EURUSD spiked to two-year low on Friday following weaker than expected data from Germany Q3 GDP / Nov PMI) and Eurozone (Nov PMI) which further soured already weak sentiment.

The single currency remains pressured by strong dollar on post-US election euphoria, as well as safe-haven demand and is on track to end the third consecutive week with significant losses.

Also, November’s drop is the biggest monthly loss since Apr 2022, with the pair being on track for the second monthly close in red.

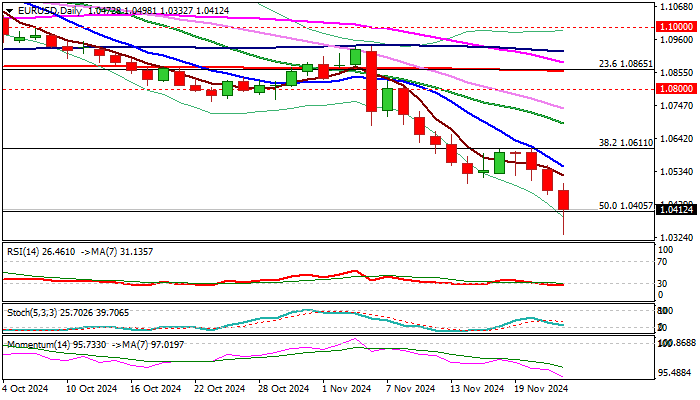

On the other hand, today’s quick bounce from new low and formation of a long tail on daily candle, warns of fresh bids and potential bear-trap formation (under 50% retracement of 0.9535/1.1275, 2022/23 uptrend).

This may, along with overstretched daily indicators and Friday’s profit-taking, keep bears on hold for consolidation, although with limited potential for stronger upside action, due to persisting strong bearish pressure in past couple of weeks.

Limited upticks should be capped under solid 1.0500/50 resistance zone to keep larger bears intact.

Only acceleration through 1.0600/10 pivotal barriers (broken Fibo / former lower platform) would sideline bears.

Res: 1.0448; 1.0496; 1.0552; 1.0611

Sup: 1.0332; 1.0290; 1.0222; 1.0200

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD treads water just above 1.0400 post-US data

Another sign of the good health of the US economy came in response to firm flash US Manufacturing and Services PMIs, which in turn reinforced further the already strong performance of the US Dollar, relegating EUR/USD to the 1.0400 neighbourhood on Friday.

GBP/USD remains depressed near 1.2520 on stronger Dollar

Poor results from the UK docket kept the British pound on the back foot on Thursday, hovering around the low-1.2500s in a context of generalized weakness in the risk-linked galaxy vs. another outstanding day in the Greenback.

Gold keeps the bid bias unchanged near $2,700

Persistent safe haven demand continues to prop up the march north in Gold prices so far on Friday, hitting new two-week tops past the key $2,700 mark per troy ounce despite extra strength in the Greenback and mixed US yields.

Geopolitics back on the radar

Rising tensions between Russia and Ukraine caused renewed unease in the markets this week. Putin signed an amendment to Russian nuclear doctrine, which allows Russia to use nuclear weapons for retaliating against strikes carried out with conventional weapons.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.