EUR/USD

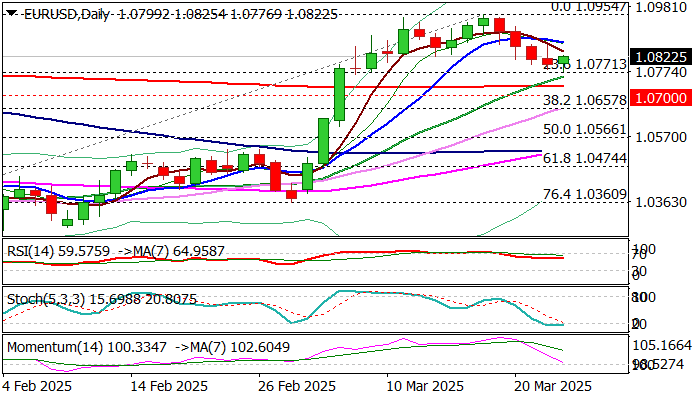

EURUSD ticked higher on Tuesday after four-day pullback from new multi-month high at 1.0954 (larger rally stalled just under Fibo resistance at 1.0969) found temporary footstep at 1.0771 (Fibo 23.6% of 1.0177/1.0954 rally).

Partial profit taking lifts the price, although bounce was not significant so far as the action remains negatively impacted by recent strong loss of positive momentum.

South-heading 14-d momentum indicator is in step descend and approaching the centreline but partially offset by the latest 20/200DMA golden cross formation (1.0727).

Recovery needs to clear 1.0860 zone (Monday’s high / 10DMA) to signal reversal and a higher low.

Fibo level at 1.0771, reinforced by rising 20DMA and nearby 200DMA (1.0729 mark solid supports, with near-term bias to remain with bulls while the price stays above these levels.

Conversely, firm break lower would open way for deeper correction.

Tariff talks remain one of key fundamental points, with today’s release of US Consumer Confidence to also contribute, as markets await release of US PCE data on Friday, Fed’s preferred inflation gauge, which will provide more details about the central bank’s near future steps on monetary policy.

Res: 1.0860; 1.0888; 1.0954; 1.0969.

Sup: 1.0771; 1.0760; 1.0729; 1.0700.

Interested in EUR/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

GBP/USD drops to fresh two-week lows below 1.2900

GBP/USD remains under pressure and trades at a fresh two-week low below 1.2900 in the American session on Wednesday. Soft February inflation data from the UK and the Spring Budget delivered by Chancellor Rachel Reeves weigh on Pound Sterling midweek.

EUR/USD stays below 1.0800 after upbeat US data

EUR/USD struggles to gain traction and trades below 1.0800 in the American session on Wednesday. Upbeat February Durable Goods Orders data from the US support the US Dollar in the second half of the day, making it difficult for the pair to stage a rebound.

Gold clings to modest daily gains above $3,020

Gold fluctuates in a relatively tight range and manages to hold above $3,020 midweek. The precious metal seems to be benefiting from the positive sentiment surrounding the commodities after Copper climbed to a new all-time high earlier in the day.

Bitcoin holds $87,000 as markets brace for volatility ahead of April 2 tariff announcements

Bitcoin (BTC) holds above $87,000 on Wednesday after its mild recovery so far this week. A K33 Research report explains how the markets are relatively calm and shaping up for volatility as the market absorbs the tariff announcements.

Sticky UK services inflation shows signs of tax hike impact

There are tentative signs that the forthcoming rise in employer National Insurance is having an impact on service sector inflation, which came in a tad higher than expected in February. It should still fall back in the second quarter, though, keeping the Bank of England on track for three further rate cuts this year.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.