From a fundamental view, we know the US will close the QE chapter for good this October, trimming the last $15B of facilities. We also know the ECB is barely starting with facilities, so from that side, the downside continues to be favored on Central Banks imbalance.

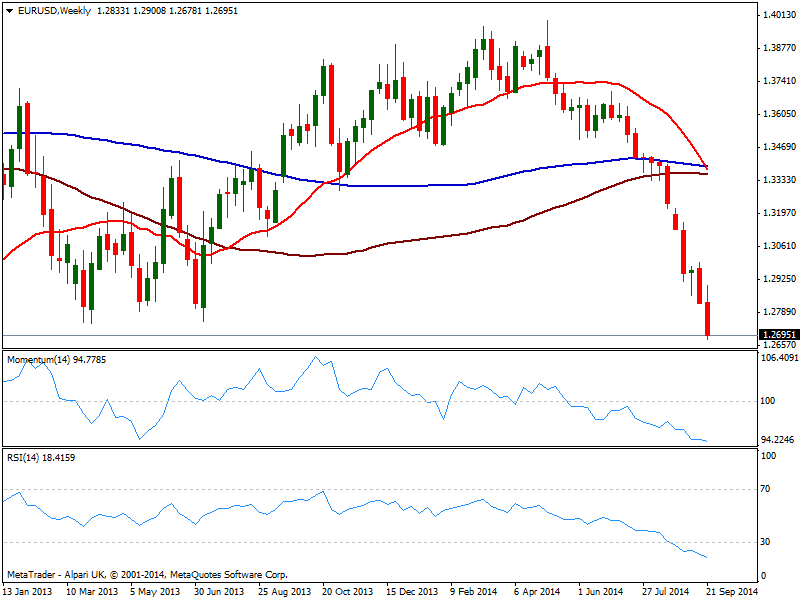

Technically, the weekly chart continues to show the pair extremely oversold, with RSI at 18.4 and an over 1000 pips almost straight decline. But at the same time indicators continue to head lower and show no aims to reverse bias. Furthermore, 20 SMA has turned strongly south and converges now with 100 and 200 ones, clearly reflecting latest dollar strength against its European rival.

In the daily chart, early momentum corrected partially higher but turned back south while RSI stands at 23 and 20 SMA capping the upside now in the 1.2920 price zone. Bottom line, bears still rule: some consolidation could be expected earlier next week, with recoveries up to mentioned 1.2920 not really affecting the dominant trend, but indeed mining sentiment among bears. Immediate support on the other hand, stands at 1.2660 and once below, the pair can quickly extend down to 1.2600 short term, thus once 1.2660 gives up, doors are open for a run towards the 1.2500 figure. If the decline continues steady with USD positive data sending price below this last by the end of the week, chances of an upward correction despite oversold readings will reduce even further, with 1.2740 then as a critical resistance for the rest of the month, and 1.2300 price zone becoming the next probable target.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.