EUR/USD Price Forecast: A convincing breakout of 1.0600 should expose extra gains

- EUR/USD rebounded sharply and retargeted the 1.0600 barrier.

- The US Dollar faced the resurgence of a robust selling interest.

- Key EMU and German flash inflation figures are next of note in Europe.

EUR/USD quickly shrugged off Tuesday’s modest gains and continued its temporary uptrend during Wednesday’s trading, climbing toward the 1.0600 level.

The pair’s rise was driven by a sharp retreat in the US Dollar (USD) as investors weighed President-elect Donald Trump’s latest remarks about a potential new wave of tariffs targeting imports from China, Mexico, Canada, and the European Union. Month-end flows also contributed to the Greenback’s decline, as traders made portfolio adjustments.

On the monetary policy front, the Federal Reserve (Fed) made a widely anticipated move on November 7, lowering its benchmark interest rate by 25 basis points to a range of 4.75%-5.00%. This action aligns with the Fed’s ongoing effort to bring inflation back to its 2% target. However, signs of strain are beginning to emerge in the US labour market, even as unemployment remains near record lows.

Fed Chair Jerome Powell has taken a cautious approach, signalling no immediate need for additional rate cuts. This stance has dampened expectations for further easing in December, offering some support to the USD. Similarly, FOMC Governor Michelle Bowman emphasised the need for patience before making any further monetary policy adjustments.

The recently released minutes from the Fed’s November meeting highlighted a split among officials regarding the future path of interest rates. While there was no clear consensus on further cuts, the Fed opted not to provide specific forward guidance, leaving markets in a state of uncertainty.

In Europe, the European Central Bank (ECB) has remained on hold since its October decision to cut the deposit rate to 3.25%. Nonetheless, inflation concerns persist, with eurozone wage growth accelerating to 5.42% in Q3. The ECB appears focused on analysing upcoming data before signalling its next move. In this context, advanced inflation readings from Germany and the eurozone later this week will be pivotal.

Adding to the euro’s momentum were hawkish remarks from ECB board member Isabel Schnabel. In an interview with *Bloomberg*, she argued for a gradual approach to easing policy, suggesting that cutting rates to levels aimed at stimulating growth might not be the appropriate course of action.

Looking ahead, developments surrounding Trump’s trade policies could add another layer of uncertainty. Fresh tariffs might fuel inflation in the US, potentially leading to a more hawkish response from the Fed. Such a scenario could strengthen the USD and maintain downward pressure on EUR/USD.

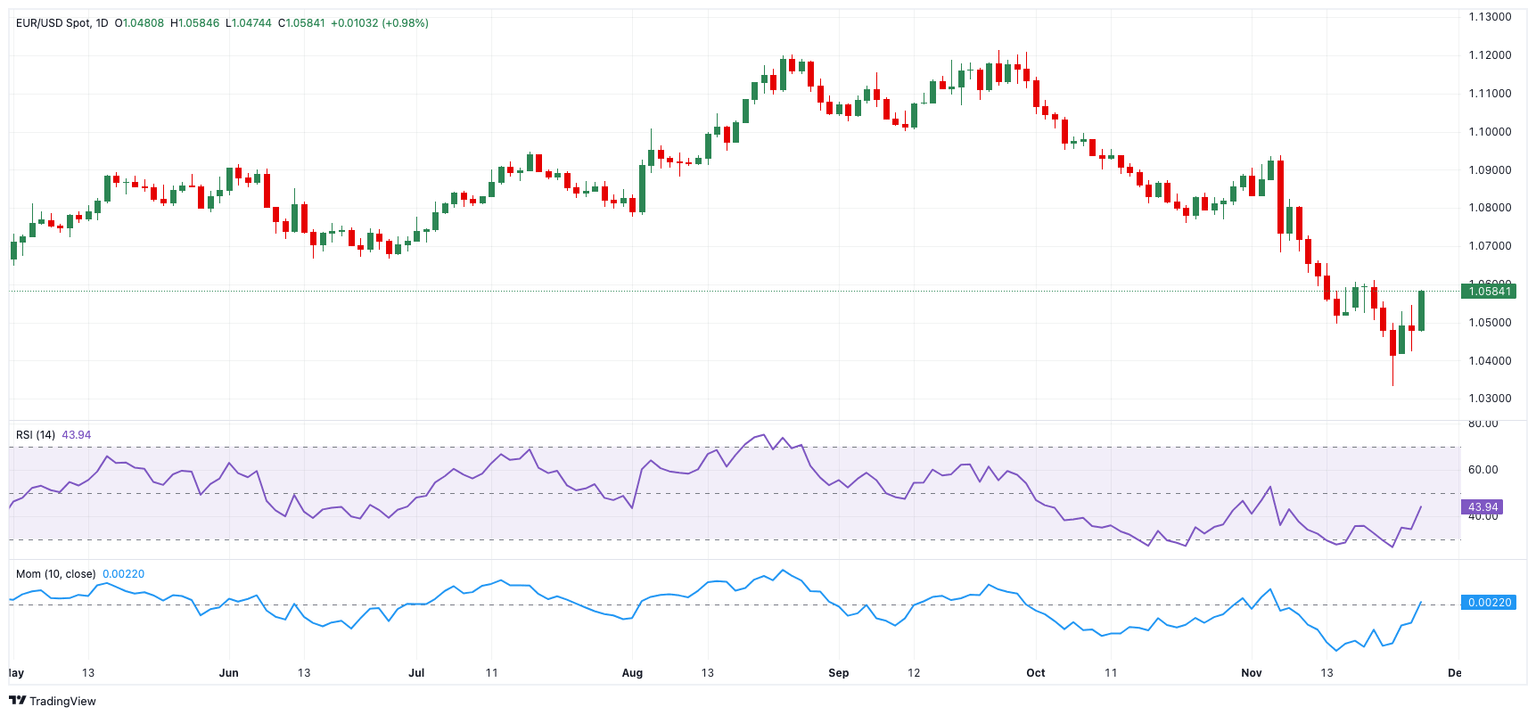

EUR/USD daily chart

Technical Outlook for EUR/USD

Further losses may push the EUR/USD down to its 2024 low of 1.0331 (November 22), followed by weekly lows of 1.0290 (November 30, 2022) and 1.0222 (November 21, 2022).

On the upside, the 200-day SMA at 1.0857 provides immediate resistance, followed by the intermediate 55-day SMA at 1.0860 and the November high at 1.0936 (November 6).

Furthermore, the short-term technical outlook is negative as long as the EUR/USD continues below the 200-day moving average.

The four-hour chart shows that a moderate recovery is achievable. However, the initial resistance is at 1.0584, which precedes 1.0609 and 1.0653. The next negative goal is 1.0331, then 1.0290. The Relative Strength Index (RSI) rose to about 62.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.