- Trade war relief to boost optimism, but could it boost growth?

- Central banks in a comfort zone, adjustments likely in the first half of the year.

- EUR/USD two-year bearish trend remains firmly in place, bears losing interest.

- EUR/USD Forecast Poll for 2020 shows a slight bullish bias.

Markets' lean season has lasted two full years and while those are not yet over, flush times are looking more and more likely for this 2020.

EUR/USD news: The beginning of the end of the trade war?

Ever since hitting 1.2537 in January 2018, the EUR/USD pair has been on a selling spiral that set a multi-year low of 1.0878 just two months ago. The level can hardly be considered an interim bottom when just considering the following price’s recovery, but the focus this time shouldn’t be put on technical readings, but in politics.

The catalyst for the two-year slump was the US foreign policy after Donald Trump became President. In the last two years, the largest EUR/USD monthly decline came in March 2018, when the trade war started. Back then, Trump announced steel and aluminum tariffs on imports from all countries and hit China with the first round of levies. Trade talks quick-started shortly afterward and have extended through the past two years, as just this December they announced that the phase one of a trade deal had been agreed.

It's worth noting that Trump’s trade war was not only with China, although their relation filled most of the breaking news headers. Trump spread its war worldwide and, while the battle is far from over, some positive signs have appeared recently that it might be coming to an end. This December, it was announced that the US Congress had approved the USMCA trade deal.

The trade war is being considered as one of the may catalyst behind the global economic downturn. And again, while it is not over, finally there seems to be light at the end of the tunnel.

Economic growth still a big concern

The eurozone is ending the year with economic markers indicating that the economic deceleration continues. In the US, things look a bit better, but fears of recession persist. Seasonally-adjusted GDP rose by 0.3% in the EU28 during the third quarter of 2019, confirming an annualized growth rate of 1.2%. In the same period, the annualized US Gross Domestic Product was reported at 2.1%.

Meanwhile, the Markit Flash US Composite Output Index hit 52.2 in December, a 5-month high, up from 52.0 in November, indicating “the quickest rise in output since July. Nonetheless, the rate of growth was below the series trend and only moderate overall.” The Markit Flash Eurozone PMI Composite Output Index in the same period came in at 50.6, unchanged from its previous month. The official report, however, states: “The eurozone economy failed to pick up momentum in December, according to the flash PMI, rounding off a fourth-quarter period in which output rose at the weakest pace since the economy pulled out of its downturn in the second half of 2013.”

Employment levels have remained healthy throughout the year in the US, but according to Markit, EU employment growth slowed to a five-year low. Inflationary pressures, however, are nowhere to be found. The EU annual core CPI stands at 1.3% according to the latest data, while in the US, Fed’s favorite inflation figure, the core PCE price index stands at 1.6%, both figures from November 2018.

Central banks’ imbalances, economics turn politics

In this scenario, central banks have returned to the easing path. The US Federal Reserve lowered rates by 25 basis points for a third time in four months back in October, to a range of 1.5% to 1.75%, with Chief Powell signaling a pause, as he said that he does not expect the bank to pull the trigger unless economic conditions worsen unexpectedly.

“Euro area growth remains weak,” said the recently debuted ECB’s head, Christine Lagarde in her first hearing before the European Parliament. Before leaving his chair and back in September, former ECB’s President, Mario Draghi, cut its main deposit rate by 10 basis points to -0.5%, a record low, and announced TLTRO III, implying 20 billion euros per month of asset purchases for as long as it deems necessary.

Policymakers from both shores of the Atlantic have acted to boost inflation. Something central bankers have spent the last decade doing with modest results.

Yet in this front, the scale also leans in US favor, as Chief Jerome Powell seems far more confident that his counterpart Lagarde. The latter has used a more confident wording in her statement, but meanwhile, macroeconomic conditions are still worsening, so it’s hard to believe her. For sure, Mrs. Lagarde is a politician rather than an economist, and more of this confident stance is to be expected, although the effects on the EUR’s performance will be filtered with this knowledge.

2020 the year of change

That’s not an expression of hope, but of need. 2020 should be the year of change. Or at least, the year when things begin to change. The recent trade deals hint some relief in the trade war front, hence in growth’s concerns. Whether the economies will be able to grow or not without the trade conflict in the way, is a different story. But optimism is supposed to reign.

The latest released data suggest that, at least in the US, recession concerns have eased. The EU, on the other hand, is yet to be seen. Both central banks have tackled such preoccupations and acted in consequence, although the EU still has pending to “better coordinate fiscal policies so low-debt countries spend more to boost the region’s economy while high-debt countries shore up their finances,” European Commissioner for Economic Affairs Paolo Gentiloni said. Coordinating fiscal policies is at the top of ECB’s wish list and it has been for years. Maybe Mrs. Lagarde can kick start the process.

Economic developments and central banks’ decisions will motorize action throughout the first half of the year. Signs of growth, should the trade deal continues progressing, will take a few months to kick in. But for sure, the market will continue depending on it.

In November 2020, the US will go to the polls. That grants a shaky year-end in the financial world. Will Trump be able to retain its chair? If not, what will happen with US foreign policy? For sure, the US election will be THE event of 2020, as those would set the dollar’s direction for the next couple of years.

EUR/USD technical outlook

The EUR/USD pair is ending a second consecutive year with losses. Having started it with 1.1460, it's ending it sub-1.1100, with the year low at 1.0978. The bearish trend remains firmly in place, according to the monthly chart, with no signs of downward exhaustion just yet.

In the mentioned time frame, the pair is developing below all of its moving averages, with the 20 SMA been the strongest and around 1.1320. The 23.6% retracement of the 2018/2019 slump comes at 1.1265, while the 38.2% retracement is at 1.1510. The latter is critical, as the EUR/USD pair will enter bullish territory once it breaches above this level. EUR/USD hasn’t been around this level since January 2019. Technical indicators, in the meantime, remain within negative territory, aiming to recover, but lacking enough strength to confirm so.

On a weekly basis, EUR/USD is neutral, having been unable to find a certain direction since mid-October. The pair is hovering around a mild-bearish 20 SMA ever since then, while the longer moving averages remain far above the current level, with the 100 SMA converging with the mentioned 38.2% retracement. Technical indicators are stuck to their midlines.

The latter chart suggests that bearish pressure has eased, but that bulls are nowhere to be found just yet. The 1.1000 psychological figure is the immediate support level and a line in the sand as, below there, bears could become bolder and try to retest the 2019 low. The next bearish target once below 1.0880 is 1.0720, en route to 2017 low at 1.0340.

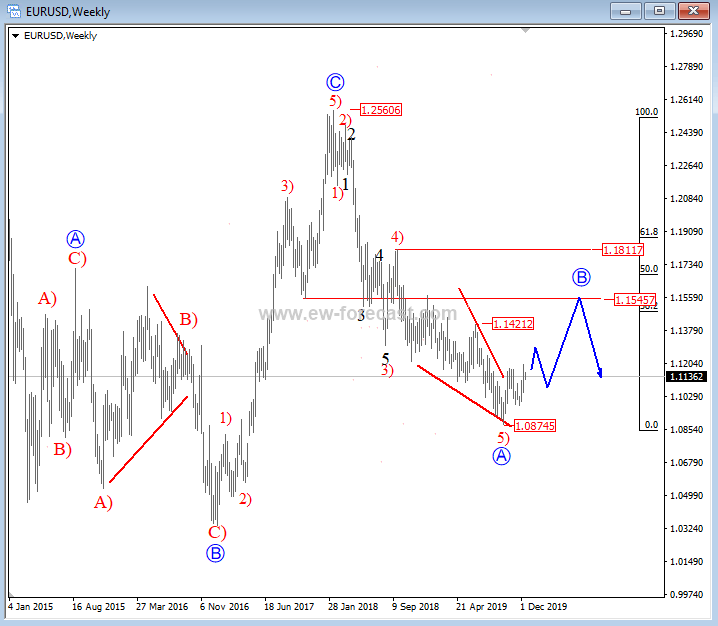

Gregor Horvat projects a bearish outlook for the Euro Dollar on his Elliott Wave analysis:

EUR/USD Elliott Wave Analysis

As we expected for 2019, EURUSD was trading nicely bearish, but seems like a five-wave decline from the 1.2560 highs can be now finished, especially if we consider a potential ending diagonal (wedge pattern) within wave 5) of A. So, in 2020 we can expect a corrective recovery in wave B that can take some time and it may also push the price into 1.14 – 1.18 area before the downtrend for wave C resumes.

Forecast Poll 2020

| Forecast | H1 - Jun 30th | H2 - Dec 31st |

|---|---|---|

| Bullish | 55.3% | 60.0% |

| Bearish | 27.7% | 17.8% |

| Sideways | 17.0% | 22.2% |

| Average Forecast Price | 1.1186 | 1.1394 |

| EXPERTS | H1 - Jun 30th | H2 - Dec 31st |

|---|---|---|

| Alexander Douedari | 1.1400 Bullish | 1.1500 Bullish |

| Andrew Lockwood | 1.0850 Bearish | 1.0500 Bearish |

| Andrew Pancholi | 0.9946 Bearish | 1.0426 Bearish |

| ANZ FX Strategy Team | 1.0900 Bearish | 1.1100 Sideways |

| Brad Alexander | 1.0750 Bearish | 1.0500 Bearish |

| BBVA Bancomer Team | 1.1400 Bullish | 1.1700 Bullish |

| BMO Capital Markets | 1.1000 Bearish | 1.1100 Bearish |

| BNP Paribas Team | 1.1300 Bullish | 1.1400 Bullish |

| BoA FX, Rates and Commodities Team | 1.1100 Bearish | 1.1500 Bullish |

| Chris Svorcik | 1.1750 Bullish | 1.2800 Bullish |

| Chris Weston | 1.1250 Bullish | 1.1500 Bullish |

| Christina Parthenidou | 1.1580 Bullish | 1.0900 Bearish |

| CIBC World Markets Team | 1.1300 Bullish | 1.1600 Bullish |

| CitiFX | 1.1400 Bullish | 1.1600 Bullish |

| Cypher Asset | 1.1265 Bullish | 1.1600 Bullish |

| Danske Research Team | 1.1100 Sideways | 1.1300 Bullish |

| DBS Group Research | 1.0900 Bearish | 1.1100 Sideways |

| Dmitriy Gurkovskiy | 1.0500 Bearish | 1.2500 Bullish |

| Dukascopy Bank Team | 1.0650 Bearish | 1.0350 Bearish |

| Eagle FX Team | 1.1735 Bullish | 1.1110 Sideways |

| ForexGDP Team | 1.1700 Bullish | 1.2500 Bullish |

| FX Trading Revolution Team | 1.1000 Sideways | 1.1500 Bullish |

| Goldman Sachs Global Investment Team | 1.1300 Bullish | 1.1500 Bullish |

| Gregor Horvat | 1.1400 Bullish | 1.1060 Sideways |

| ING Global Economics Team | 1.1100 Sideways | 1.1300 Bullish |

| Ipek Ozkardeskaya | 1.1300 Bullish | 1.1600 Bullish |

| Jamie Saettele | 1.1600 Bullish | 1.2100 Bullish |

| Jeff Langin | 1.0800 Bearish | 1.0700 Bearish |

| Jose Blasco | 1.0900 Bearish | 1.1200 Sideways |

| Justin Paolini | 1.0800 Bearish | 1.0500 Bearish |

| LMAX Exchange Team | 1.1600 Bullish | 1.2000 Bullish |

| NAB Global Market Research Team | 1.1500 Bullish | 1.1700 Bullish |

| National Bank of Canada Eco. & Strat. Team | 1.1300 Bullish | 1.0900 Bearish |

| Nenad Kerkez | 1.1653 Bullish | 1.2090 Bullish |

| OctaFx Analyst Team | 1.1300 Bullish | 1.1400 Bullish |

| Rabobank Financial Markets Research Team | 1.0800 Bearish | 1.1200 Sideways |

| RBC Economic Research Team | 1.0900 Bearish | 1.1000 Sideways |

| Societe Generale Analyst Team | 1.1400 Bullish | 1.1200 Bullish |

| Standard Bank Research Team | 1.1500 Bullish | - |

| Stelios Kontogoulas | 1.1400 Bullish | 1.1500 Bullish |

| Stephen Innes | 1.1500 Bullish | 1.2000 Bullish |

| TD Securities Research Team | 1.0900 Bearish | 1.1100 Sideways |

| Tomasz Wisniewski | 1.1400 Bullish | 1.1800 Bullish |

| UniCredit Research Team | 1.1400 Bullish | 1.1600 Bullish |

| UOB Group Team | 1.1100 Sideways | - |

| Wells Fargo Research Team | 1.1100 Sideways | 1.1300 Bullish |

| Westpac Institutional Bank Team | 1.1100 Sideways | 1.1200 Sideways |

I think that Lagarde my bring some changes to the ECB and EU countries may invest more to provide stimulus and press on with the "green deal" Therefore the EUR price looks to me that it has only limited upside overall.

Signals for 2019 were bearish as a sequence of lower quarterly highs & lows turned momentum studies lower. These were confirmed as 2019 has posted a lower yearly high at 1.1574 and a lower yearly low just below 1.0900. November was an inside month which stalled the Q4 rally and held prices below the 2017 Marabuzo line. As such, signals for 2020 remain cautiously bearish and our call is to sell below the November lows at 1.0977 with a stop loss at the 2017 Marabuzo line at 1.1200 with targets to the 2019 lows at 1.0877, the 2017 pullback lows at 1.0500 and even the 2017 lows at 1.0313.

Related 2020 Forecast Articles

GBP/USD: Pound may continue to fall on hard Brexit deadline

USD/JPY: A journey from trade fears to high-stakes elections

AUD/USD: May the aussie live in interesting times

USD/CAD: Canada and loonie are well positioned but not in control

Gold: XAU/USD bulls likely to remain in control

Crude Oil: WTI bulls to hold their horses despite tighter market, rosier economy

USD/INR: Domestic factors barely support a turnaround for Indian rupee

Bitcoin: BTC, the ultimate store of value

Ethereum: Calm on ETH/USD after the storm is over

Ripple's XRP: The glimpse of hope

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Gold: Record-setting rally remains intact ahead of US PCE data

Gold price refreshes a fresh all-time peak, closing on the $3,100 mark. The global risk sentiment continues to be undermined by worries over Donald Trump's auto tariffs announced earlier in the week, with traders rushing for safety in Gold price. US PCE inflation data awaited.

EUR/USD trades with mild losses below 1.0800, awaits US PCE

EUR/USD is on the back foot below 1.0800 early Friday, struggling to capitalize on the previous day's goodish bounce. Trump's tariff jitters keep investors on the edge, leaving the pair gyrating in a range ahead of the key US PCE inflation data.

GBP/USD holds steady near 1.2950 after UK data

GBP/USD stays quiet and fluctuates near 1.2950 in the European session on Friday. Uncertainty over US President Trump's tariff plans weigh on risk mood and caps the pair's upside, even after February Retail Sales data from the UK came in better than expected.

US core PCE inflation expected to remain sticky, reinforcing Federal Reserve’s cautious stance on rate cuts

The United States Bureau of Economic Analysis is set to release the PCE Price Index data for February on Friday at 12:30 GMT. The core Personal Consumption Expenditures Price Index is expected to rise 0.3% MoM and 2.7% YoY in February.

US: Trump's 'Liberation day' – What to expect?

Trump has so far enacted tariff changes that have lifted the trade-weighted average tariff rate on all US imports by around 5.5-6.0%-points. While re-rerouting of trade will decrease the effectiveness of tariffs over time, the current level is already close to the highest since the second world war.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-637127096634346042.png)