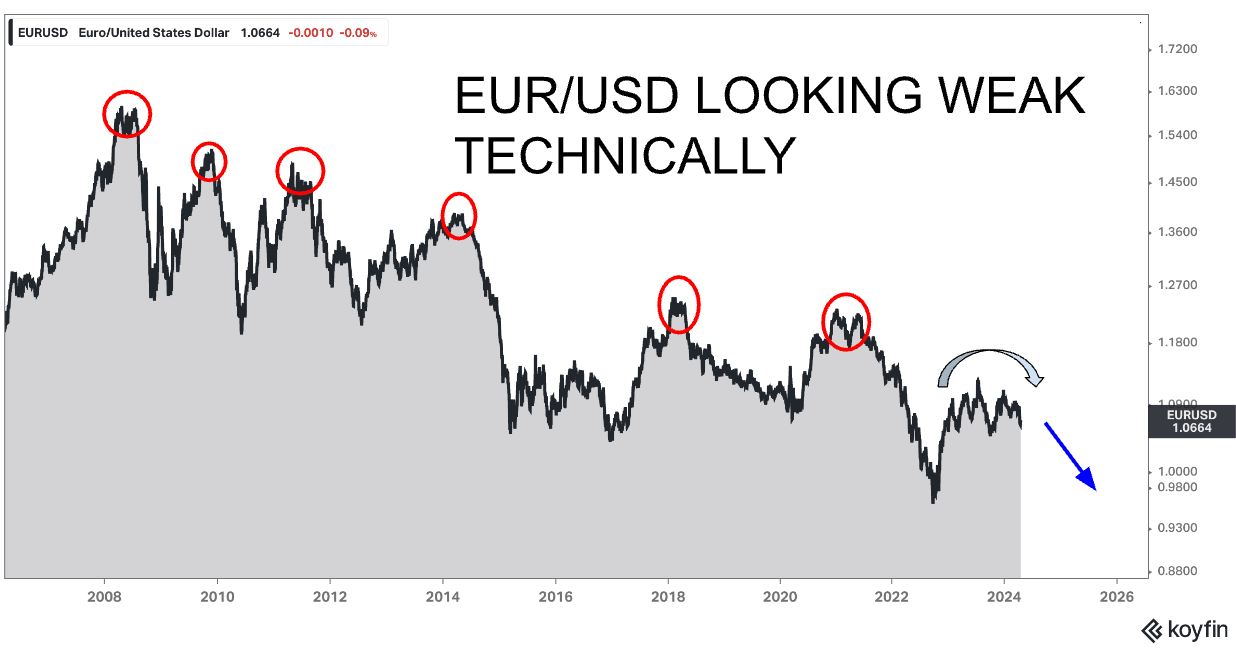

EUR/USD deep dive: A case for a significantly weaker Euro

I’ve been reflecting on recent macro-economic events and a number of factors now suggest that a meaningful downtrend in the Eur/Usd is underway.

Let’s begin by first discussing the ECB’s current monetary policy stance.

ECB stance

The ECB has been explicitly dovish in recent communications, essentially claiming victory over inflation. The result has been a suppression of European yield curves which now price in a more aggressive easing cycle in Europe relative to other G7 countries.

Headline inflation has been coming down, I agree, but still sits above their official target at 2.4%. Service sector inflation has remained firm at 4% and there are upside risks to energy and industrial goods prices from recent market developments. To claim victory on inflation in this context when core inflation remains elevated and Headline CPI is still 40 basis points above target feels premature in our view.

Unlike the Fed, the ECB has a singular inflation mandate. Their focus is stable prices, not economic growth. While the Fed can take risks on inflation in order to support GDP growth, the ECB cannot. They must focus on inflation.

It is this rigid focus on price stability that has been the back bone of confidence within the European monetary system. To now see the ECB step out ahead of the Fed, signalling rate cuts when inflation risks remain, is quite unprecedented from a historical perspective. US long-term interest rates are already above German rates by some 2%. If the ECB delivers on its “dovish” promises they risk pushing this interest rate differential even further in the dollar’s favour and against the Euro.

US situation

Various evolving macro factors over in the US are also concurrently Dollar positive. Short term inflation trends in the US have been rising both in response to global macro-economic factors and a strong domestic economy.

Despite the Fed’s dual mandate and their desperate desire to normalize policy, recent comments from Chairman Powell and other Fed members show a willingness to delay rate cuts in light of rising inflation. This will have the effect of keeping USD funding rates at historically elevated levels.

Elevated dollar funding rates will have the effect of exporting high US inflation to other economies via the currency channel.

Put another way, if you are a non US central Bank, you already know that a bout of currency weakness against the dollar is imminent as the Fed backs away from its dovish stance. This bout of local currency weakness now becomes an upside risk to your inflation outlook.

The ECB seems to be ignoring that risk and choosing instead to “out dove” the Fed which risks even further weakening your currency and increasing upside risks to inflation.

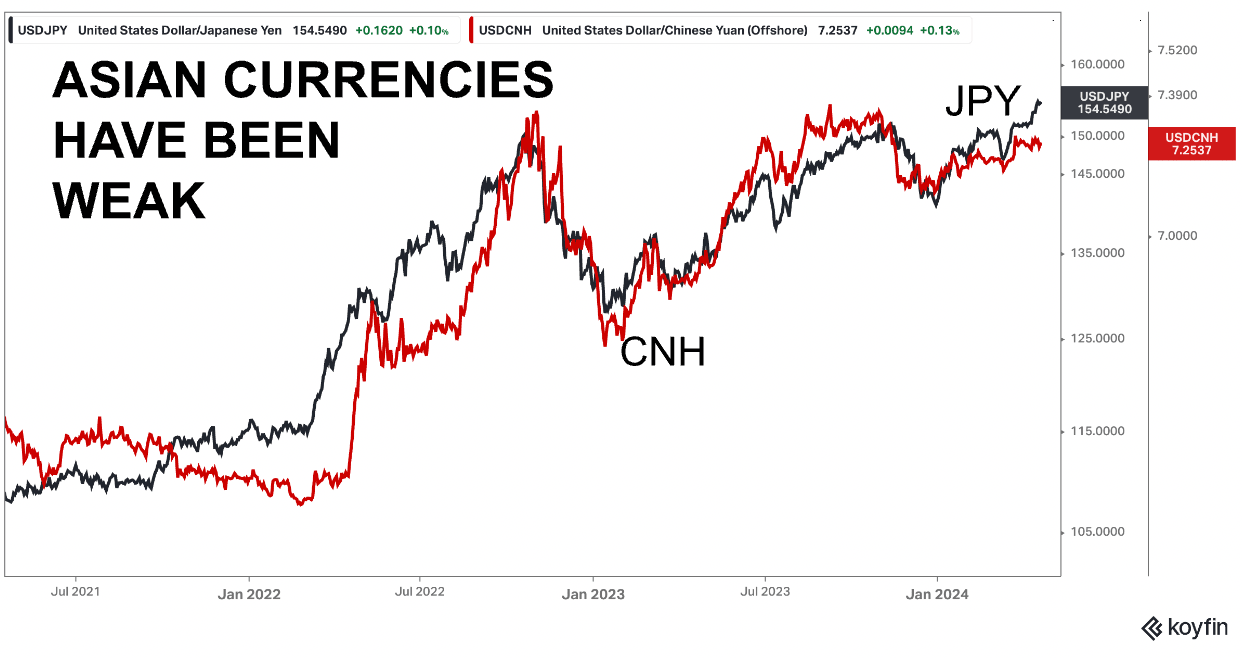

Asian FX

Asian FX dynamics are also starting to exert downward pressure on the Euro.

The Yen has been under pressure ever since the BOJ recently disappointed markets by signalling a very timid tightening cycle and continuing with QE. The dollar funding yield advantage versus the Yen in this case will remain close to 5% thus ensuring upward pressure on USD/JPY.

In China, the rationale for Yuan weakness is different but ultimately produces the same result, a stronger dollar.

The Chinese are actively trying to support growth and boost inflation, both of which have been below desired levels. These efforts will ultimately translate into easier monetary policy and the printing of money while the opposite will be true in the US. The Fed will need to keep monetary policy tight and continue reducing the balance sheet as it waits for both inflation and growth to come back down.

The macro thesis for a stronger dollar vs Asian currencies thus will remain but will be resisted by both the Japanese and Chinese authorities for fear of excessive volatility. Verbal and actual interventions have been and will continue to take place in these respective FX markets in order to limit the downside pressure these currencies experience relative to the dollar. Fast depreciating Asian currencies could unnerve foreign investment into China and put Japan’s inflation target further in peril.

The cap placed on dollar appreciation by asian authorities will lead to dollar buying in other FX markets where central banks are unlikely to intervene, like for example in Europe.

These well substantiated reasons for “macro selling” of the Eur/Usd has already started, in our opinion, and is at risk of further intensifying as the ECB’s monetary policy stance meaningfully diverges from the US.

Perhaps a weaker currency is desired by European authorities in order to boost growth, or the ECB feels inflation dynamics are sufficiently different in Europe to justify an easier relative monetary policy. Either way, the outcomes would be similar, a lower Euro.

Author

Mohammad H. Ali, CFA

Independent Analyst

A former Global Head of Currency Trading at TD Bank with over 20 years of institutional trading experience in FX and Fixed Income Markets.