EUR/USD

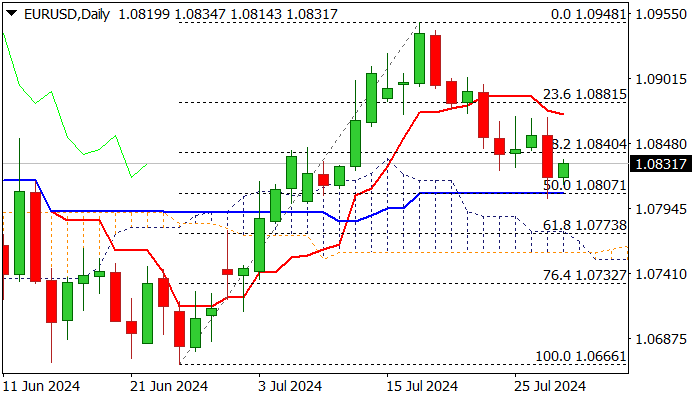

EURUSD edges higher on Tuesday morning after strong fall on Monday was contained by solid support at 1.0807 (daily Kijun-sen / 50% retracement of 1.0666/1.0948 rally) and also failed to register a daily close below cracked converged 55/200DMA’s (1.0815).

Monday’s downside rejection also left a bear-trap, generating an initial positive signal, which requires confirmation on lift above 1.0870 (lower platform of past four days, reinforced by daily Tenkan-sen) to indicate an end of corrective phase and shift near term focus higher.

Daily studies show MA’s in mixed setup, while momentum and RSI are currently neutral.

On the other hand, tomorrow’s twist of daily cloud could be magnetic and attract bears for attack at thinning cloud, break of which to activate negative scenario and risk deeper drop towards 1.0732 Fibo support (76.4%).

Eurozone preliminary Q2 GDP was in line with expectations but better than Q1, which provided some support to Euro, with German in inflation data (due later today) eyed for fresh signals.

Res: 1.0840; 1.0870; 1.0881; 1.0902.

Sup: 1.0814; 1.0802; 1.0758] 1.0732.

Interested in EUR/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0800 after German inflation data

EUR/USD continues to fluctuate above 1.0800 on Tuesday. Following the mixed GDP readings from Germany and the Eurozone, the latest data showed that annual CPI inflation in Germany rose to 2.3% in July. Market focus now shifts to US data releases.

GBP/USD fluctuates at around 1.2850 ahead of US data

GBP/USD stays in a consolidation phase and trades at around 1.2850 in the second half of the day on Tuesday. The cautious market stance doesn't allow the pair to gather recovery momentum as investors await US data.

Gold extends sideways grind below $2,400

Gold moves sideways below $2,400 after closing the first trading day of the week little changed. Investors refrain from taking large positions ahead of Federal Reserve's policy announcements and this week's key US data, making it difficult for XAU/USD find direction.

Bitcoin price declines as US Government transfers funds worth $2 billion

Bitcoin (BTC) stabilizes around the $68,000 level on Tuesday after failing to close above $70,000 the day before. The US government moved $2 billion worth of Bitcoin from Silk Road's confiscated funds on Monday.

US JOLTS Preview: Job openings expected to inch lower in June

The US JOLTS data will be watched closely by investors ahead of the July jobs report. Job openings are forecast to edge lower to 8.03 million on the last business day of June. Markets fully price in a 25 bps Fed rate cut in September.