EUR/USD outlook: Looks for near-term direction signals

EUR/USD

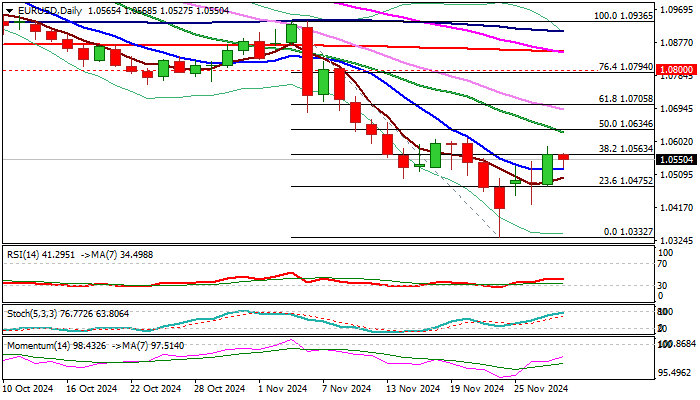

EURUSD edged lower in early Thursday’s trading, retracing a part of Wednesday’s 0.8% rally, but dip was so far limited by broken 10DMA (1.0524, reverted to support).

Near term action is expected to remain biased higher while holding above 10DMA and keep in play potential upside prospects, sparked by strong advance on Wednesday which registered a marginal close above pivotal Fibo barrier at 1.0563 (38.2% of 1.0936/1.0332 bear-leg).

Sustained break above 1.0563 to generate fresh bullish signal and open way for further recovery.

However, existing negative signals should not be ignored, as north-heading 14-d momentum is still in negative territory and converged 55/200DMA about to form a death cross.

Cautin on repeated failure at 1.0563 Fibo level, which would further signal that recovery is running out of steam, with dip and close below 10DMA to further weaken near-term structure and return below 1.0475 (broken Fibo 23.6%) to bring bears back to play.

Today’s release of German November inflation data will be closely watched for fresh signals.

Expect thinner volumes in the US session due to Thanksgiving day holiday.

Res: 1.0587; 1.0609; 1.0634; 1.0691.

Sup: 1.0525; 1.0500; 1.0475; 1.0424.

Interested in EUR/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.