EUR/USD

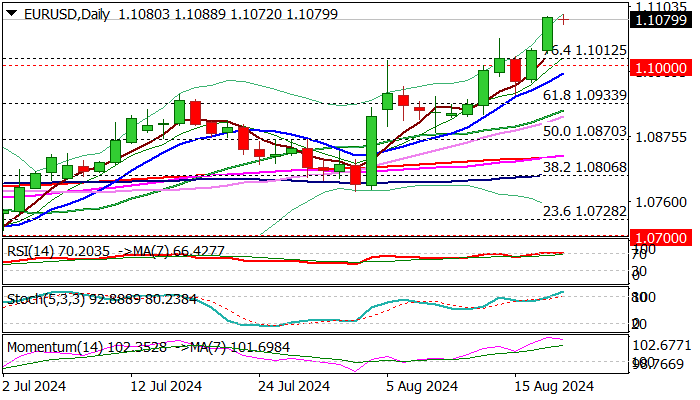

EURUSD ticked to new 2024 high (1.1088) on Tuesday, but bulls show signs of fatigue after strong rally in past two days.

Fundamentals remain supportive as Eurozone trade surplus strongly widened in June and inflation remained elevated in July, signaling further gains after correction.

Bullish daily studies contribute to positive outlook, but overbought conditions and momentum turning south from new highs warn that bulls might be running out of steam.

Dips should be ideally contained by supports at 1.1000/ 1.0985 zone (broken psychological barrier, reverted to support and daily Tenkan-sen) to keep larger bulls intact for acceleration through 1.1105 (55MMA), towards 1.1139 (Dec 2023 high), guarding 1.1220 (100MMA) and 1.1275 (2023 high).

Close above cracked 200WMA (1.1063) to generate fresh bullish signal.

Res: 1.1088; 1.1105; 1.1139; 1.1220.

Sup: 1.1063; 1.1021; 1.1000; 1.0985.

Interested in EUR/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD climbs to new 2024-high above 1.1100

EUR/USD stretches higher in the second half of the day on Tuesday and trades above 1.1100 for the first time in 2024. The US Dollar stays under persistent selling pressure and allows the pair to push higher despite the mixed action seen in Wall Street.

GBP/USD holds above 1.3000, closes in on yearly peak

GBP/USD preserves its bullish momentum and closes in on the annual-high it set at 1.3045 in July. The broad-based US Dollar (USD) weakness fuels the pair's rally as investors await comments from Federal Reserve officials.

Gold advances to new record high above $2,520

Gold extends its uptrend and trades at a fresh record high above $2,520 on Tuesday. The benchmark 10-year US Treasury bond yield stays in negative territory below 3.9%, allowing XAU/USD to continue to stretch higher.

Tether to launch USDT on Aptos blockchain

Aptos announced on Tuesday that Tether is launching its USDT stablecoin on the Aptos blockchain. This move is positive for Aptos as stablecoins such as USDT act as a bridge between the crypto assets and fiat currencies.

Canadian headline CPI matched estimates in July

According to a report from Statistics Canada on Tuesday, annual inflation in Canada, as indicated by the Consumer Price Index (CPI), held steady at 2.5% in July, falling short of market expectations.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.