EUR/USD outlook: In quiet mode, awaiting economic data for fresh signals

EUR/USD

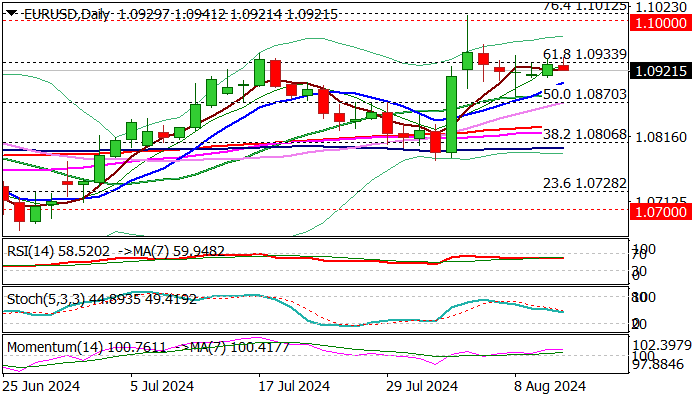

EURUSD is holding within a narrow congestion, capped by Fibo resistance at 1.0933 (Fibo 61.8% of 1.1139/1.0601), as markets slowed ahead of key release this week – US inflation report.

German ZEW economic sentiment (July f/c 32.6 vs June 41.8) due in a while, would also impact Euro’s sentiment.

Technical picture is predominantly bullish on daily chart (strong positive momentum / 10-20DMA bull-cross), but firm break of 1.0933 pivot is required to revive larger bulls after consolidation and expose key barriers at 1.1000 zone (psychological / Fibo 76.4%) where the action faced strong upside rejection last week.

Near-term bias is expected to remain bullish above rising 10DMA (1.0901), guarding lower pivots at 1.0882/70 (20DMA / broken 50% retracement) loss of which would weaken near term structure and risk further drop.

Res: 1.0933; 1.0945; 1.0962; 1.1000.

Sup: 1.0901; 1.0882; 1.0870; 1.0832.

Interested in EUR/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.