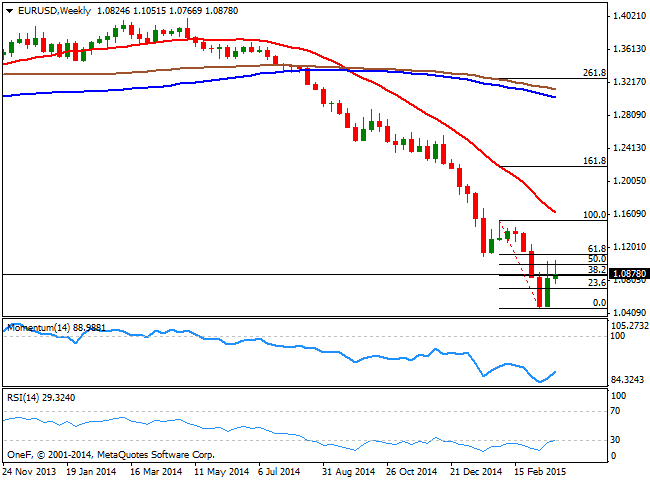

The pair seems to have lost part of its upward strength this past week, ending it barely 50 pips above the opening. The strong rejections on spikes above 1.1000 suggest that selling interest is just waiting for a better entry, rather than capitulate. Besides, the weekly chart shows long upper wicks in the last two candles, reinforcing the idea. Technically and in the same chart, the RSI has turned flat in oversold territory, still below 30, whilst the Momentum indicator managed to stage a tepid recovery from oversold territory, but remains well into the red. The 20 SMA maintains a strong bearish slope, but too far away to be relevant at this point.

In the daily chart, the price holds above a bearish 20 SMA, currently around 1.0760, whilst the Momentum indicator heads strongly higher in positive territory, but the RSI indicator already capitulated and turned lower at 48. Considering the day will likely end into the red, the Momentum indicator will likely turn lower before next candle opening. Anyway, the immediate resistance stands around the 1.0950 level, where the pair stalled several times intraday these last weeks, with a break above it favoring a continuation up to the mentioned highs around 1.1050, in route to the critical 1.1120 level. It would take a weekly close above it to confirm EUR bulls are here to stay.

To the downside, the mentioned 1.0760 is the first level to watch, with additional declines below it exposing the 1.0600 area for next week, whist if this last level gives up, the dollar will be positioned to retest its year high around 1.0460.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

EUR/USD clings to recovery gains near 1.0850 ahead of Fedspeak

EUR/USD trades in positive territory near 1.0850 on Friday following a four-day slide. China's stimulus optimism and a broad US Dollar correction help the pair retrace the dovish ECB decision-induced decline. All eyes remain on the Fedspeak.

GBP/USD pares UK data-led gains at around 1.3050

GBP/USD is trading at around 1.3050 in the second half of the day on Friday, supported by upbeat UK Retail Sales data and a pullback seen in the US Dollar. Later in the day, comments from Federal Reserve officials will be scrutinized by market participants.

Gold at new record peaks above $2,700 on increased prospects of global easing

Gold (XAU/USD) establishes a foothold above the $2,700 psychological level on Friday after piercing through above this level on the previous day, setting yet another fresh all-time high. Growing prospects of a globally low interest rate environment boost the yellow metal.

Crypto ETF adoption should pick up pace despite slow start, analysts say

Big institutional investors are still wary of allocating funds in Bitcoin spot ETFs, delaying adoption by traditional investors. Demand is expected to increase in the mid-term once institutions open the gates to the crypto asset class.

Canada debates whether to supersize rate cuts

A fourth consecutive Bank of Canada rate cut is expected, but the market senses it will accelerate the move towards neutral policy rates with a 50bp step change. Inflation is finally below target and unemployment is trending higher, but the economy is still growing.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.