EUR/USD outlook: Break 1.0800 support but bears may take a breather on oversold conditions

EUR/USD

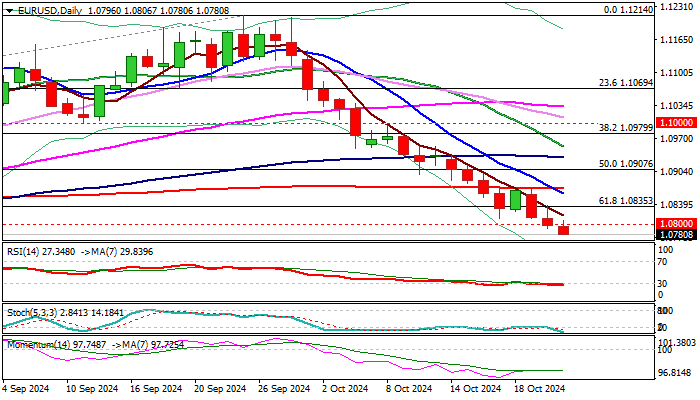

EURUSD dipped below psychological 1.08 support and hit new multi-week low in early Wednesday.

Larger bears remain firmly in play and reinforced by the most recent formation of 10/200DMA death cross, with daily close below 1.08 to reinforce bearish stance.

However, oversold RSI and 14-d momentum in sideways mode suggest that the downtrend may be running out of steam.

Bears approached support at 1.0777 (Aug 1 higher low) and eye another significant point at 1.0745 (Fibo 76.4% of 1.0601/1.1214 uptrend) where fresh headwinds could be expected.

Upticks are likely to be limited and provide better selling opportunities, with broken Fibo 61.8% (1.0835) to ideally cap and potential extended upticks to stay below 200DMA (1.0870, also Oct 17/21 lower platform) to keep larger bears intact.

Break of 1.0745 pivot to open way for test of 1.0670 zone (June higher base) and unmask key med-term support at 1.0601 (2024 low, posted on Apr 16).

Res: 1.0800; 1.0835; 1.0870; 1.0907.

Sup: 1.0777; 1.0745; 1.0700; 1.0676.

Interested in EUR/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.