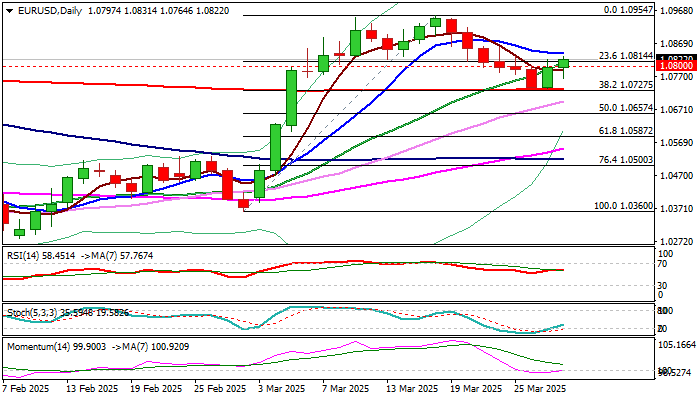

EUR/USD outlook: Reversal signal developing on daily chart

EUR/USD

EURUSD regained traction and rose above 1.08 handle in early US trading on Friday, as hotter than expected US inflation and higher consumer spending failed to impress traders, concerned about slower economic growth.

Fresh strength broke above the top of two-day congestion and generating initial basing and reversal signal after recent pullback from 1.0954 (Mar 18 top) was contained by strong support at 1.0727 (Fibo 38.2% of 1.0360/1.0954 / 200DMA).

This also points to scenario of a healthy correction of larger uptrend and overall bullish structure intact.

Technical studies on daily chart are about to return to full bullish setup as 14-d momentum is about to enter positive territory and moving averages are in bullish configuration and heading north.

Daily close above 1.0800/17 (round-figure / Fibo 38.2% of 1.0954/1.0732 bear-leg) will be required to keep fresh bullish structure intact for attack at 1.0843 (daily Tenkan-sen / 50% retracement) and 1.0869 (Fibo 61.8%) violation of which to confirm reversal.

Initial supports lay at 1.0800/1.0782 (round-figure / broken Fibo 23.6% and guard key support at 1.0727.

Res: 1.0843; 1.0869; 1.0902; 1.0954.

Sup: 1.0800; 1.0782; 1.0727; 1.0700.

Interested in EUR/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.