EUR/USD

EURUSD edges higher in European trading on Monday as bears are taking a breather after a two-day pullback from a multi-week high (1.0948).

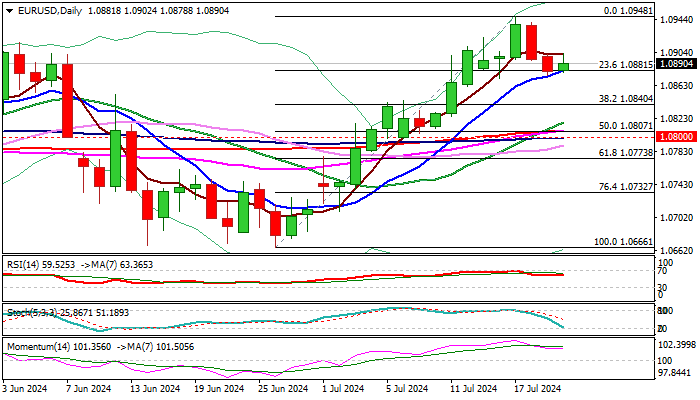

Rising 10DMA and Fibo 23.6% of 1.0666/1.0948 (1.0881) contained dips for now, signaling a scenario of shallow correction before larger bulls regain control.

Talks about possible start of easing monetary policy as early as September add to positive outlook for the single currency, as daily studies keep strong positive momentum and MA’s remain in bullish setup.

However, weekly bull trap above 1.0933 Fibo barrier and weekly Doji candle with long upper shadow, warn that bulls might be running out of steam and deeper pullback cannot be ruled out.

Sustained break of 10 DMA / Fibo support to activate such scenario and expose next supports at 1.0840/07 (Fibo 38.2% / 50% / 200DMA).

Conversely, ability to hold above 1.0881support would keep near-term bias with bulls, with extension and close above 1.09 zone to generate initial signal of reversal and formation of a higher low.

Res: 1.0902; 1.0922; 1.0948; 1.0964.

Sup: 1.0881; 1.0840; 1.0807; 1.0788.

Interested in EUR/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0900 amid weaker US Dollar

EUR/USD defends gains below 1.0900 in the European session on Monday. The US Dollar weakens, as risk sentiment improves, supporting the pair. The focus remains on the US political updates and mid-tier US data for fresh trading impetus.

GBP/USD trades sideways above 1.2900 despite risk recovery

GBP/USD is keeping its range play intact above 1.2900 in the European session on Monday. The pair fails to take advantage of the recovery in risk sentiment and broad US Dollar weakness, as traders stay cautious ahead of key US event risks later this week.

Gold price remains on edge on firm prospects of Trump’s victory

Gold price exhibits uncertainty near key support of $2,400 in Monday’s European session. The precious metal remains on tenterhooks amid growing speculation that Donald Trump-led-Republicans will win the US presidential elections in November.

Solana could cross $200 if these three conditions are met

Solana corrects lower at around $180 and halts its rally towards the psychologically important $200 level early on Monday. The Ethereum competitor has noted a consistent increase in the number of active and new addresses in its network throughout July.

Election volatility and tech earnings take centre stage

/stock-market-graph-gm532464153-55981218_XtraSmall.jpg)

The US Dollar managed to end the week higher as Trump Trades ensued. Safe-havens CHF and JPY were also higher while activity currencies such as NOK and NZD underperformed.