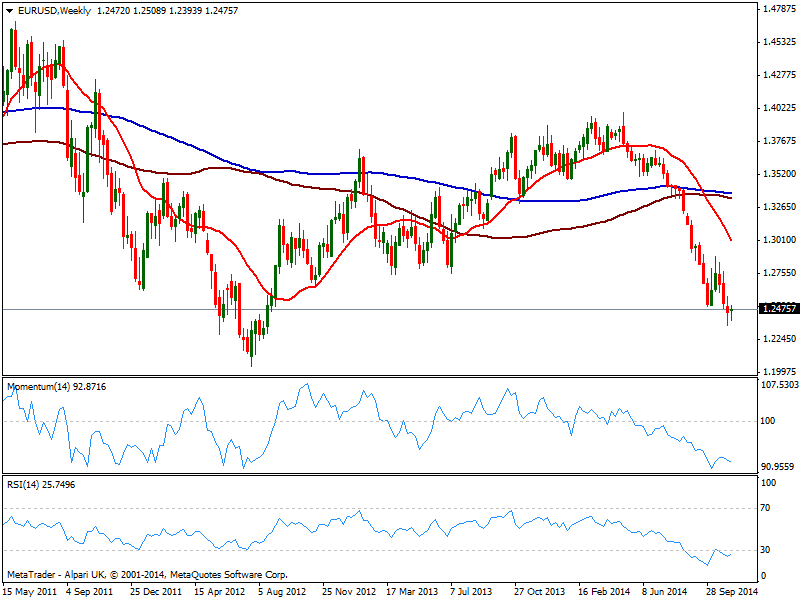

Technically, the weekly chart shows 20 SMA has extended its decline through larger ones, momentum maintaining its bearish slope and RSI still below 30, with sellers surging on advances towards the 1.2500 price zone.

Daily basis, 20 SMA offers dynamic resistance well above current price in the 1.2550 price zone, whilst indicators had erased oversold conditions but remain well into negative territory, and showing no aims to advance further. For the upcoming days, the year low of 1.2357 will be the critical support to follow, as it will take a break below to see the pair resuming the side, down to 1.2280/90 price zone, where the pair presents several weekly historical lows. If this last gives up, an approach to 1.2100 seems likely, opening also doors for a test of the long term key psychological level of 1.2000 in a longer term view.

Above afore mentioned 1.2550 the pair may correct higher, but the line in the sand remains at 1.2660, next resistance and probable top in case of a weekly recovery. In the unlikely case the pair manages to break above it, next target comes at 1.2750/70 price zone, albeit chances of such advance seem extremely poor at this point.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

EUR/USD struggles to hold above 1.0400 as mood sours

EUR/USD stays on the back foot and trades near 1.0400 following the earlier recovery attempt. The holiday mood kicked in, keeping action limited across the FX board, while a cautious risk mood helped the US Dollar hold its ground and forced the pair to stretch lower.

GBP/USD set to swoon on holiday-shortened week

GBP/USD waffled near the 1.2550 level on Monday, kicking off the holiday trading week with a third of a percent decline as market sentiment coils. Market volumes are set to drain out of global exchanges as investors broadly hang up their hats for the Christmas holiday, and global markets will be shuttered on Wednesday.

Gold flat lines above $2,600 ahead of holiday trading week

Gold price trades flat around $2,610 during the early Asian session on Tuesday. Markets face a relatively quiet trading session ahead of the holiday trading week. The US Richmond Fed Manufacturing Index for December is due later on Tuesday.

Ethereum risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.