EUR/USD Price Forecast: A deeper, sustained drop seems unlikely

- EUR/USD broke below the 1.1100 support to print multi-day lows.

- The Dollar extended its rebound, although it lost some impetus later.

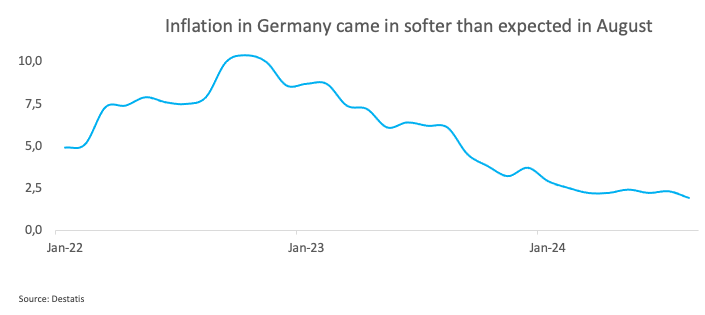

- Germany’s advanced Inflation Rate surprised to the downside in August.

EUR/USD added to Wednesday’s retracement and breached the key 1.1100 support to hit multi-day lows on Thursday. The marked decline in spot came in response to an equally strong, albeit in the opposite direction, move in the Greenback, taking the US Dollar (USD) back above the 101.00 hurdle.

In fact, the US Dollar (USD) regained further ground on the back of further depreciation of the Japanese yen, selling pressure in the risk complex, and positive data releases in the US docket, which saw Q2 GDP figures and weekly Claims surpass expectations.

The pair’s daily pullback was also accompanied by a generalized bounce in US yields across the curve and German 10-year bund yields, all against the backdrop of steady speculation of rate cuts by the Fed next month.

Meanwhile, investors continued to watch for any signs regarding the size of the most likely interest rate cut by the Fed in September, after Fed Chair Jerome Powell suggested that the time may be right to consider recalibrating monetary policy. Powell also noted that "barring any unexpected developments, the labour market is unlikely in the near term to add significantly to upward pressures on inflation, and that the Fed doesn't want to see further cooling in labour market conditions.

Speaking about rate cuts, Federal Reserve Bank of Atlanta President Raphael Bostic argued on Wednesday that, with inflation declining further and the unemployment rate rising more than he had expected, it might be the right time to consider rate cuts, although he wants to be certain before taking action.

Earlier this year, Bostic had said he anticipated the Fed would need to cut rates only once this year, likely in the fourth quarter, but recently he has suggested he might be open to starting the cuts sooner.

Reflecting these likely cuts, the probability of a 25 bps rate cut in this September 18 gathering is almost 67%, according to the CME Group's FedWatch Tool:.

Around the European Central Bank (ECB), its latest Accounts showed that policymakers felt that there was no compelling reason to cut interest rates in the previous month; however, they had also warned that this issue may be reviewed in September in view of the relentless impacts of high rates on economic growth

In recent comments, board member Klass Knot said the central bank could consider a gradual interest rate reduction if inflation continues on its current downward trajectory. But, he added, more data will be needed before any decision on whether to make such a cut in September. Knot also called for caution, noting that while there may be some merit to the easing of policy, no decision is yet on the table.

However, the release of lower-than-expected flash CPI data in Germany in August could play against any cautious approach from rate setters. The EMU’s advanced inflation figures are due on Friday, and a similar surprise could prompt ECB officials to seriously start considering another rate cut at the September 12 event.

In summary, should the Fed choose to implement further or more substantial rate cuts, the policy gap between the Fed and the ECB could lessen over the medium to long term, potentially elevating the EUR/USD. This is especially likely as markets predict that the ECB will reduce rates two more times this year.

Over the long term, however, the US economy is expected to outperform that of Europe, suggesting any longer-term dollar weakness might be contained.

Moreover, additional appreciation in the euro appears supported by position sizing. According to the recent CFTC report, EUR net longs have risen to levels not seen since early June, reinforcing the sustained bullish bias of speculators. Conversely, commercial traders, especially hedge funds, continued to hold their net short positions, placing contracts at multiweek highs. Within the period under scrutiny, EUR/USD staged a fierce bounce, well and truly piercing the psychological barrier of 1.1000 to achieve new yearly highs on the back of the renewed and significant slide across the US Dollar.

EUR/USD daily chart

EUR/USD short-term technical outlook

Further north, the EUR/USD is projected to test its 2024 top of 1.1201 (August 26), ahead of the 2023 peak of 1.1275 (July 18) and the 1.1300 round level.

The pair's next downward objective is the weekly low of 1.0881 (August 8), before the critical 200-day SMA at 1.0852 and the weekly low of 1.0777 (August 1). From here, the low of 1.0666 (June 26) emerges prior to the May low of 1.0649 (May 1).

The pair's upward trend, in the meantime, should continue as long as it remains above the key 200-day SMA.

The four-hour chart shows some pick-up of downside momentum in past hours. The initial resistance is 1.1201, before 1.1275. Instead, there is immediate support at 1.1055, followed by the 100-SMA at 1.1046 and the 200-SMA at 1.0960. The relative strength index (RSI) retreated to around 35.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.