1.1139 (December 28).

On the downside, the pair's next objective is the 200-day SMA at 1.0835, followed by the weekly low of 1.0777 (August 1) and the June low of 1.0666 (June 26), all of which are prior to the May bottom of 1.0649 (May 1).

Looking at the big picture, the pair's upward trend should continue if it trades over the crucial 200-day SMA.

So far, the four-hour chart shows a decent pick-up of the upside bias. The initial resistance level is 1.1008, which comes ahead of 1.1132. On the other hand, immediate conflict is at 1.0881, prior to the 200-SMA of 1.0855 and 1.0777. The relative strength index (RSI) improved to nearly 70.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.