EUR/USD Forecast: Will bulls take action on a soft US inflation print?

- EUR/USD struggles to find direction and continues to trade below 1.0800.

- Annual inflation in the US is forecast to soften to 2.9% in January.

- The USD could come under selling pressure on a weaker-than-expected CPI print.

EUR/USD continues to move up and down in a tight channel below 1.0800 early Tuesday after closing the first day of the week marginally lower. January Consumer Price Index (CPI) data from the US could help the pair break out of its range in the second half of the day.

Inflation in the US, as measured by the changed in the CPI, is forecast to soften to 2.9% in January from 3.4% in December. The Core CPI is seen rising 3.7% in the same period, down from the 3.9% increase recorded in December. On a monthly basis, the CPI and the Core CPI are expected to increase 0.2% and 0.3%, respectively.

Inflation figures are unlikely to alter the market view about the Federal Reserve's (Fed) policy decisions in March. The CME Group FedWatch Tool shows that markets are pricing in a nearly 90% probability of the Fed staying on hold at the next meeting. However, investors are still undecided about whether there will be a policy pivot in May.

Although investors could opt to wait and see more employment and inflation data before positioning themselves for a Fed rate cut in May, a softer-than-expected monthly Core CPI print, close to 0%, could trigger a short-term selloff in the US Dollar (USD) and help EUR/USD push higher. On the other hand, an upside surprise could have the opposite impact on the USD's valuation and force the pair to stay on the back foot.

EUR/USD Technical Analysis

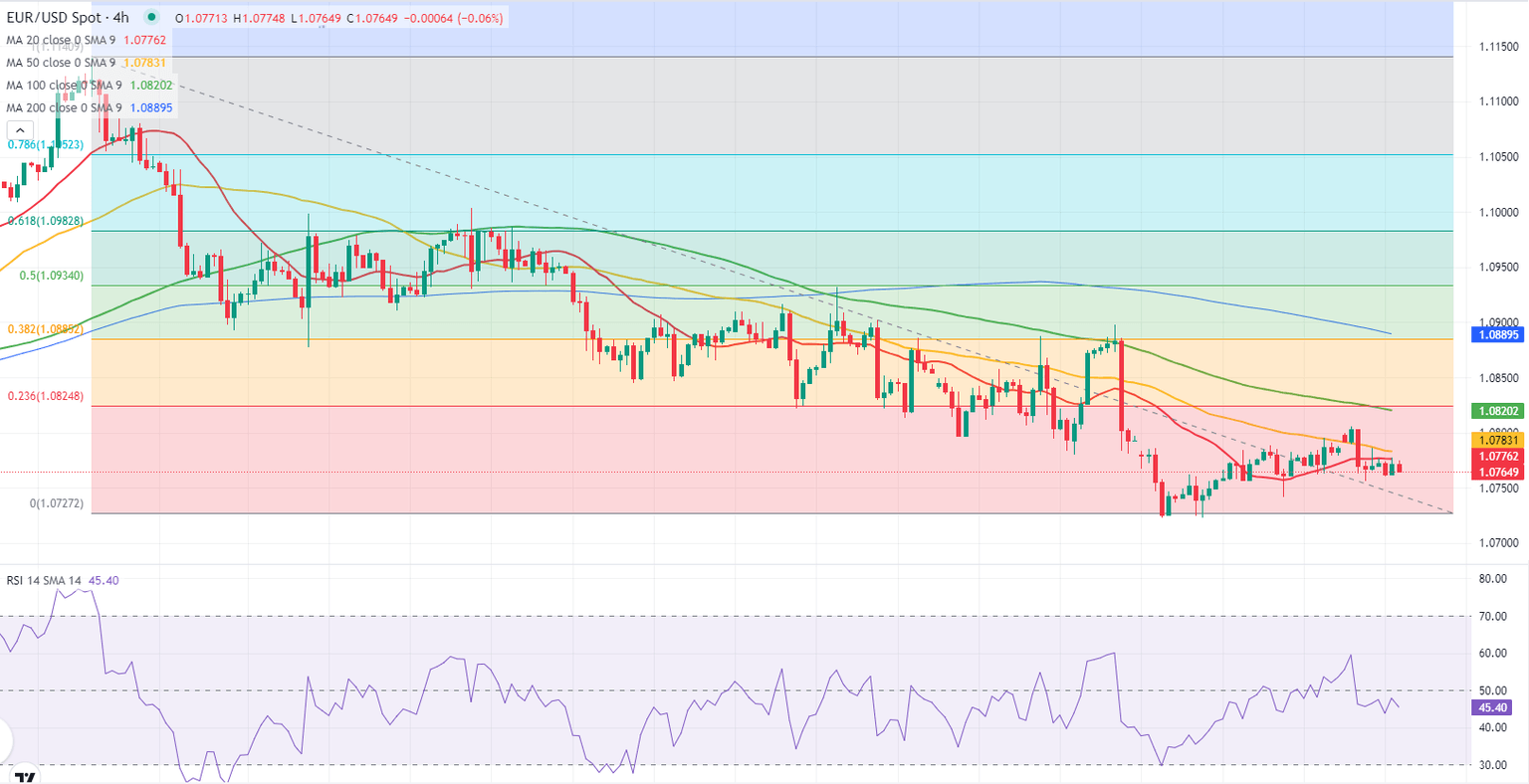

The Relative Strength Index (RSI) indicator on the 4-hour chart stays below 50 and EUR/USD closed the last 5 4-hour candles below the 20-period and the 50-period Simple Moving Averages (SMA), highlighting the lack of buyer interest.

On the downside, 1.0730 (end-point of the latest downtrend) aligns as first support before 1.0700 (psychological level). Looking north, first resistance is located at 1.0800 (psychological level, static level) ahead of 1.0820-1.0830 (100-period SMA, Fibonacci 23.6% retracement) and 1.0900 (Fibonacci 38.2% retracement, 200-period SMA).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.