-

EUR/USD holding 1.1200

-

97.50 DXY fails

-

President Trump comments on monetary policy

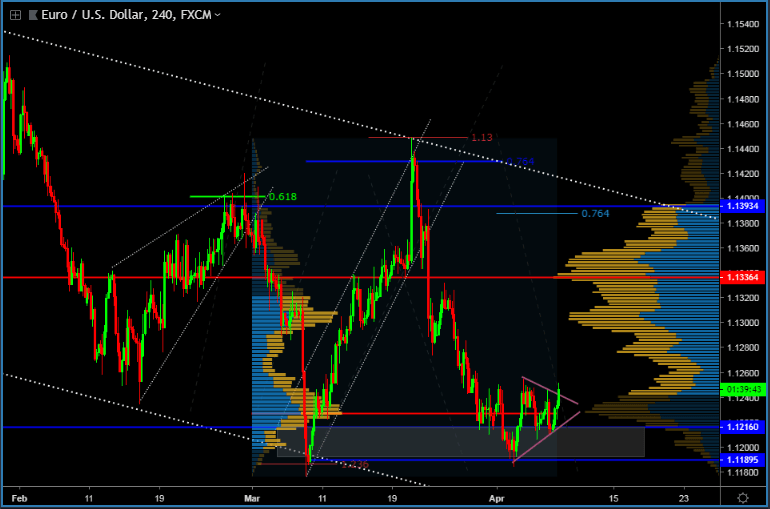

The EUR/USD has been trading down inside a bear channel for the best part of the year now and has dropped 2.27% since it peaked and tested the 1.1400 level on March 20th. It has now traded below the 1.1200 level and bottomed 20 pips lower at the 1.1800 level. This is not only an important psychological low but it's fair to say that heavy volume was traded here. Buyers came in and protected this level fiercely and now we are trading up.

The upside on the EUR/USD is looking even brighter if we take a look at the $DXY. The US Dollar index fails to break above the 97.50 level again even with great job numbers (NFPs beating expectations at 196k jobs added). The concerning part of this is the average hourly earnings month over month, they dropped meaning that wages didn't go up with the extra jobs added. Not particularly good to have extra jobs but a regression in pay for labor because this cuts consumer spending.

Also, late last week President Trump spoke on monetary policy saying that he thinks the Federal Reserve should be cutting rates instead of hiking them because this slows the economy down. His words, not mine. Not only that but he's trying to appoint 2 of his puppets into the federal reserve board in order to try to control monetary policy, which is unheard of. This could be terrible for the US Dollar.

Now back to the EUR/USD. Targets to the upside should be 1.1335 the next big volume zone before we start thinking of going higher.

Information on the Learn2.trade website and inside our Telegram Group is intended for educational purposes and is not to be construed as investment advice. Trading the financial markets carries a high level of risk and may not be suitable for all investors. Before trading, you should carefully consider your investment objectives, experience, and risk appetite. Only trade with money you are prepared to lose. Like any investment, there is a possibility that you could sustain losses of some or all of your investment whilst trading. You should seek independent advice before trading if you have any doubts. Past performance in the markets is not a reliable indicator of future performance. Learn2.trade takes no responsibility for loss incurred as a result of the content provided inside our Telegram Groups. By signing up as a member you acknowledge that we are not providing financial advice and that you are making the decision on the trades you place in the markets. We have no knowledge of the level of money you are trading with or the level of risk you are taking with each trade.

Recommended Content

Editors’ Picks

AUD/USD: Next stop emerges at 0.6580

The downward bias around AUD/USD remained unabated for yet another day, motivating spot to flirt with the area of four-week lows well south of the key 0.6700 region.

EUR/USD looks cautious near 1.0900 ahead of key data

The humble advance in EUR/USD was enough to partially leave behind two consecutive sessions of marked losses, although a convincing surpass of the 1.0900 barrier was still elusive.

Gold extends slide below $2,400

Gold stays under persistent bearish pressure after breaking below the key $2,400 level and trades at its lowest level in over a week below $2,390. In the absence of fundamental drivers, technical developments seem to be causing XAU/USD to stretch lower.

Breaking: SEC gives final approval for Ethereum ETFs to begin trading tomorrow

The Securities and Exchange Commission approved the S-1 registration statements of spot Ethereum ETF issuers on Monday, according to the latest filings on its website. Following the approval, issuers have started making moves as the products are set to begin trading on exchanges tomorrow.

What now for the Democrats?

Like many, I applaud Biden’s decision. I would have preferred that he’d made it sooner, but there’s still plenty of time for the Democrats to run a successful campaign. In fact, I wish something on the order of a two-month campaign – as opposed to a two-year campaign – were the norm and not the exception.