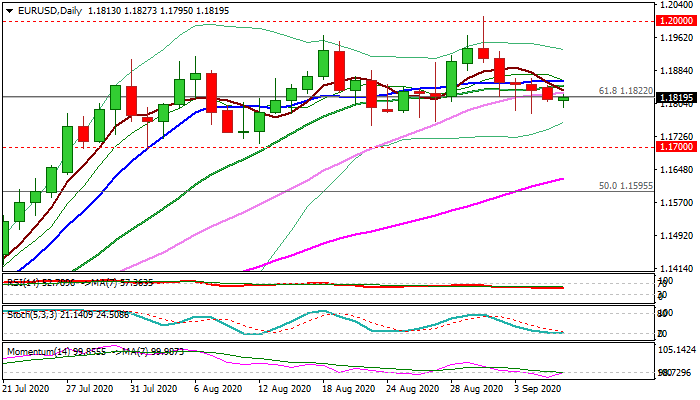

EUR/USD outlook: Bears need repeated close below 1.1816 Fibo support to sideline existing risk of stall

EUR/USD

The Euro stands at the back foot in early Tuesday's trading, following fresh acceleration lower on Monday (after two long-tailed Dojis last Thu/Fri) that generated initial negative signal on marginal close below 1.1816 (Fibo 61.8% of 1.1695/1.2011).

Fresh weakness requires repeated close below this level to sustain negative signal and open way towards pivotal supports, higher bases at 1.1750 and 1.1700 zone.

Failure to firmly break below 1.1816 would add to signals from two strong downside rejections last week that suggest bears are lacking strength and would add to initial signs of stall.

Rising momentum on daily chart and stochastic in sideways mode at the border of oversold territory, support scenario, along with German exports data, which missed the forecast but maintain an optimism that the economy remains on recovery track.

Near-term action may extend current mode without clear direction, as traders await signals from ECB's policy meeting on Thursday. Although the central bank is not expected to change the policy this time, markets expect to hear more from ECB's President Lagarde about the euro's strength and possible lowering inflation forecast.

Res: 1.1827; 1.1846; 1.1865; 1.1895

Sup: 1.1795; 1.1780; 1.1754; 1.1700

Interested in EUR/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.