EUR/USD outlook: Break above 1.1000 adds to bullish outlook, limited dips should be anticipated

EUR/USD

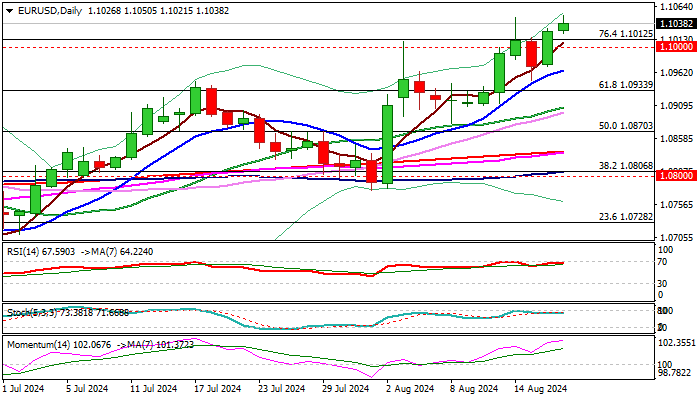

EURUSD keeps firm tone at the start of the week and extends gains above psychological 1.10 barrier after registering a weekly close above this level for the first time since late December.

Bulls also cleared a Fibo resistance at 1.1012 (76.4% retracement of 1.1139/1.0601), adding to bullish stance.

Falling 200WMA (1.1063) is in focus, with break here to generate fresh bullish signal and open way for push through 1.1100 and attack at December’s peak at 1.1139.

Technical studies remain in full bullish setup on daily chart, but overbought conditions and fading bullish momentum on weekly chart warn of increased headwinds that bulls may face on approach to 200WMA barrier.

Broken 1.10 pivot reverted to solid support which should ideally keep the downside protected, with deeper dips to find firm ground above rising 10DMA (1.0965) to keep bulls in play and provide better levels to re-enter bullish market.

Res: 1.1050; 1.1063; 1.1100; 1.1139.

Sup: 1.1021; 1.1000; 1.0965; 1.0933.

Interested in EUR/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.